Table of Contents

DOT coin buying – the ultimate guide

Polkadot is one of the hottest projects in the world of crypto. Polkadot attempts to connect different blockchains together. Their native currency is DOT. The strength of this coin lies in the fact that Polkadot is actually solving a very important issue of interoperability. This practical use case of Polkadot actually reinforces the importance of DOT and gives a positive outlook for potential investment.

Polkadot is connected with the Web 3.0 project. In the era before the Internet, computers were isolated from each other. Groups of computers joined together in a network was possible only for military, government, or IT companies who had the technology, and logistics to connect the computers. Different networks were not connected as each had different communication protocols. It was only when the need for a decentralized network with the unifying protocol was suggested, that the true Internet was born.

Blockchain networks (Ethereum, IBM Blockchain, Ripple, etc) are currently in that pre-Internet state. They are not connected, and each has its own connection protocols. Polkadot is building the technology which will enable different blockchain networks to connect, effectively revolutionizing the blockchain networks space, and creating a brand new Internet.

What is Polkadot currency?

Polkadot is the name of the blockchain and interoperability protocol. Their native currency is called DOT. It was launched in 2017. DOT is a coin that serves as:

1. Token for the governance of the network

2. Token to be staked for the operation of the network

3. Token to be bonded to connect a new blockchain

4. A currency that can be traded

Polkadot is an inflatory coin. This means that the total number of tokens in circulation will rise over time. There is no set limit for the maximum number of DOT tokens. Inflation is set to be approximately 10% annually. The projected number of tokens to be staked – pledged in order to give credibility to the Polkadot network – is around 50%. This means that users are incentivized with a 20% annual nominal return for holding tokens if the ideal staking rate is not achieved or incentivized to withdraw their stake if the system staking rate is above the ideal.

The total number of tokens in supply is currently around 1.13 bn. Polkadot’s market cap is $28.20 bn, and the 24h trading volume is $752.69 mil, making the DOT quite a respectable cryptocurrency.

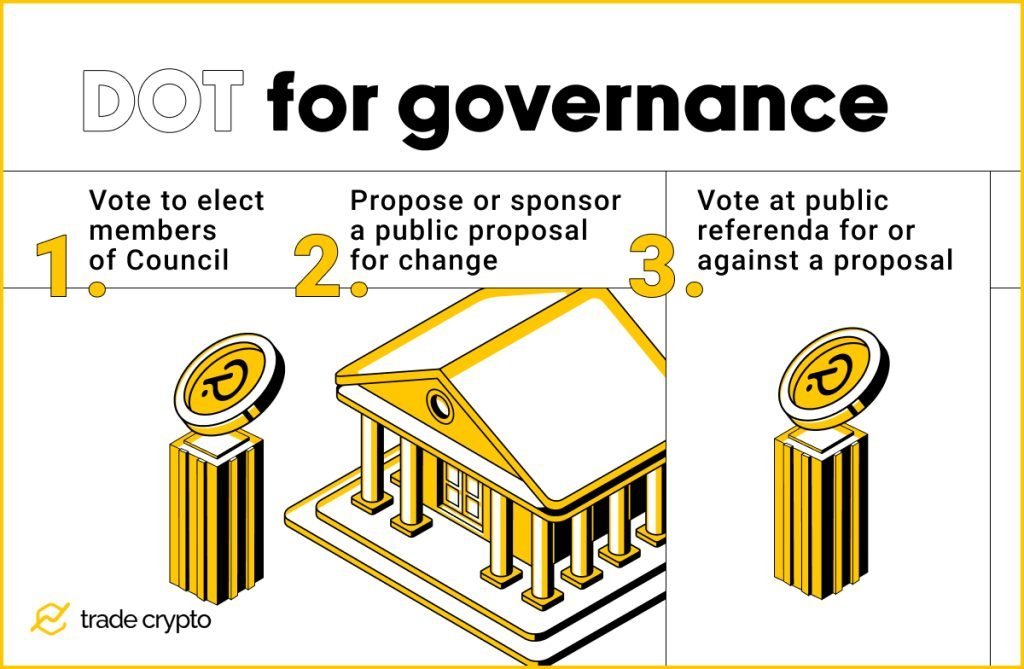

DOT for governance

Polkadot has ways for users to express their wishes for change. Holders of DOT tokens can:

- Vote to elect members of Council

- Propose or sponsor a public proposal for change

- Vote at public referenda for or against a proposal

Since blockchains are economic vehicles, those who want to influence the decision-making must take an active stake in it. That’s why the number of tokens counts. However, at Polkadot, what matters, even more, is the duration of time a voter pledges to lock their tokens.

