Table of Contents

Aave Review: A Complete Guide

Decentralized finance platforms have been taking center stage in the world of cryptocurrency for the past several months. Within this realm, decentralized lending protocols are truly spearheading the way for an increasing number of emerging independent projects through their attractive loan services, ease of access, rich communities and, more often than not, excellent customer support.

Today, we will be taking a deep dive into Aave, a major DeFi lending protocol that has helped reshape the world of decentralized finance in the last several years.

History of Aave

Aave is an extremely popular decentralized finance (DeFi) protocol built on the Ethereum blockchain, which specializes in crypto lending and borrowing services. It roughly belongs to the same category as BlockFi, Alchemix, or CoinLoan, as it provides similar services. Having launched in 2017, the platform was originally dubbed ETHLend, with Ether lending being its flagship service. ETHLend was essentially used as a marketplace for crypto lenders and borrowers looking to make peer-to-peer lending deals without an intermediary.

Although this erstwhile iteration had managed to reach some moderate levels of success, the platform truly began its expansion into the DeFi space when it rebranded itself into Aave (which is the Finnish word for ‘ghost’, representing the platform’s genuine intention to become a fully transparent and reliable decentralized finance network) in 2018. Its native token, LEND, was also consequently renamed into AAVE.

In 2020, Aave really came into its own when it launched the Aave protocol with tons of novel features related to crypto lending and interest earning, effectively reshaping the world of DeFi as we knew it back then.

Stani Kulechov, Aave CEO and Founder, has always been hyper focused on collaborating with the best and brightest of minds from the world of DeFi in order to ensure that Aave can attract both crypto enthusiasts as well as investors working in institutions unrelated to the world of digital assets. Like many true crypto aficionados, he believes that a fully decentralized world of finances is the future.

Aave Roadmap

The team behind Aave has so far been exceedingly devoted to outlining the project’s goals and milestones through the roadmap located on the protocol’s website. Every single milestone has thus far been reached, including the launch of the new lending protocol, incorporating the Chainlink oracle, integrating with Trust Wallet and MyEtherWallet, and also adding UniSwap Market which opened up a ton of opportunities for people using Aave’s Flash Loans feature.

Aave has also fulfilled its goal of becoming a completely decentralized, community-governed platform that allows AAVE token holders to have a say in the project’s further development. Those who wish to participate in the platform’s governance are able to stake their AAVE tokens in order to earn a portion of the interest that the platform collects on loans. Through this, the protocol has a reserve liquidity pool (internally titled Safety Module), liquidating small amounts of assets to ensure financial stability during unforeseen dips or market crashes.

For more detailed and up-to-date information on the protocol’s community management, visit Aave’s dedicated Governance Guide.

Benefits of Using Aave

At a mindblowing TVL (total value locked) of over $9.8 billion as of June 2022, Aave is the third biggest DeFi protocol available today, as well as the largest decentralized money market.

Apart from its passionate development team and devoted community, the Aave protocol has many benefits that make it stand out among its peers, all of which are grounded in transparency and clear-cut processes surrounding lending and borrowing.

The following characteristics are largely why it continues to appeal to newcomers and seasoned crypto investors alike.

Full transparency

One of the advantages of open-source protocols like Aave is that they are scrutinized by a large number of people who work persistently to ensure that it is free of errors. True enough, the open-source lending protocol used by Aave makes it one of the most secure platforms for digital transactions. The project is constantly being reviewed by a community of Aave maintainers in order to detect and eradicate vulnerabilities. As a result, users can remain confident that no bugs or other compromising risks will gain access to their accounts.

Great selection of lending pools

Aave users can currently choose between 17 different lending pools that they can provide liquidity to in order to generate profits for themselves. Once you deposit your own funds, others looking to borrow can withdraw from any of the following pools to obtain loans. If you’re a lender, you can deposit your funds into your wallet, or use them to execute trades.

At the time of writing, the following lending pools can be used through Aave:

- Binance USD (BUSD)

- Dai Stablecoin (DAI)

- Synthetix USD (sUSD)

- USD coin (USDC)

- Tether (USDT)

- Ethereum (ETH)

- True USD (TUSD)

- ETHlend (LEND)

- Synthetix Network (SNX)

- Ox (ORX)

- Chainlink (LINK)

- Basic Attention Token (BAT)

- Decentraland (MANA)

- Augur (REP)

- Kyber Network (KNC)

- Maker (MKR)

- Wrapped Bitcoin (wBTC)

Complete anonymity

As an industry leader in decentralization, Aave does not require any KYC or AML (know your customer and anti-money laundering procedures related to identity verification) from its users. Investors who wish to remain completely private about their holdings and investments are able to do so freely.

How Does Aave Work?

The lending and borrowing process on Aave is easy to grasp. Users who want to lend out their funds simply make deposits to a lending pool of their choice. For loan purposes, funds are drawn from the lending pools by borrowers, and the borrowed tokens can either be used for trading or transferring. Investors can also choose to opt out of having their deposited funds used for lending purposes if they wish to do so.

