Table of Contents

As the realm of decentralized finance (DeFi) is evolving into its second phase, the developers of DeFi 2.0 projects are looking to address some of the key issues that trouble DeFi 1.0. Such DeFi 1.0 projects have done an important job of establishing the initial userbase and the technological foundation upon which DeFi 2.0 projects are built. However, significant problems with DeFi 1.0 protocols do exist and have made such protocols outdated.

In this article, we’ll examine some of the most attractive DeFi 2.0 projects and tokens that you can try in 2022. We’ll also look at the methods these projects have used to solve some of the common DeFi 1.0 issues.

What are the best DeFi 2.0 projects and tokens to try?

After careful consideration, we have selected the six best DeFi 2.0 projects. Each of them has gained a reputation as a trustworthy and innovative protocol, that deserves the attention of users.

Why DeFi 2.0 matters?

However, before we examine the most appealing DeFi 2.0 projects and tokens in 2022, let’s quickly look at the DeFi 1.0 issues these projects are trying to solve. These include scalability, oracle, liquidity, and decentralization issues.

First of all, scalability poses a problem, as users are faced with long waiting times and high gas fees. This makes it difficult for users to interact with DeFi 1.o protocols, especially for beginners.

Oracle networks, which are third-party sources of data, are often not of the highest quality with DeFi 1.0 projects. Conversely, DeFi 2.0 projects rely on trustworthy oracles.

With DeFi 1.0, liquidity pools are split over various blockchains. Moreover, when users stake tokens in one liquidity pool, they can’t use them anywhere else, as funds are then locked. This leads to capital inefficiency. By using the staking mechanism, the need for liquidity mining is eliminated.

Achieving fully decentralized finance is one of the primary goals of DeFi 2.0. However, many such projects don’t actually abide by DAO (decentralized autonomous organization) principles. In contrast, DeFi 2.0 protocols are actually DAOs.

Finally, smart contracts offered by DeFi 1.0 projects are often not secure enough. Despite the presence of occasional security auditing, with the passing of time, such audits become less valuable. This leads to the endangerment of investors’ funds.

DeFI 2.0 is important because it seeks to evolve decentralized finance by solving all of these issues. If you’re interested to learn more, here’s our in-depth article on DeFi 2.0 that’ll provide you with all the info you need.

And with that out of the way, it’s time to proceed to our selection of the best DeFi 2.0 projects and tokens in 2022.

Olympus DAO

Developers of the “reserve currency protocol” named Olympus DAO have solved the problem with liquidity in an innovative way. Olympus is built on the Ethereum platform. Its treasury contains a load of coins such as Frax, wETH (wrapped Ethereum), and DAI, that are used to back the platform’s native token – OHM.

Such backing makes it possible for 1 OHM to equal 1 DAI. Since DAI is a stablecoin, it has a fixed price that is attached to another currency. In this case, the price of DAI will never go below $1. Thanks to this stability, the investors can put more trust in the security of their funds on Olympus DAO. Moreover, as Olympus will typically own more than 99% of the entire liquidity, practically all trading fees go to Olympus’ treasury.

Through the process called bonding, Olympus can function as a liquidity bridge to other DeFi protocols. By using other currencies, users can buy OHM tokens at a discounted price. Those other currencies are then utilized to add liquidity to decentralized exchanges (DEXs), such as Sushiwrap and Uniswap.

Olympus’ also eliminates the need for liquidity mining. It enables users to join its staking pool and become liquidity providers. Its APY (annual yield percentage) for staking amounts to more than 8000%. Such a high percentage is possible because this platform uses the profit it makes to print additional OHM tokens. Olympus then utilizes those tokens to incentivize users in its staking liquidity pool.

Wonderland

Wonderland DAO is extremely similar to Olympus DAO and has originated as Olympus’ fork. It uses the TIME token and is the first DeFi 2.0 protocol of its kind available on the Avalanche network.

Most of the information we’ve provided about Olympus also applies to Wonderland. The differences are mostly in the details. Wonderland uses coins such TIME-AVAX LP and MIM to ensure the stability of its native token’s value. In other words, the price of one TIME token will also not fall below $1.

Instead of bonding, Wonderland DAO relies on the so-called minting of tokens. Effectively, the process is the same, as Wonderland sells TIME tokens at a discounted price and uses the obtained currency to add liquidity on DEXs.

However, while the same method is used in terms of staking, Wonderland’s APY is much higher than Olympus’, and amounts to more than 80,000%. Furthermore, the Avalanche network allows for a lower cost of transactions and greater speed than the Ethereum network.

TemplarDAO

Here’s another Olympus fork. By using what the developers are calling the Treasury Reverse Protocol, Templar has created a DeFi 2.0 cross-chain for investing in Olympus OHM and Wonderland TIME tokens.

Just like Olympus, this decentralized reserve currency protocol uses the bonding mechanism to provide discount prices for buying Templar (TEM) tokens. This is handled in a way that doesn’t grossly inflate the token’s circulating supply. It is because of this that Templar’s treasury is adequately stocked, including a significant number of stablecoins.

Long-term stakers are entitled to receive some amounts of these stablecoins, thanks to the rebase profits of TIME and OHM investments.

The Templar protocol follows in the footsteps of Olympus. The idea of a decentralized reserve currency and protocol owned liquidity is at the core of the project.

Abracadabra

This is one of the DeFi platforms designed for decentralized lending services. It has a similar function to the well-known DeFi 1.0 lending platform Maker DAO, but is improved.

