After a month of inactivity, the bankrupt sister company of FTX, Alameda Research, was caught transferring $1.7 million worth of assets through multiple crypto mixers.

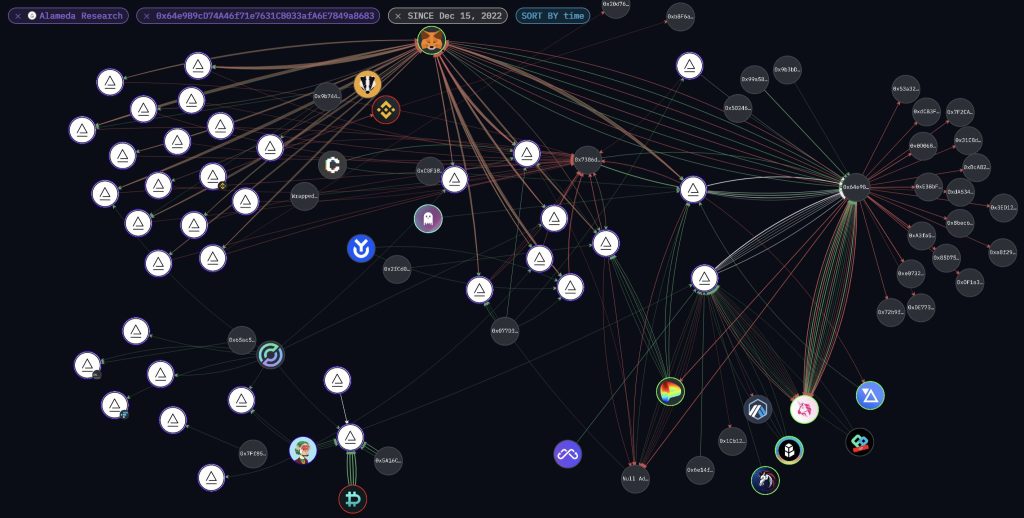

Data from the crypto intelligence agency Arkham shows that in the 24 hours between December 27th and 28th, 30 Alameda wallets started swapping ETH/USDT and sending it to crypto-mixing services. Most of the incoming transactions were from Alameda’s wallets starting with 0xe5D and 0x971.

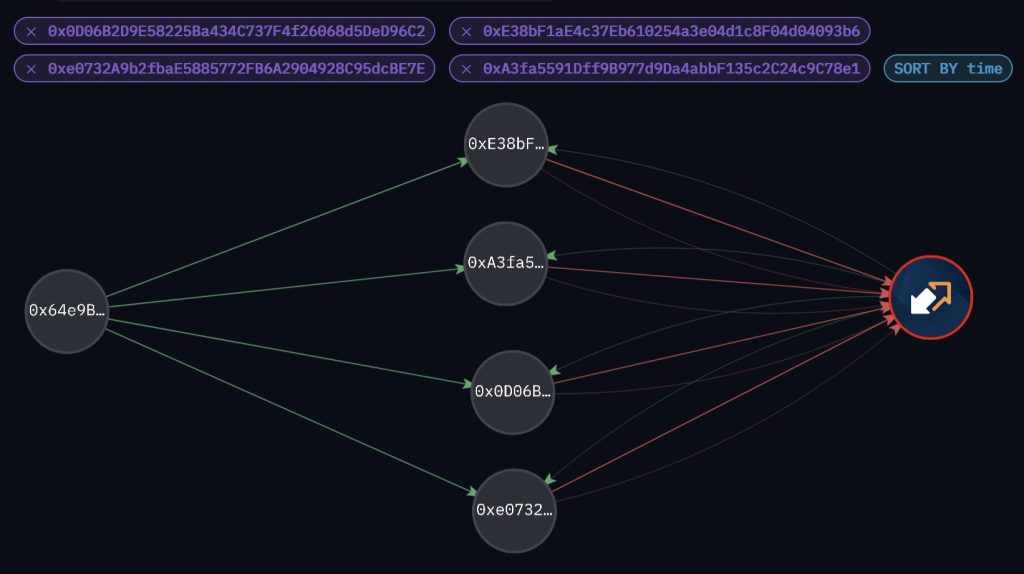

Swapped tokens then were sent to 0x738 wallet or 0x64e address. Tokens from 0x738 were forwarded to the 0x64e address. From the 0x64e, tokens were split into smaller amounts, in sizes of generally $200 thousand and $60 thousand. Those smaller amounts were sent to mixers such as ChangeNow and FixedFloat.

This sudden activity of Alameda wallets has raised suspicion in the crypto community. As Arkham said:

The assets here are certainly getting ‘liquidated’ – but this doesn’t seem like the work of a liquidator.

If this was a rogue employee or some kind of breach, it was rather extensive. Arkham can count at least 30 known Alameda addresses that were active sending funds in the past 24 hours. Directly sending funds to mixing services is never a good sign.

Given that U.S. regulators view crypto mixers as tools used by illegal actors such as criminals and exploiters, using them to liquidate funds would be a very strange move indeed.

Related: U.S. Treasury Department Bans Crypto Mixer Tornado Cash

Moreover, the community is wondering if it has something to do with the recent release of FTX’s ex-CEO, Sam Bankman-Fired, on $250 million bail.

Related: SBF is released on $250 million bail

In total, Alameda-related wallets have mixed:

- 270.5 ETH through ChangeNOW (around $325 thousand at the time of writing)

- $800 thousand in USDT through Fixedfloat

- $200 thousand in USDT through Curve SynthSwap (to native BTC)

- $200 thousand in USDT through Airswap

- $200 thousand in USDT through other crypto-mixing services, reaching a total of $1.7 million mixed.

Crypto Ping Pong Digest

Trash style news. You will definitely like