On the other end of the spectrum, to qualify as an Aave borrower, you must first lock a particular amount of funds on the platform, with the value of your collateral set in USD. Just like with other DeFi protocols, the amount a borrower locks must be greater than the amount they intend to borrow from the lending pool. After that, the user is free to borrow as much as they want; however, if the collateral falls below the network’s minimum level, it will be liquidated so that other Aave members can purchase it at a reduced price. To maintain positive liquidity pools, the system accomplishes this automatically.

Core Features of Aave

Aave takes advantage of a number of different functionalities to provide a consistent and satisfactory user experience. Here are some of its major features.

Oracles

On any blockchain, oracles act as a connection between it and the outside world. Oracles collect real-world data from the outside and feed it into blockchains to make transactions easier, particularly smart contract transactions.

Every DeFi network relies on oracles, which is why Aave has integrated Chainlink (LINK) oracles to determine the optimum values for collateralized assets. Chainlink currently protects tens of billions of dollars across DeFi, insurance, gaming, and other important industries, and provides a universal gateway to all blockchains to global organizations and prominent data suppliers.

Reserve liquidity pool

As previously mentioned, Aave established a liquidity pool reserve fund to shield its users from market volatility. This reserve fund aids in persuading lenders of the security of their cash locked in the network’s various pools. To put it another way, the reserve acts as a safety net or insurance for the lender’s money on Aave. While many other peer-to-peer lending platforms were still battling with market volatility, Aave took steps to ensure that its users would be protected in the future.

Flash loans

When Aave came out with the concept of flash loans, it took the crypto lending market by storm. Flash loans provide users with the ability to take out loans without having to deposit any collateral, and execute borrowing and lending transactions within the same block.

What’s the catch? Well, users are obliged to pay back their loans before mining new Ethereum. If they fail to do so, every transaction they’ve completed within the loan period gets canceled. However, with proper planning and foresight, users can accomplish a number of profitable outcomes within the duration of the loan.

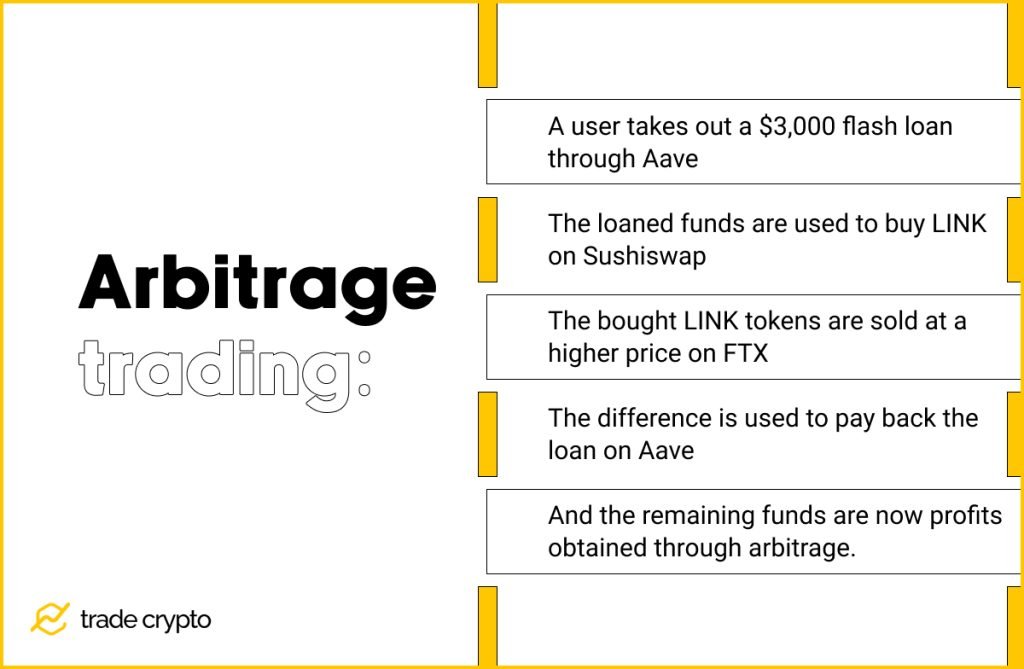

Another major way that people make use of flash loans is for arbitrage trading. This means you can take out a flash loan on Aave in order to trade the coins on a different platform to maximize your profits. Here’s an example of what this process might look like:

You can even use a flash loan from Aave to refinance another loan you’ve taken out on a different lending platform, or simply exchange collateral.

It was the emergence of flash loans that made it possible for crypto holders to do yield farming. Without them, features like compounding would not have been introduced to the world of digital asset trading.

Aave retains a 0.3% fee for each flash loan they issue.

aTokens

Upon depositing assets in Aave, users receive something called aTokens in return. The number of aTokens you receive is always equal to the value of your deposit on Aave. For example, a user who puts 100 DAI into the system will receive 100 aTokens automatically. The aTokens are crucial because they are what allows users to earn interest. Lending activities would not be made possible without the existence of aTokens.

