Table of Contents

How does staking work in cryptocurrency?

In the beginning, there was only Bitcoin. The only way to create new coins was to “mine” them. The crucial thing to understand is that the underlying technology of Bitcoin is a network. Nodes in a network have a distributed ledger. Each node verifies and vouches that the new “mined” block on the chain is valid. This is to prove that a new block is a result of sufficient “work”, eg. computational power expended. Hence the name “proof of work” for this sort of consensus. Miners complete the block, and the reward is – a new Bitcoin.

How does cryptocurrency staking work?

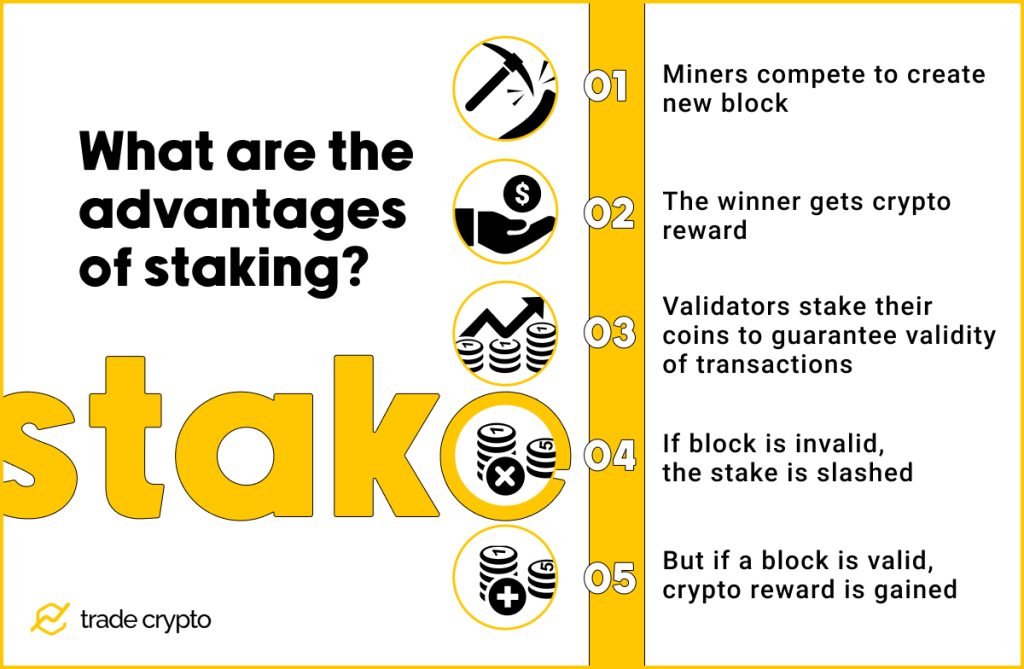

Certain coins allow holders to “stake” some of their assets, to get a reward. Being decentralized, blockchain networks don’t have a central authority. The health of a network depends on having a number of interested users ready to participate in the consensus protocol. They are called validators.

Those users, willing to invest, eg. stake their assets, guarantee the legitimacy of new blocks by placing their tokens on the line. When a new block is created, the network picks a validator, based on the size of their stake and the length of their investment. They are given a reward for their service. Think of it as a crypto savings account, only it’s not providing liquidity but providing a guarantee that the transactions on the chain are valid. That’s why this method of consensus is named “proof of stake”.

What is proof of stake?

Old, proof of work consensus is energy and time-consuming process. To increase the speed and efficiency, instead of forcing validators and miners to go through math problems to “solve” a new block, transactions are validated by a network of users invested in staking.

Therefore it’s safe to say that “staking” is new “mining” for those networks that want to have lower energy costs, lower transaction fees, and a more approachable way for validators to participate in the consensus of the network. Instead of expensive mining equipment, high-output processors, a lot of electricity, and troubles with overheating, users interested in supporting the network and earning new coins can simply lock their assets, stake them, and gain rewards.

What are the advantages of staking?