DOT for staking

Blockchain networks are revolving around consensus and validation. Just like a regular bank is using deposited cash in savings accounts as proof of their reliability (and a customer earns an interest), a holder of a DOT coin can stake their token to add to the stability of the network, while earning an interest (staking reward). Staking crypto coins can be lucrative passive income. Staking rewards on Polkadot start at 120 DOT (this minimum changes dynamically), and the yield is around 8-10% annually.

DOT for connecting the blockchains

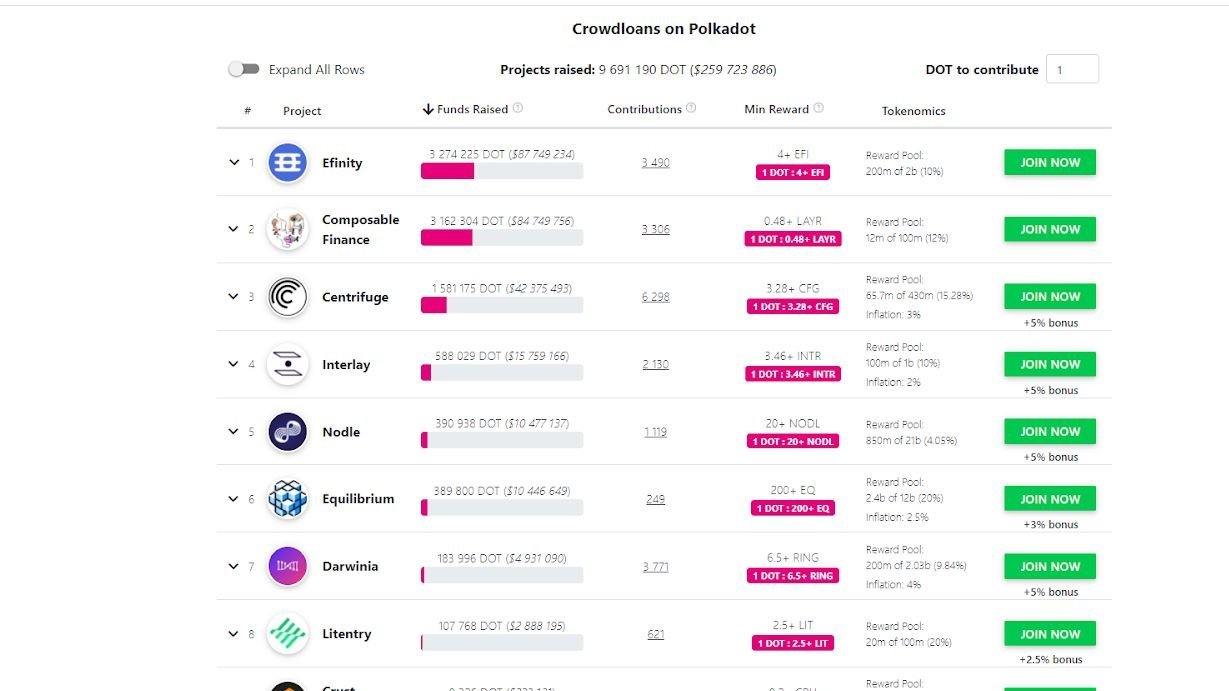

Polkadot connects other blockchains via ‘bridges’ and ‘parachains’. Since there is a limited number of ‘slots’ to connect, there are auctions held for blockchain projects to earn their spot on the Polkadot platform. The highest bidder wins after random auction time expires. Therefore, bidders are often asking for loans from the DOT token holders. This is called a ‘crowdloan’.

It takes a minimum of 5 DOT tokens to participate in the crowdloan. Each user can declare a project to support with a number of DOT tokens (equal to or above 5 DOT). Projects use the loan to participate in auctions. Each project rewards its contributors however they see fit. This is an opportunity for DOT holders to gain rewards.