Rate switching

As previously noted, Aave users can choose between variable and fixed interest rates. Within 30 days, stable interest rates reflect the rate average for a crypto asset. Variable interest rates, on the other hand, fluctuate in response to changes in Aave’s liquidity pools. The good news is that based on their financial goals, Aave users may choose to switch between these two rates at any time. However, keep in mind that switching between interest rates is charged through a small Ethereum gas fee.

AAVE

AAVE is the platform’s native ERC-20 token. It was initially launched as the LEND token in 2017, due to the fact that Aave used to be called ETHLend, so you might see these two names used interchangeably at times. AAVE is a deflationary and utility coin that can be purchased through many different crypto exchanges, such as the Binance network.

How to Use Aave to Borrow Crypto and Earn Crypto Interest?

Interest earning

Aave allows its users to deposit a variety of cryptocurrencies in exchange for different levels of interest. To make a deposit on Aave, you’ll need to log on using a web 3.0 Ethereum digital wallet. Then, click Deposit next to the asset you would like to lend through Aave. Next, using your web 3.0 wallet, input an amount you are comfortable with and confirm the transaction. You should receive the corresponding number of aTokens in your digital wallet after the transaction is completed. The aTokens will subsequently start earning interest. Remember, the value of your aTokens is pegged to the deposited cryptocurrency’s value.

As an example, if you were to deposit 200 DAI into Aave, you would trigger the minting of (and subsequently receive) 200 aTokens in return. Apart from using them to earn interest, your aTokens could also be exchanged for the original cryptocurrency on Aave, or used to trade with on any other DeFi protocol that supports the tokens.

Borrowing funds

Borrowing funds is just as simple as lending them out on the platform.

In order to take out a loan on Aave, you will need to secure it through a deposit. Note that all loans need to be over-collateralized, which means that the value of your deposit has to be larger than that of the loan itself.

Once you deposit your collateral of choice, you will be able to select the cryptocurrency that you wish to take out a loan in by clicking on Borrow on the Aave homepage. This will give you a prompt to connect to your web 3.0 crypto wallet. At this point, you will be asked to choose between a stable or a variable interest rate for your loan. Choose your preferred rate option and then confirm the transaction through your digital wallet.

Is Aave a Profitable Investment?

Aave has plans to make its protocol more flexible and introduce a mobile wallet app in the foreseeable future. This, paired with the rising popularity of DeFi, has caused experts to forecast a positive AAVE price movement.

Every DeFi initiative strives to eliminate traditional financial institutions’ centralized procedures. Aave is part of a bigger picture that developers are working on to remove or lessen the need for financial middlemen. The network aided in elevating peer-to-peer lending to unprecedented heights. This, on top of its attractive features, is one of the major reasons why its member base puts so much trust in it and willingly invests funds into Aave’s liquidity pool.

However, because of the inherent volatility of the digital asset market, crypto holders should constantly conduct their own research and reexamine their investments. For instance, most major crypto exchanges accept AAVE; make sure to thoroughly research which one offers you the greatest bargain. Keep in mind that you should only invest what you can afford to lose, and that prices might go down as well as up.

Is it Safe to Use Aave?

According to the developer team, Aave was built with security as its top focus. The protocol is kept safe by performing regular vulnerability checks and audits, and the creators claim to have put in all of the required effort to guarantee that the protocol meets the highest security requirements.

In March 2022, the creators introduced the Bug Bounty program that offers a lofty prize of $250,000 to users who report bugs and vulnerabilities they’ve noticed while using the platform. To read more about the terms and eligibility criteria, visit the program’s dedicated document page.

Can I Lose Money in Aave?

Investing in cryptocurrencies and DeFi carries the risk of losing money due to market volatility. Before investing, it is always a good idea to learn everything there is to know about the particular protocol you wish to engage with.

Furthermore, let’s be completely honest here: there is no such thing as a risk-free platform. The smart contract risk (risk of a defect in the protocol code) and the collateral liquidation risk are two main dangers associated with Aave and similar platforms.

However, it really does seem that Aave went above and beyond to protect its community members’ data and assets. While their protocol code may be public and open source, the platform has been audited numerous times, indicating that every precaution has been made to reduce potential risks.

The risk framework and security and audits sections of Aave’s website include further risk and security-related information.

Conclusion

There is no doubt that Aave is currently leading the DeFi lending market because of its innovative approaches, some of which gave us features that revolutionized the world of crypto lending. These include their flagship product – flash loans, stable/variable interest rate switching, but also an intuitive and accessible user interface.

The success of the protocol has a lot to do with the fact that it has always been steadfast in its mission towards full decentralization, while maintaining attractive APYs on their users’ deposited funds, flexibility for crypto loans, as well as a highly welcoming and supportive development team, led by industry pioneer Stani Kulechov.

In truth, it’s not that we personally think Aave is the greatest DeFi platform out there; the community and the market themselves have made that decision. Aave’s TVL is currently the highest of any DeFi platform you can find.

If you are looking to get started in the world of DeFi lending and borrowing, Aave is an excellent way to begin earning your first cryptocurrency rewards. And if you’re a veteran crypto investor, well, we would just be preaching to the choir at this point.

Crypto Ping Pong Digest

Trash style news. You will definitely like