Table of Contents

Ecommerce and Cryptocurrency – The Ultimate Guide to Using Crypto in Ecommerce

In a previous couple of years, both eCommerce and cryptocurrency markets have made unprecedented progress. As there are more people investing in crypto every day, they are looking for shops that accept crypto payments.

If you are an eCommerce owner that aspires to create a crypto eCommerce in the future, you are in the right place. You will find all relevant information on the benefits and risks of crypto for eCommerce businesses, what it takes to start accepting crypto payments, and more.

Everything you need to know about cryptocurrency and eCommerce

Before we explain which crypto payment options are at your disposal, let’s do some homework first, and explain what are cryptocurrencies and how you could benefit from them.

What is a cryptocurrency and what can it be used for?

Cryptocurrencies are a digital version of traditional (fiat) money, facilitated by blockchain technology. The first and by far most famous crypto is Bitcoin, but it is not the only one. There are many different cryptocurrencies, and there are some of the main reasons for that:

- There are multiple ways blockchain algorithms can function. In other words, there are many modifications of the original Bitcoin blockchain to tackle the environmental footprint, and balance scalability, speed, and safety of transactions

- Cryptocurrencies are products of different communities and/or platforms.

The idea behind cryptocurrencies is to create a platform people could use to trade directly, without intermediaries such as banks or other centralized institutions. The tendency to bring money closer to people is understandable if we remember that cryptocurrencies were invented in 2009, in the midst of a serious financial crisis.

Cryptocurrencies use blockchain technology for making a public record of all transactions that have ever occurred. In plain English, that means that while some people are trading with crypto, others are keeping records of these transactions and earning a certain amount of crypto as a reward. The process of monitoring transactions is called “mining”.

So how do you get a cryptocurrency? There are several ways to do that. You can either mine it, or buy it in exchange for some fiat currency through a crypto wallet. Also, some people buy it through a broker.

Apart from Bitcoin, there are more than 1500 other cryptocurrencies (a.k.a. altcoins). Some of the most famous ones are Ethereum, Ripple, Cardano ADA, BitcoinCash, etc. They rely on distinctive modifications of blockchain and need various communities and amounts of energy to function.

Cryptocurrency’s potential for businesses

In the beginning, people were sceptical about crypto, and a lot of them still are. How do you create money out of thin air? A “hidden” (encrypted) currency that consists of bits and random letters encryptions can’t be legit.

However, if you think about it, all money is created from thin air. What are dollar bills if not papers? They are indeed special papers, but still – papers. What gives value to them as well as to gold is our common agreement on their worth. The same goes for crypto. In 2010, an early Bitcoin adopter paid a pizza for 10,000 Bitcoins. At the time it was equal to $41, but in today’s worth of Bitcoin, that pizza would cost $490 million. Sounds crazy, but it isn’t. This is actually a great opportunity for businesses.

There are a lot of people out there that got rich thanks to Bitcoin and are now seeking ways to spend their money. At the same time, as crypto gets out of the dark web and becomes recognized by legal authorities worldwide, a lot of money is being invested in it. However, the owners of crypto have problems as to how to spend their crypto assets. Cryptocurrencies are still a novelty for a large majority of people, and the ways to do that are still being developed.

What happens now is that, in the wake of pandemics, two industries are blossoming at the same time: crypto and eCommerce. For many, these two industries seem quite complementary and ECommerce businesses need safe online payment, and crypto promises exactly that. So, we should address the benefits of crypto-eCommerce fusion, and what are the risks involved.

Access to a new market share

One of the major troubles for eCommerce businesses is the need to adjust prices to national currencies. This concern would be eliminated with cryptocurrencies, as their value is absolutely independent of any national or international authority.

Additionally, the community of crypto users keeps growing, and businesses realize the great opportunity of expanding the volume of consumers. Despite the value volatility and occasional crashes, a lot of crypto owners are immune. They stay positive because they have invested a long time ago.