Namely, Abracadabra enables users to deposit collateral in the form of tokens from other platforms, such as Curve, Sushi, and Yearn Finance. With this deposit, users can loan the platform’s stablecoin MIM (Magic Internet Money), which can further be used to swap for other currencies and stablecoins on platforms that support MIM trading.

However, with this DeFi 2.0 protocol, the deposit is comprised of interest bearing tokens, meaning that this interest can repay your loan after sufficient time has passed. Effectively, these are self repaying loans.

What Abracadabra brings to the table in comparison to other DeFi 2.0 lending platforms is that it offers lower interest rates and costs of borrowing. Additionally, those assets that have a substantial chance of high-yielding interest are converted into liquidity, which increments capital leverage and income on the platform.

Tokemark DAO

This protocol can be thought of as a sort of intermediary that provides other DeFi protocols with liquidity. In fact, a high number of DeFi 1.0 lending projects rely on Tokemark to supply them with sufficient liquidity.

Tokemark uses a decentralized market-making solution to create sustainable liquidity. Its DAO members then vote on DeFi projects that will receive liquidity in this way.

Tokemark’s native token, TOKE, is utilized to direct liquidity from the so-called “reactors”, which represent each asset’s liquidity pool. It’s necessary for users who will be supplying protocol owned liquidity to place only one token into a reactor. Holders of TOKE become “liquidity directors”, i.e. they gain the power to decide on the projects that Tokemark will supply with liquidity.

All of this is done in an effort to democratize the process and incentivize both liquidity directors and providers.

Convex Finance

Based on the Curve finance protocol, Convex Finance is aimed at CRV (Curve) token holders and liquidity providers. The main purpose of Convex Finance is to provide secondary liquidity to Curve Finance. CRV holders can stake these tokens for cvxCRV (Convex CRV) tokens, which is a kind of CRV that is vote-escrowed (veCRV). Additionally, holders of Curve LP tokens, which are used to provide liquidity, can boost their tokens by staking them.

This is more beneficial than simply staking the coins on Curve Finance, for several different reasons. For starters, there are rewards for providing liquidity in the form of CRV tokens that were boosted by Convex, a base rate interest, and a portion of Curve’s trading fees.

Additionally, users that are staking their CRV tokens on Convex will receive veCRV holder-connected airdrops, veCRV and CVX tokens, as well as a portion of earnings made by the Convex platform. Unlike when providing liquidity, however, users that are just staking coins will burn their CRV.

The main advantage that Convex Finance brings is that this DeFi 2.0 project makes it much easier to boost yields when compared to Curve Finance. When using Curve Finance, boosting is only possible after a lengthy process that’s not especially favorable to users.

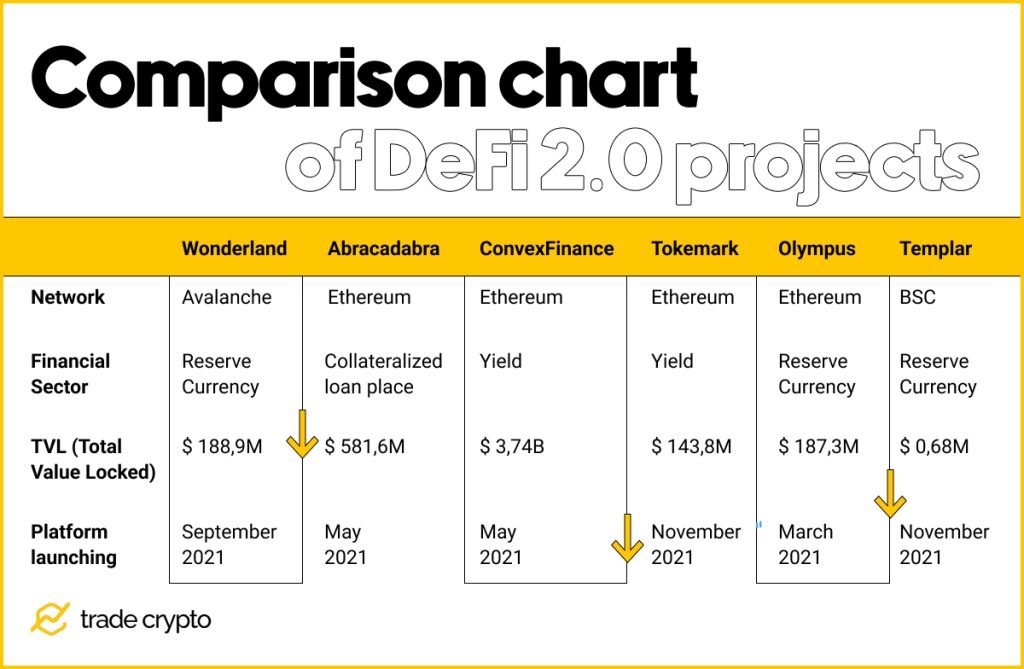

Comparison chart of DeFi 2.0 projects

Conclusion

DeFi 2.0 projects and overall goals are making us optimistic as to the further advancement of decentralized finance. These six projects are all noteworthy because they have managed to push the envelope in the world of DeFi, and with that, to evolve cryptocurrency and Web3. There’s no doubt that, in the near future, new and fresh projects will continue the process that these six protocols have started.

Crypto Ping Pong Digest

Trash style news. You will definitely like