No matter what’s the value of an asset, no one profits from funds that are not generating more, be it in interest, rent, or some other way. One of the safest ways to earn more on your crypto assets is to stake them.

Staking increases the stability of the network, supporting the value of the tokens you hold. While risks are always present in the world of crypto, they are minimized in the case of staking. So, a holder can gain more assets while making the blockchain more secure. That’s why in some cases, networks reward validators with governance tokens, allowing those who are interested to participate in future changes to the protocol.

How do I start staking?

For staking, you will need a minimum investment of tokens that support staking. For instance, Bitcoin can’t be staked, as they have different proof consensus. Then there needs to be a computer, that will be online all the time, performing validations day-in-day-out. If the validator’s node is disconnected, there could be slashing, e.g. loss of staked funds. Node computer needs to run appropriate software. Setting this up requires some advanced competencies. Luckily there are different staking methods.

Staking methods

Since becoming a validator and setting up a validating node manually could be technically complex, there are several other methods that allow those interested in staking as an investment to start gaining the rewards.

One of the methods is custodial staking, where you simply deposit your tokens, and the service sets up a node for you, managing it. They take their cut of the rewards, but you don’t have to handle the software and hardware requirements.

Another method is stake pooling, where many investors pool together their assets in order to increase their reward percentage, as the volume staked affects the reward. The most convenient method, however, is through exchanges that offer staking services.

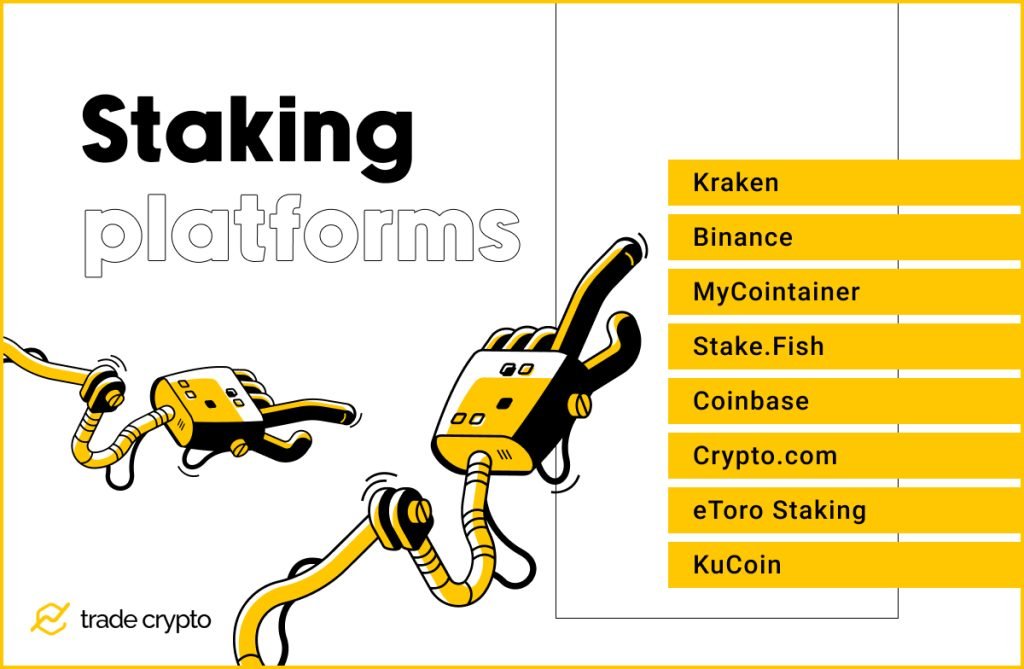

Staking platforms

Some of the best coins to stake are Ether (ETH), Tezos (XTZ), Polkadot (DOT), Cardano (ADA), and Algorand (ALGO). There are several platforms ideal for the casual investor, that provide staking services: crypto exchanges, wallets, and dedicated staking service platforms, so we can provide a list of best crypto staking platforms.