Cost efficiency

Compared to transactions through credit cards or platforms such as PayPal and Stripe, crypto exchanges are much less expensive. Usually, fees for credit card transactions are between 2% and 5%, while crypto transactions are around 1%. This means that you could lower some prices and attract new customers without losing anything.

Besides, in most countries, you won’t pay taxes for crypto transactions.

However, there are businesses that claim things aren’t as black and white as they seem. The average Bitcoin transaction fees grew significantly in 2021, from $23 to $59 in only a couple of months. The reason for this was the increasing demand for mining and the network congestion As the mining services fall under market law as well, this has direct repercussions on the crypto exchange platforms.

Namely, in order to trade with crypto, you have to sign up to some exchange platform. One of the most popular is Binance, and they officially stated that their fees will depend on the current mining fees rates.

If you do some math with this information, you would see that it pays off to trade in crypto only for larger amounts. For example, in the case of the most expensive credit card transaction (4%), you would need a purchase of at least $575 to profit from it. On the other hand, in the case of crypto, you would need at least a $1475 purchase.

Faster transactions

We all know that payments through PayPal and credit cards can take a couple of days to process by the banks, especially in the case of international transfers. With crypto, the processing goes much faster. The longest processing periods are around one hour, although it usually takes around 20 minutes. With additional fees, it could take even less than that. In turn, your customers could enjoy faster deliveries.

The secret is in the very nature of blockchain technology. While algorithm never sleeps and mining factories work 24/7, banks have certain working hours (although they also have their automation systems).

Safety and security

Many customers will like the ability to trade anonymously again. With credit cards and PayPal, an excessive amount of personal data becomes visible. In the case of crypto, we get to enjoy the anonymity of good old cash.

And although a lot of people still don’t trust crypto, those who own them are familiar with how they work and they know very well that it is much safer to pay with crypto. The reason is, again, in the way blockchain works. In the case of Bitcoin, each blockchain transaction has to be monitored and approved by everyone involved. Once they do, the transaction is written in stone, and can’t be reversed.

Thanks to this system, blockchain protects your business against customer fraud as well. One of the most common customer fraud happens when they receive the product but report to the bank that they never did, requesting money back. Since blockchain is irreversible, people are discouraged to do this.

Nonetheless, although risks are significantly reduced with crypto, they are not eradicated. Although transactions are irreversible and blockchain technology is hard to hack, crypto-assets can be attacked elsewhere. For example, you need a crypto wallet to keep your crypto coins in. These aren’t blockchain-based, although we use them for storing blockchain products. That is why occasionally they become targets of hacker attacks, who can breach the protection systems and steal crypto stored inside.

Advantages of using cryptocurrency in eCommerce for your customers

Although there are many eCommerce-cryptocurrency pros, cryptocurrency inevitably holds some risks as well. In any case, cryptocurrency benefits are outweighing the risks. These are reasons you shouldn’t miss on the upcoming crypto-eCommerce blend in 2022.

It is improving customer experience

Thanks to blockchain, business owners can also track online behaviour and create personalized ads. Also, people will have an additional, faster payment choice and be more flexible. Thanks to crypto, cart abandonment won’t happen as frequently.

Perks for the loyalty program

Just like communities use blockchain to create and trade cryptocurrencies, you can use the same technology to issue custom loyalty points to your customers. These would never expire and would most certainly be an entertaining and safe way to reward the best customers.

Global marketplace

As previously mentioned, there are owners of crypto in almost every country in the world. These people can’t wait to find ways to spend their money on products and services they need. Therefore, eCommerce businesses have an opportunity to make this possible, with fast, low cost, and reliable transactions.

Some drawbacks of eCommerce cryptocurrency introduction

There are some major drawbacks of allowing cryptocurrency for eCommerce payments.

First of all, there is volatility. If you accept crypto, you will be exposed to significant and often unpredictable crashes in value. It is true that your crypto assets could just as easily become more valuable too. It is a matter of how much risk are you willing to take and how long are you ready to wait. Partially, the volatility can be avoided by accepting purchases in stablecoins, which are more stable versions of crypto as their value is linked to that of traditional currencies.

