Table of Contents

How to use crypto launchpads: List of trustful projects

Investors already know that the most lucrative opportunities are in the sphere of DeFi. That’s the space free of banks, unburdened by intermediaries, the place of peer-to-peer exchange markets, and there is no lack of projects that promise to skyrocket.

However, it is also a world inhabited by hackers, scammers, and rug pull. This article will examine how crypto launchpads help bring a layer of security to DeFi. We will present a list of projects you can trust, but as always, your own homework, and your own research is the best resource.

If you are a beginner to DeFi, we advise you to check out our comprehensive guides, a full guide to DeFi, and how to start with DeFi.

What are crypto launchpads?

They are also known as crypto incubators or crypto crowdfunding. The incubator element is all about curation. Projects that need funding are submitted to the launchpad’s board. Experts consider the features that indicate success: project blueprint, scalability, project ecosystem, tokenomics, and the team behind the project.

If the project raises all the green flags, it is introduced to the crypto launchpad. Then audience of investors, crypto enthusiasts, and the general population can get informed about the project.

How do crypto launchpads work? Each project presents its case on the launchpad’s website. There you can learn about the product (project or service) itself, what problem does it solve, what is their business model, what is the market position (who are the competitors), who were the main investors, who is the team behind, and what is the token utility.

Each launchpad has its own token. When you find an open project you want to support, you need to get on the project’s whitelist. Different launchpads handle it differently, but the point is that you first need to compete with other investors for your slot, then stake a certain number of launchpad’s tokens or participate in a liquidity pool. Then you will get to earn a number of project-specific tokens, as well as the chance to buy that token while it’s cheap. This method is part of Initial DEX Offering or IDO.

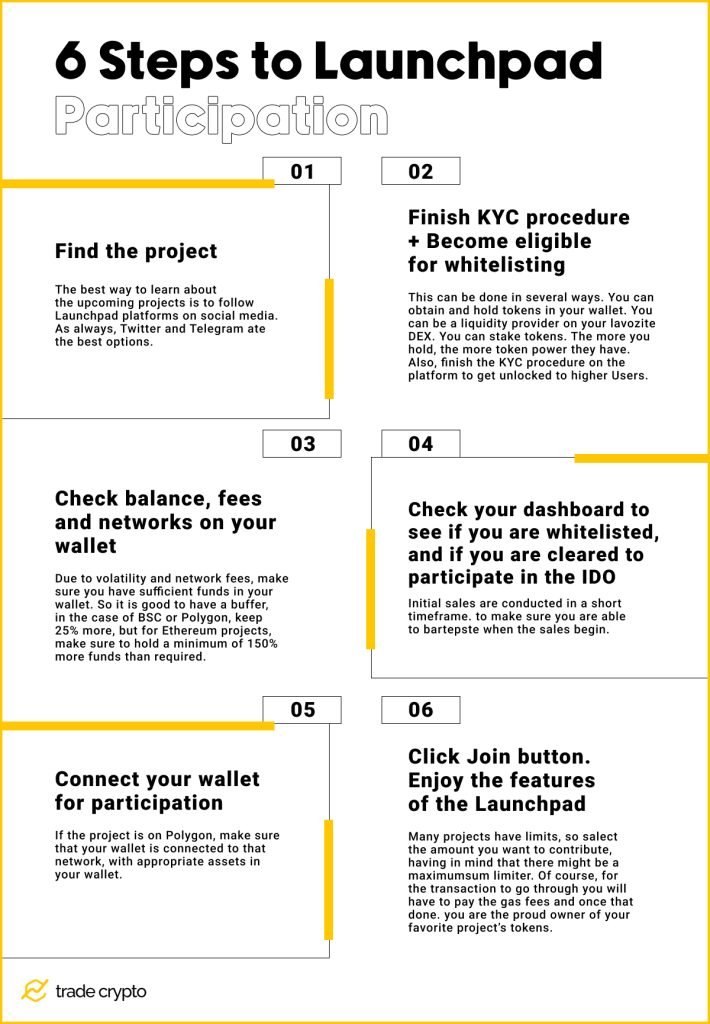

Example of launchpad participation

We will use Polkastarter as an example. While every platform will have its specific rules and steps, Polkastarter’s protocols and procedures are fairly representative.

Step #1

Find the projects. The best way to learn about the upcoming projects is to follow Polkastarter on social media. As always, Twitter and Telegram are the best options. You can also read Polkastarter’s blog, or regularly visit the website looking for the current and upcoming projects.

Step #2

Become eligible for allowlisting (whitelisting). This can be done in several ways. You can obtain and hold POLS tokens in your wallet. You can be a liquidity provider for POLS liquidity on your favorite DEX. You can stake POLS in the platform’s dashboard. Every 250 POLS grants you one ticket. The more you hold, the more “ticket power” they have. You are not exchanging tokens for tickets. They represent the chance to get on the allow list. Also, finish the KYC procedure on the platform to get unlocked to higher “ticket power” tiers.