The actual staking procedure is always straightforward with the users simply deciding on the coins and amount to stake. Sometimes the staking time is determined and that’s it. This is why staking platforms are more popular than setting up your own computer to act as validator.

Kraken

Kraken is a US-based reputable exchange. They offer Cardano, Ether, but also Cosmos (ATOM), and Flow (FLOW) coins. Yearly rewards are 4-9% and up to 12% (for ATOM). The process is fairly easy. Get your coin of preference through Kraken exchange, select it and earn rewards.

Binance

One of the most popular exchanges is very novice-friendly making it the first choice for many. While Binance is predominantly an exchange, they offer the staking service through their Binance Earn section. You can stake XTZ, ATOM, ALGO, and a choice of other tokens, stablecoins included. They also offer two flavors of staking.

You can lock your funds away for a fixed amount of time, then get them back with all the rewards you’ve earned. Or they can connect you to various DeFi platforms, acting as an intermediary between your assets and third-party staking service platforms.

MyCointainer

This is a service that acts as a wallet for your staking. Transfer your coins and either keep assets in their wallet or your wallet to enjoy regular profits. They offer Polygon (MATIC), Cardano (ADA), or you can opt for more risky coins with higher rewards, such are Cartesi (CTSI), Nem (XEM), and Syntetix (SNX). Because they are less popular tokens, rewards can be over 40% annually.

Stake.Fish

Stake Fish offers non-custodial and staking pool services. You can invest a minimum of 32 ETH needed to become a validator. They will set up and manage a node for you. Of course, 32 ETH being a substantial sum, you can start with as low as 0.1 ETH with a stake pool service. Basically, you can stake the desired amount of ETH. Their system will gather assets from other users and once the 32 ETH threshold is met, they will establish a node. At the end of the staking period, a smart contract is dissolved, and the rewards split.

Coinbase

Coinbase is another mega-popular exchange. Consequently, they offer a vast number of tokens to be staked along with the most popular, ETH, ALGO, ATOM, XTZ, and ADA. They run the technology needed for the nodes to be set up, pooling the assets of the investors, making the whole process very simple. Decide which coins from your wallet you want to stake, and Coinbase handles the rest, keeping the portion of the rewards, for 0.1% to 6% APY.

Crypto.com

This exchange excels in the area of staking by offering a variety of stablecoins to be staked. Users can, for example, go for the USDC coin, select the time, from 1 to 3 months, and enjoy the APYs. An especially good offer is for Tether, USDC, DAI at 8%, and Polkadot for up to 12.5% APY.

eToro Staking

Not to be confused with the eToro platform, eToro Staking is the staking division of the platform otherwise renowned for copy trading services. While eToro primarily deals with stocks and futures, eToro Staking is dedicated to Cardano, Ethereum, and Tron staking with very short lock-up times of about 10 days before you start earning.

KuCoin

In traditional staking, investors lock the assets, unable to withdraw them from custody. The interest payment is scheduled, and the required period is fixed. KuCoin is a popular exchange that offers “soft staking” enabling investors to receive interest on a daily basis, with no minimum staking period and retaining the custody over assets in their KuCoin wallet.

With KuCoin you can stake ATOM, Tron (TRX), XTZ, Dai, but also a gamut of exotic coins, like EOS, Elastos, Decred, or Kusama.

What are some risks of staking crypto?

If you are staking as a validator, there is a number of things that can go wrong. The primary risk is from your validating node going offline. That’s why staking through services, wallets or exchanges is the most convenient way to go.

Another risk is volatility. This is an ever-present danger when dealing with crypto. While your coins are staked, the price can suddenly drop, effectively nullifying the gains you earn. Because staking often means locking away your funds for a period of time, a sudden surge in prices can leave you without a possibility to sell or trade your, suddenly valuable, coins.

As always, do your own research, and invest only the amounts you can afford to set for the purpose of staking. For maximum security, try staking stablecoins or other less volatile coins.

Crypto Ping Pong Digest

Trash style news. You will definitely like