Secondly, there are legal uncertainties. In most countries, cryptocurrencies aren’t illegal, but they are unregulated. If you decide to start accepting payments in crypto, it is a good idea to check.

The irrevocability of crypto payments limits space for customer protection in case of unauthorized expenses. Brand loyalty will become even more important, as the final receiver will have to deal with such cases since there is no bank (third party) to resolve the issue.

Crypto market fragmentation can seem overwhelming at the beginning. Which coins should you accept, and which aren’t legit or worth the effort? These are hard and important questions, and sometimes need a lot of time and research to answer. Time eCommerce businesses sometimes don’t have.

How to implement a crypto payment system for your eCommerce?

There are two ways an eCommerce business can accept crypto coins:

- directly to a personal crypto wallet

- meditated by fiat to crypto payment gateways.

If you decide on the wallet, you can get either a virtual or physical wallet. Virtual wallets are apps that will store your coins for a fee, while physical wallets are USB resembling devices. The second option is much safer, as there is almost no risk of losing your coins.

Alternatively, if you decide on a payment processor, you can either make one (i.e. hire a developer to make it) or choose from existing options. Some of the most popular processors are BitPay and Coinbase, but there are many others. What’s beneficial about processors is that they will convert crypto coins into real currencies right away, thus protecting you from crypto value fluctuations.

Furthermore, most eCommerce platforms (Shopify, WooCommerce, BigCommerce) have crypto integrations available at their app stores.

As if you’re wondering how to accept Bitcoin on Shopify, here is how to do it:

- find the Payment providers page on your Shopify admin dashboard

- choose among Coinbase Commerce, BitPay, CoinPayments.net

- accept Bitcoin or any of more than 300 altcoins available.

After that, you have successfully added a new gateway.

Which cryptocurrency payment gateway can you use?

There are dozens of gateways you can entrust with your future eCommerce cryptocurrency transactions. Some of the most popular and therefore, we would say, most reliable are CoinBase, CoinGate, SpectroCoin, BitPay, to mention only a few.

Keep in mind that choosing the right and reliable wallet and payment processor is not an easy job to do. These platforms will hold all your crypto assets and are therefore best to research the topic well, or even better hire a professional to do the job for you.

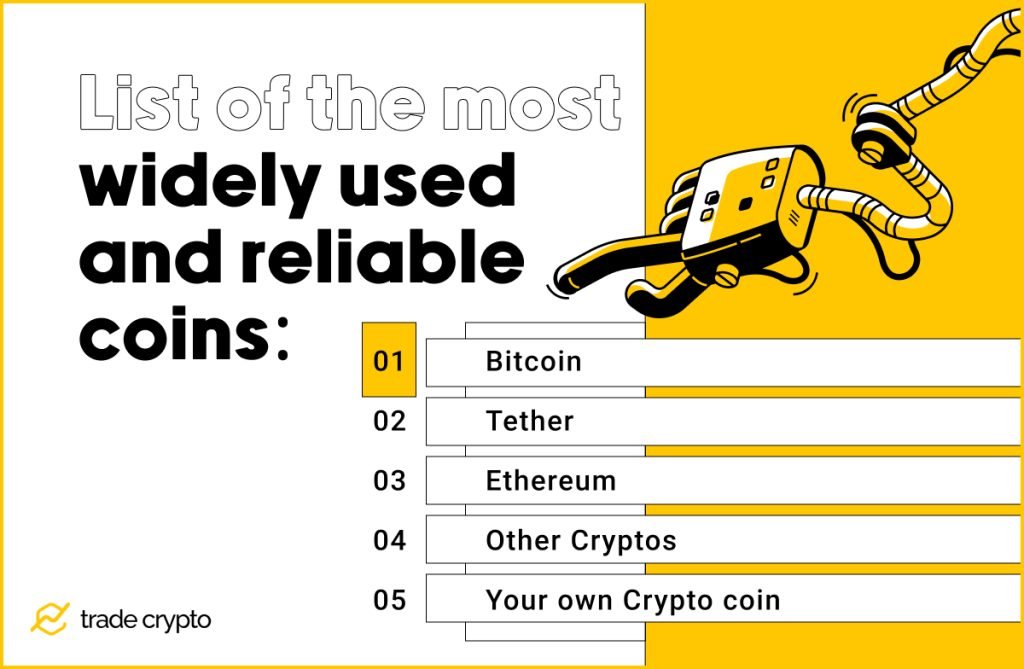

Which cryptocurrencies should you think about including?