Step #3

Prepare your wallet. Due to volatility and network fees, make sure you have sufficient funds in your wallet. So it is good to have a buffer, in the case of BSC or Polygon, keep 25% more, but for Ethereum projects, make sure to hold a minimum of 150% more funds than required.

Also if you have funds on a different blockchain network, make sure you know how to bridge assets to Polygon or BSC.

Step #4

Make sure you check your dashboard to see if you are allowlisted, e.g if you are cleared to participate in the IDO. Initial sales are conducted in a short timeframe, so make sure you are able to participate when the sales begin.

Step #5

When the time comes, make sure you visit the project’s page, and connect your wallet, ensuring that the correct network is selected. If the project is on Polygon, make sure that your wallet is connected to that network, with appropriate assets in your wallet.

Step #6

Time to smash that “JOIN” button on the project’s page. Many projects have limits, so select the amount you want to contribute, having in mind that there might be a maximum sum limiter. Of course, for the transaction to go through you will have to pay the gas fees and once that’s done, you are the proud owner of your favorite project’s tokens. Wait for the confirmation. When the sales are over, you will be able to claim your tokens, and hopefully you will watch them skyrocket in value.

Benefits of using launchpads

Launchpads benefit both startups and investors. New projects benefit from presenting their Dapps to the potential investors, crowdfunding to provide both potential users, as well as a boost in the capital.

Investors get a curated list of tested projects, so they can support them without fear of scams. Early access grants the opportunity to invest in “to the moon” new fresh tokens. So the launchpads provide both a return on investment and a measure of safety.

Launchpads also profit, as garnering the interest of investors will also mean growth for launchpad’s native tokens, which in turn can provide prestige for participating startups, and again, the investors benefit from both the token growth and expanded pool of projects to invest into.

This positive feedback loop is still expanding and evolving, creating great momentum for bringing new Dapps on the existing blockchain networks, providing a safer ecosystem and great value for all the participants.

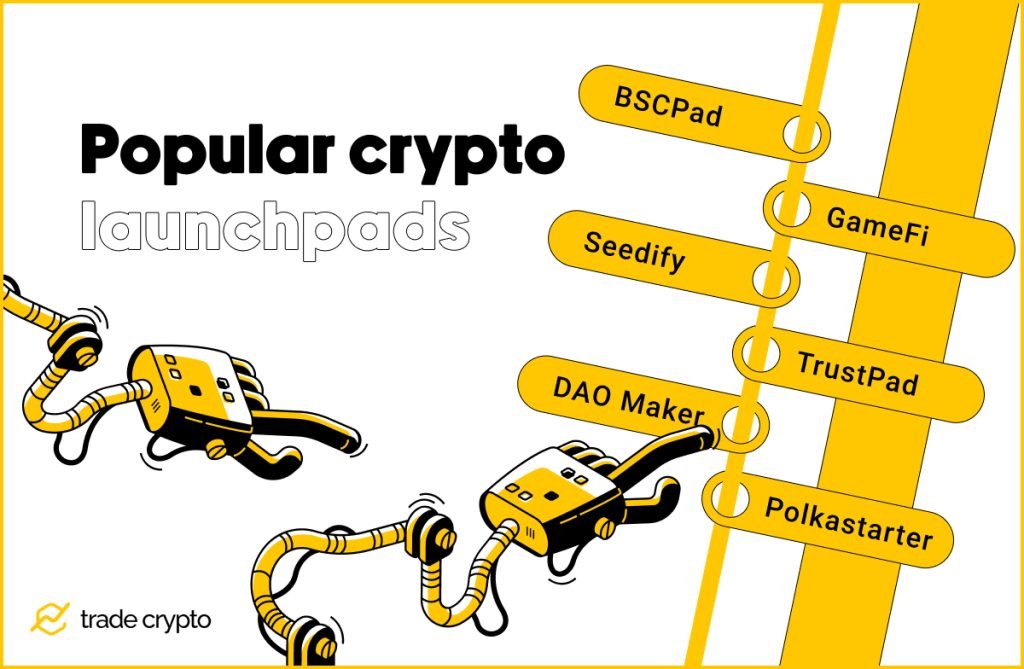

Popular crypto launchpads

So, what are the best launchpads in 2022? We present you the top 6 launchpads for the initial DEX offering (IDO).

BSCPad

This is the first decentralized IDO platform for the Binance Smart Chain, quite a popular network. While many launchpads rely on lottery or first come first serve principle, BSCPad lets investors choose between a guaranteed slot and a chance to win, as they stage a two-round system of allocation. You can buy BSCPAD tokens on PancakeSwap.

GameFi

What is GameFi? Crypto gaming is getting huge, so this pad is seen as the best ROI. Games built on BSC, ETH, or Polygon networks can conduct capitalization either through IGO (Initial Game Offering) or INO (Initial NFT Offering). They also sport a live market, where you can grab land from metaverse projects, or game asset NFTs. The majority of the games offer an open whitelist, but there are also lotteries for the most lucrative projects.