DOT as cryptocurrency

While you cannot buy anything with DOT coins, they hold value. DOT can be traded like any other cryptocurrency at specialized exchanges. The practical use case for the Polkadot platform promises big importance and even bigger growth in the future. The value of DOT coins will, hopefully, keep rising. If the majority of networks decide to connect with Polkadot, it can become a new market giant, with the price of DOT rising accordingly.

What is the connection between Polkadot and Ethereum?

Ethereum is a popular blockchain network. It was founded in 2013 by Vitalik Buterin, Gavin Wood, Charles Hoskinson, and other founders. Eventually, the three split with Hoskinson founding the Cardano network, and Gavin Wood founding the Polkadot.

Polkadot is dubbed the ‘Ethereum Killer’ because it is solving a lot of issues that the Ethereum network is attempting to solve. However, Polkadot is not necessarily a competitor, since its main focus is interoperability. Polkadot is offering a way for many blockchains to connect (e.g ‘bridge’), and it features the bridge to Ethereum.

Where to buy Polkadot coin

There are two ways to buy DOT coin:

- Through a crypto exchange (Binance, Kraken, KuCoin, etc)

- Directly through a wallet (TrustWallet)

- Over decentralized exchange (Binance DEX)

Buying DOT through the crypto exchange

There is a large number of crypto exchanges on the market. One of the largest is Binance and Coinbase. Quite popular are the Kraken and KuCoin exchanges due to the array of practical investment tools and options. While each exchange has its own procedure, the steps are the same:

1. Search for [Sign Up], or [Get Started] buttons

2. Open an account with the exchange, submit an email and follow the instructions

3. Provide identification details, name, address, an official public document

4. Deposit funds via bank order or credit card

5. Purchase DOT coins

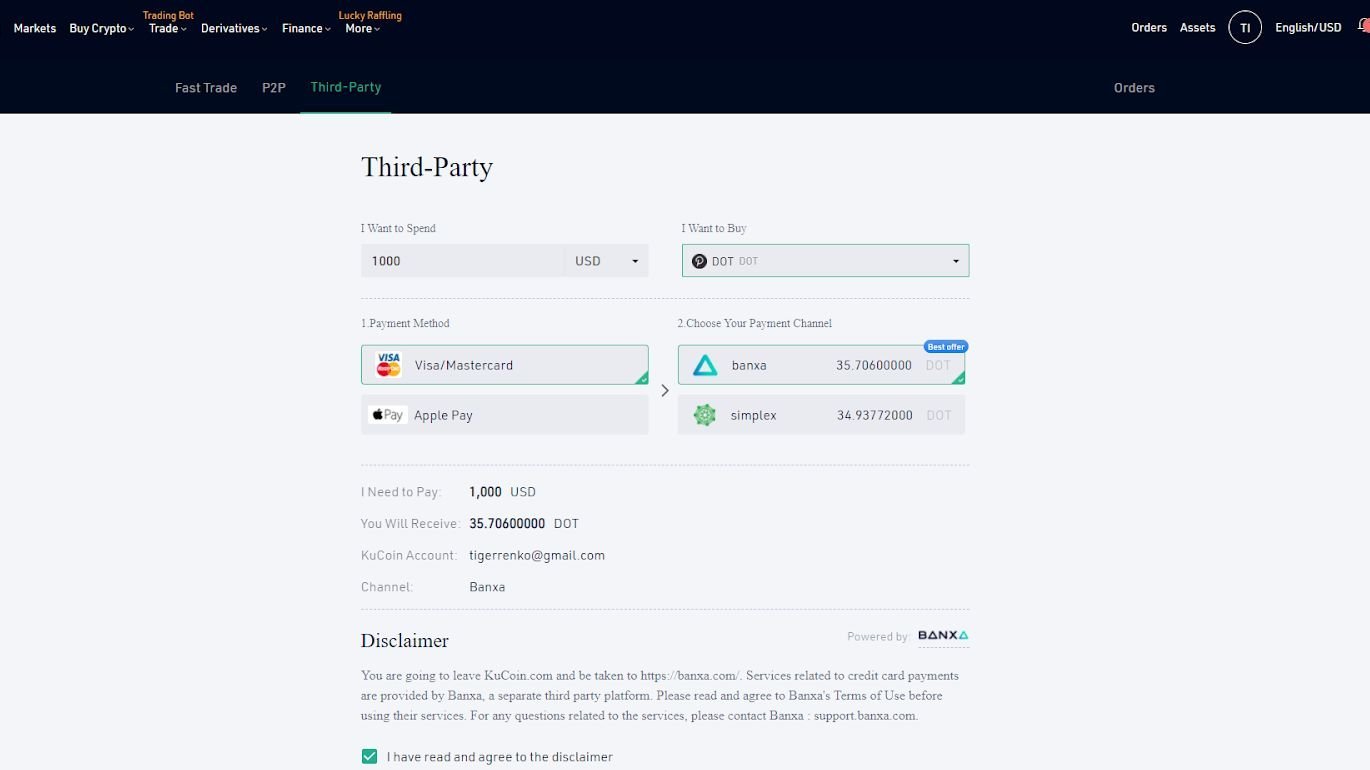

Sometimes crypto exchange doesn’t offer you to buy DOT directly from them. However, they provide third-party solutions (Simplex, Banxa, Btcdirect). Peer to peer (P2P) option allows you to buy DOT coins directly from holders, but this can prove to be risky and the price is always higher.

When searching for a crypto exchange, consider why are you buying the tokens. If your interest is staking, go through an exchange that provides easy staking solutions: Binance, Fearless, Kraken.