This is another big question, as there are hundreds of crypto coins, and you don’t have nor can accept all of them. Here is a list of the most widely used and reliable coins you should probably accept if you want a cryptocurrency eCommerce in the future.

Bitcoin

Created in 2008, by a man (or woman?) behind a mysterious pseudonym Satoshi Nakamoto, Bitcoin was the first cryptocurrency ever made. Currently, it is the most valuable crypto coin and receives the most investments.

As of writing, the average BTC transaction fee is $2.05.

Tether

Tether is a stablecoin, which means it is much less volatile and attractive for eCommerce businesses. Its anticipated worth is $1 US dollar.

There are no fees for transactions among Tether wallets, while exchanges for fiat currencies go with a 0.1% fee.

Ethereum

This cryptocurrency is one of the biggest competitors of Bitcoin at the moment. The key difference between Ethereum and BTC is in their blockchain algorithm. Ethereum’s PoS (proof-of-stake) algorithm needs much less energy consumption and is considered to be a greener solution, compared to BTC.

The average transaction fee for Ethereum is $3.9.

Other cryptos

Altcoins you could also consider accepting are Litecoin, Dogecoin, Bitcoin CASH, and Cardano ADA. Each of these cryptos has its own story, but what is important is that they are not a scam, have decent worth, and large communities that support them.

Your own crypto coin

In case you don’t like either of the suggested coins, you can always make one for yourself! It is as cool as it sounds, however, it will require a knowledgeable and experienced developer.

What professional should I hire to create custom crypto?

If you decide to create your own coin or token, it would be best to contact a trusted software development company. It will provide you with people, knowledge, and guidance as to what should be done to create crypto. A cheaper option is to hire a freelancer from one of the crypto labour platforms.

How much does it cost to add a crypto payment option to the store?

Integrating crypto processors into your eCommerce website is most probably going to be free (in case your website is running on WooCommerce or BigCommerce).

Otherwise, if you decide to create your own coin, then hiring the developer team might cost you between $2000 and $5000. However, that might well pay off in the long term.

Are there any taxes for crypto payments?

Every country is different. In the USA for example, cryptocurrencies are considered to be assets rather than money. That means that any gains achieved with crypto are subject to tax laws. As an eCommerce, it will be necessary to keep detailed track of transactions, their values, and regularly report these to the IRS.

FAQ

Since eCommerce-crypto synergy is a new concept, there are many questions surrounding the topic. Here are some questions eCommerce owners often have on their minds.

What are the advantages of cryptocurrencies?

Cryptocurrencies are much cheaper to trade with, and the transactions are much more safe and reliable.

What can you use cryptocurrency for?

Although it’s not as easy to shop with crypto as it is with regular money, there are many things you can buy with crypto assets. Depending on the currency and the amount, you can make anonymous transactions, invest in startups, buy a Tesla car, etc.

What is the best cryptocurrency payment gateway?

There is no definite answer to this question, as it will depend on your particular needs. Based on user reviews, however, BitPay and CoinBase are among the most popular solutions at the moment.

Conclusion

Cryptocurrency-eCommerce teaming sounds like a very idea for your online retail business in 2022. Although there are risks and there are many crypto eCommerce sceptics, this is a great moment to seize the opportunity and attack new markets. This would substantially boost your customer experience, but also sales and opportunities to grow in the future.

The eCommerce and cryptocurrency markets have too much in common for businesses not to thrive from their potential to mutually support growth. ECommerce crypto trade is a great trend for 2022 and will most probably continue to be in the following years as well.

Crypto Ping Pong Digest

Trash style news. You will definitely like