Seedify

This is another launchpad for crypto games and pay-to-earn games. You can get an SFUND token from PancakeSwap, KuCoin, and Gate.io. The curated list includes various games, mostly traditional games with blockchain elements, such are FPS, survival, or train simulator.

TrustPad

This launchpad is focused on metaverses. There are also gaming projects, but this very popular platform is also hosting various DeFi apps, such as a next-gen trading platform aimed to help investors find the best markets. The most represented blockchain in TrustPad network is BSC, and TPAD tokens can be staked for greater rewards.

DAO Maker

DAO Maker is not a new name in the blockchain space, operating since 2018. Not only you can stake DAO to get yield, but you can use your profits to invest in different IDOs and IGOs. They support Dapps, as well as games. Since DAO Maker also provides consulting services, they clearly label crowdfunding projects that they have supported in this role.

Polkastarter

Polkastarter, one of the biggest pads out there, is boasting over 200,000 investors. Other than allowlist (whitelist) conducted via lottery, they also host auctions. One of the greatest successes was the launch of Tosdis (a DeFi-as-service – DaaS – provider), with the pool sold out in a record time of 30 seconds.

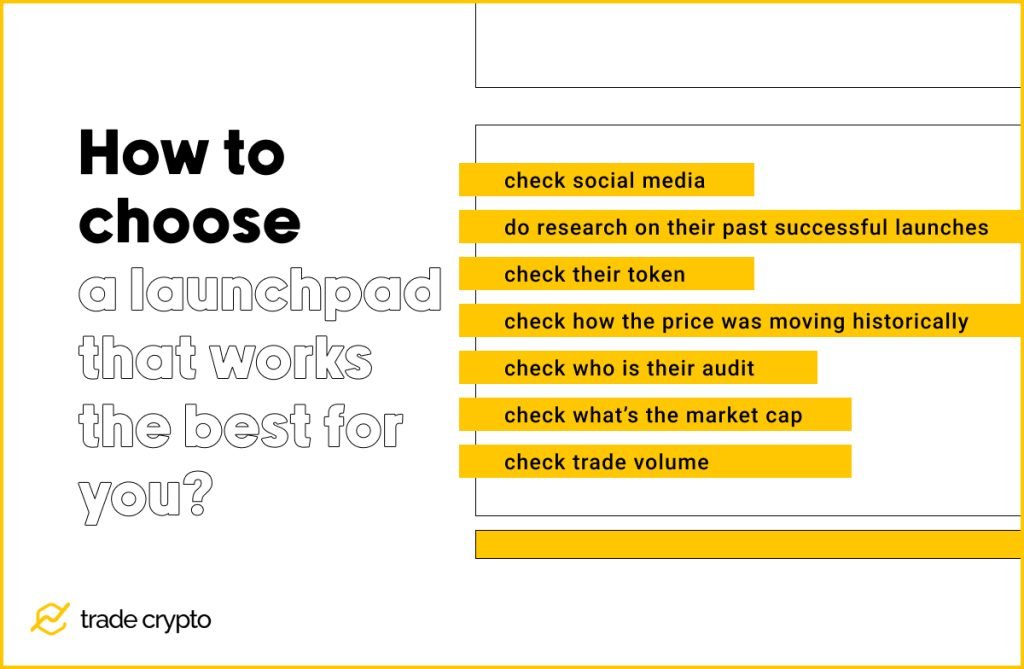

How to choose a launchpad that works best for you?

The first thing to consider is – do you believe in the platform. Following their social media, researching their past successful launches, how do they look to you as an investor?

If they are a platform you would back, then the next consideration is – their token. Check how the price was moving historically. Check who is their audit, and what’s the market cap. Trade volume isn’t that important, but it can give you a general idea about the market’s interest in their token.

Then as the final consideration, plan your investment according to the type of products you want to support. Do you want to invest only in financial Dapps, or do you believe in crypto gaming, maybe metaverse? Focus on your preferred type of startup.

Risks of using launchpads

Just like the entire world of DeFi, even the best crypto launchpads are not without risks. Supported projects might falter, and the risk of tokens received for participation losing all value is real. Participation tokens might also lose their original value.

Another risk, everpresent, in the DeFi world, is hacker attacks. DeFi platforms can be hacked, or defaulted on by the owners. Such is the risk whenever there is a centralized platform.

Conclusion

However, despite all the risks, crypto launchpads are a great tool to enable crowdfunding, to broaden the base of investors by allowing a great number of people the same benefits that until recently only huge financial institutions enjoyed.

When governed successfully, launchpads can offer incredibly successful initial offering events. Projects can be funded in no time, even overfunded, just like on Kickstarter. There is a clear demand for this market from the investors, and there is still room for this segment of the industry to grow and evolve.

Crypto Ping Pong Digest

Trash style news. You will definitely like