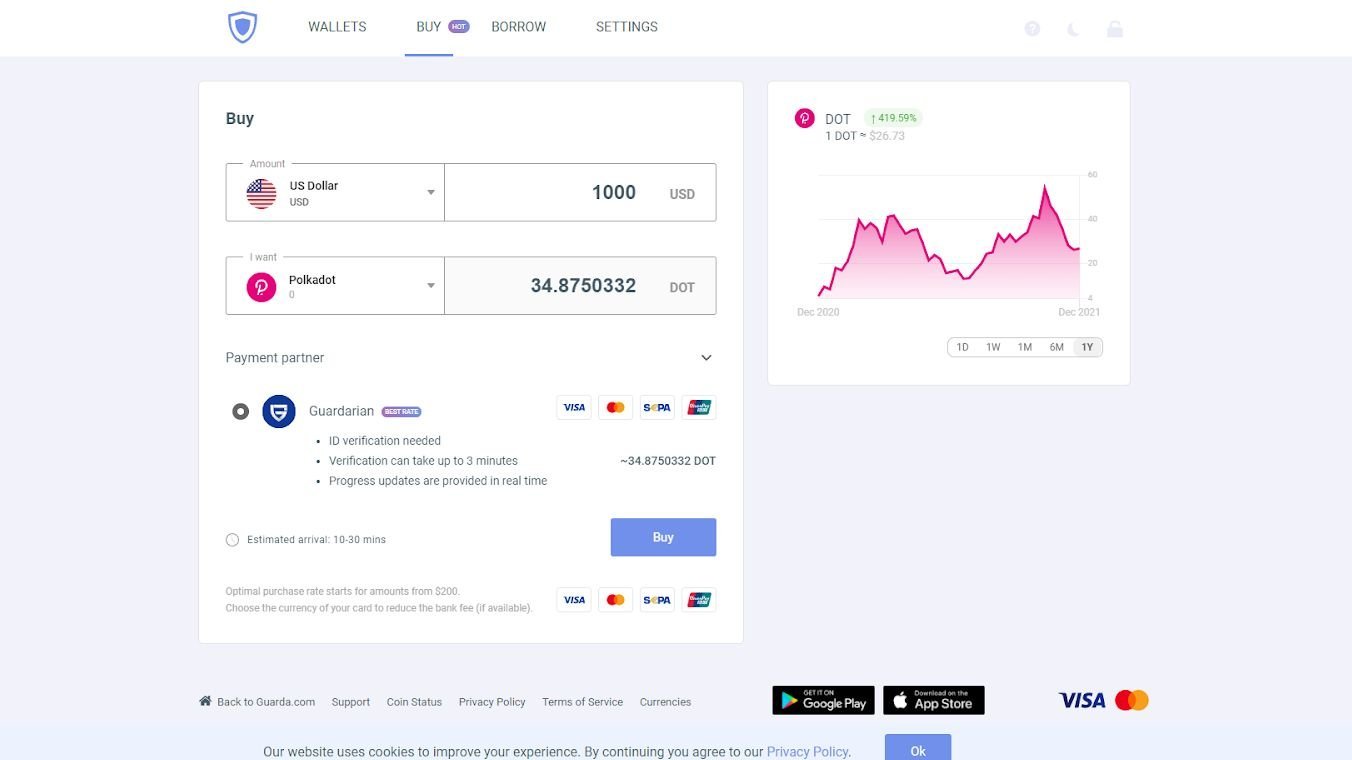

Buying DOT through the wallet

Most of the e-wallets today offer their services in the shape of a mobile, or desktop app as well as a browser extension and web wallet. When you are searching for a wallet for keeping DOT tokens, check if they offer direct purchase or third-party solutions.

Each wallet offers different perks, so choose based on your preference and needs: Trust Wallet, Guarda Wallet, Atomic Wallet, SafePal Waller, imToken are some of those suitable for DOT tokens.

The registration process is similar to crypto exchange signup. Download the app and create a password. You will be required to provide identification details in order to purchase DOT coins. Since a crypto exchange account doubles as a wallet, that is the recommended option if you are a newcomer to the world of crypto.

