Bankrupt crypto exchange FTX has asked the bankruptcy court to sell FTX Japan, FTX Europe, LedgerX, and Embed to save the companies from legal troubles.

In the upcoming hearing on January 11, FTX’s lawyers will prove to the U.S. Bankruptcy Court in Delaware that the four companies are solvent and ready for sale. If the judge agrees, the subsidiaries will be put up for sale.

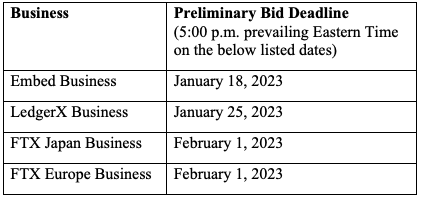

The motion was filed on December 15. The FTX layers proposed the auction, assuming there would be plenty of buyers. The bid includes digital currency derivatives platform LedgerX, stock trading service Embed, and FTX Japan and FTX Europe.

FTX attorneys explained the filed motion:

Since the commencement of these Chapter 11 Cases, each of the Businesses has experienced regulatory pressures which merit an expeditious sale process. The Businesses have been in active conversations with a number of regulators, including FINRA with respect to Embed, the CFTC with respect to LedgerX’s registrations as a DCM, SEF and DCO, the JFSA with respect to FTX Japan, and the Swiss Financial Market Supervisory Authority (“FINMA”) and the Cyprus Securities and Exchange

Commission (“CySEC”) with respect to FTX Europe.

These companies were recently acquired by FTX, which means that they operate largely independently of their global parent. This means that their assets and funds remain separate from FTX, unlike some other subsidiaries.

Not all subsidiaries were independent. On December 13, new FTX CEO John Ray III testified before the House Financial Services Committee on why the bankruptcy filing mentioned FTX subsidiary FTX US. He said:

Questions have been raised as to why all of the FTX Group companies were included in the Chapter 11 filing, particularly FTX US. The answer is because FTX US was not operated independently of FTX.com. Chapter 11 protection was necessary both to avoid a ‘run on the bank’ at FTX US and to allow our team the time to identify and protect its assets.

Related: Sam Bankman-Fried to testify on House Committee hearing

Crypto Ping Pong Digest

Trash style news. You will definitely like