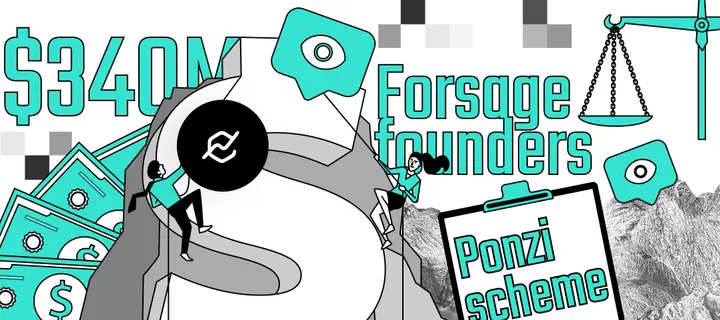

A federal grand jury in the District of Oregon indicted the founders of the so-called DeFi platform Forsage. The DOJ found that Forsage used smart contracts coded like a Ponzi scheme.

Four founders – Vladimir Okhotnikov, Olena Oblamska, Mikhail Sergeev, and Sergey Maslakov, were accused of playing a key role in promoting Forsage, which raised about $340 million from victims.

An official DOJ statement from February 22 goes:

Analysis of the computer code underlying Forsage’s smart contracts allegedly revealed that, consistent with a Ponzi scheme, as soon as an investor invested in Forsage by purchasing a “slot” in a Forsage smart contract, the smart contract automatically diverted the investor’s funds to other Forsage investors, such that earlier investors were paid with funds from later investors.

Forsage billed itself as a legitimate, low-risk decentralized platform powered by Ethereum, allowing users to earn long-term passive income. However, upon investigation, blockchain analysts found that 80% of users who invested ETH in Forsage received less than they had invested, while 50% never received a single payout.

In addition, the founders coded at least one of the Forsage accounts (“xGold” smart contract on the Ethereum blockchain) to fraudulently move investors’ funds out of the Forsage investment network and into cryptocurrency accounts under their control. This is precisely the opposite of statements made to Forsage investors, claiming that “100% of [Forsage] proceeds will go directly and transparently to the members of the project with zero risk.”

Okhotnikov, Oblamska, Sergeev, and Maslakov are each charged with conspiracy to commit wire fraud. If convicted, they face a maximum penalty of 20 years in prison.

In August, SEC raised flags by charging 11 individuals, four founders included, with a $300 million crypto pyramid scheme. Yet, US SEC was not the first one concerned about the project. Philippines SEC flagged the project as fraudulent in 2020, but a month later, the platform was still the second-most popular DApp on the Ethereum blockchain.

Crypto Ping Pong Digest

Trash style news. You will definitely like