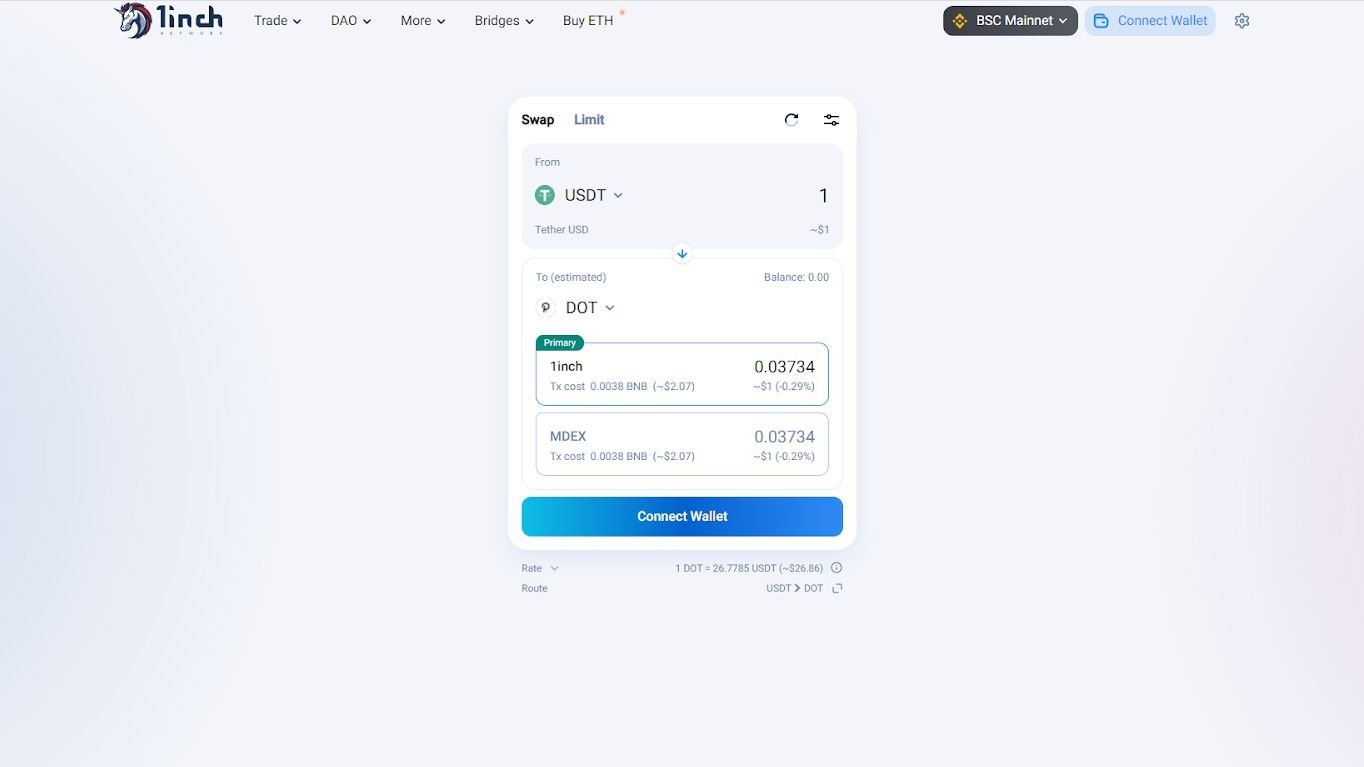

Buying DOT through a decentralized exchange

If you already hold different tokens, you can swap them for DOT via decentralized exchange (DEX). This is the advanced user approach. It assumes that you already have a wallet, crypto-funds on it and that you know how to connect your wallet to a DEX. Then you can swap coins you hold for DOT. Binance DEX and 1Inch provide this service. Watch out for availability, as Binance DEX is not offered in a number of countries.

- The first step is to switch to BSC Mainnet.

- Then select coins you already own in [From] and select DOT in the [To] field.

- Connect your wallet holding the selected currency

- Select the exchange provider

- Watch out for the fee (Tx cost) and make sure your wallet holds enough funds to cover the fee

How much does DOT cost?

The value of DOT fluctuates, just like all the cryptocurrencies do. DOT token’s volatility is around 7%. The current value is fluctuating around $25 per coin, with the all-time high at $55.

However, due to the importance of the issue that the Polkadot platform is solving, it is possible that the price will be much higher in the future. If other platforms manage to solve the problem of interoperability and interconnectivity of the blockchain networks first, then DOT coins could remain at this price point or even sink. Polkadot competes with Cosmos Network, Coinbase, and a number of other crypto-companies.

Is buying Polkadot a risky investment?

Yes. And no. Buying cryptocurrencies is always risky. The world is at the gate of the next step in the evolution of the Internet. Just like the transition from Web 1.0 to Web 2.0 gave birth to market giants such are Facebook, Google, and Youtube, Web 3.0 could give birth to new dominant players.

Polkadot is invested in Web 3.0 development and could be one of the winners, becoming the new Google. Or it could crash and burn and become one of the losers (remember MySpace?). No one can tell what the future will bring. Treat every crypto-investments as risky. Invest only the amount you are ok with losing. Professional brokers suggest no more than 5% crypto-investments in your global portfolio.

Pros and Cons of buying Polkadot coin

As with any other risky investment, there are a number of pros and cons to buying the DOT coin:

Pros

Cons

FAQ

What are the risks of the inflatory nature of DOT coin?

Passive holders of DOT, that is holders of DOT that do not perform different roles within Polkadot, will see their percentage holdings of DOT dilute over time as more DOT come into existence as a result of the as yet determined inflation model. Over time, this may result in the dilution of a passive participant’s holdings of DOT to close to zero in percentage terms.

Is DOT coin safer than USDT?

No, it is not. DOT is not a stablecoin. It is a token with an inflation model. Its primary intended use is to provide the functionality of the Polkadot network, with the role of cryptocurrency and store of value secondary.

Why would I want to invest in DOT?

Basically, investment in DOT coin is viable if you believe that Polkadot’s solution for connectivity and interoperability of blockchains will be the best and the only one used by future Web 3.0 landscape.

Tell me again, how do I profit from DOT?

Holding DOT coins is not profitable without actively using them for staking, crowdloans, or parachain auctions. However, if you plan to actively seek the auctions and join the crowdloans, or if you are willing to stake a minimum amount of DOT to collect the staking rewards, then DOT can be a relatively safe way to provide passive income.

How is DOT legally handled?

As the sale of tokens is a nascent practice, the treatment of DOT by regulatory and governmental authorities is uncertain and may vary across jurisdictions. The legal and regulatory treatment of DOT may be prone to change in the future, which may have a materially adverse impact on the legal status of DOT, the economic value (if any) of DOT and the liquidity of DOT, as well as the development, function or governance of Polkadot and/or the Web3 Foundation itself.

Crypto Ping Pong Digest

Trash style news. You will definitely like