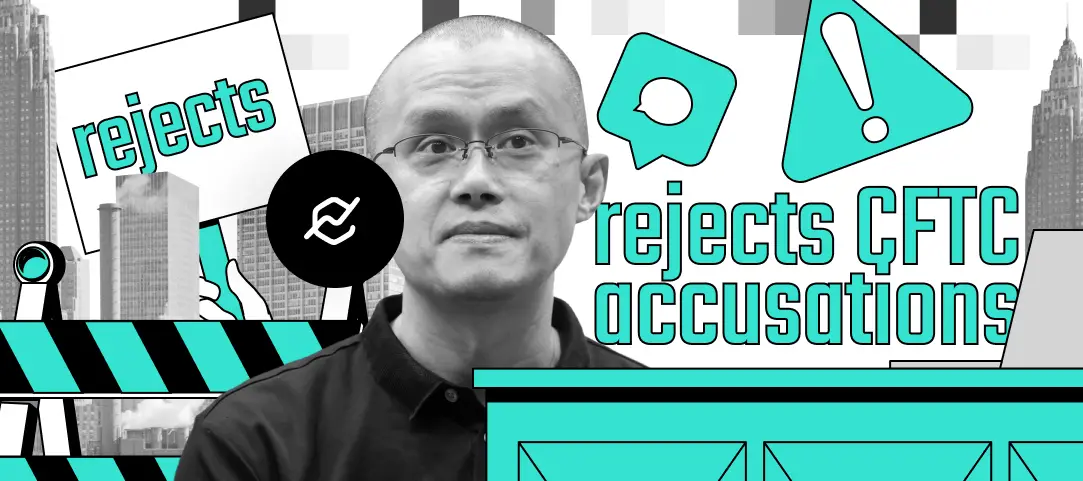

Changpeng Zhao is fighting back against the lawsuit filed yesterday by the CFTC accusing Binance and its executives of market manipulation to ban the exchange in the US.

In a March 27 blog post, CZ called the CFTC’s lawsuit disappointing because it contains “an incomplete recitation of facts”

We do not agree with the characterization of many of the issues alleged in the complaint.

The CFTC civil complaint, filed on March 27, alleges Binance violated several commodity laws in the U.S., including money laundering on the platform – an allegation that could be accompanied by criminal prosecution.

The CFTC also accuses Binance of obscuring compliance. In a blog post, CZ fired back at this accusation by pointing out Binance’s “best-in-class technology” mandatory KYC program, which automatically blocks US users by nationality, location, credit card number and so on.

As for Binance’s transparency, CZ said the company employs 750 people on its compliance teams, “many with prior law enforcement and regulatory agency backgrounds,” and noted that the company has 16 licenses and registrations worldwide.

In the lawsuit, CFTC alleges Binance has repeatedly evaded subpoenas to investigate the exchange’s trading activities, adding:

On information and belief, Binance has not subjected the trading activity of Merit Peak, Sigma Chain, or its approximately 300 house accounts to any anti-fraud or anti-manipulation surveillance or controls.

CZ argued:

Binance.com does not trade for profit or “manipulate” the market under any circumstances. Binance “trades” in a number of situations. Our revenues are in crypto. We do need to convert them from time-to-time to cover expenses in fiat or other crypto currencies. We have affiliates that provide liquidity for less liquid pairs. These affiliates are monitored specifically not to have large profits.

CFTC claims that Binance engaged in insider trading was also fired back by CZ, citing, “we have strict policies for anyone with access to private information, such as details of listings, Launchpad, etc. They are not allowed to buy or sell those coins.”

Crypto Ping Pong Digest

Trash style news. You will definitely like