Table of Contents

As the global cryptocurrency community grows, more and more coin investors are beginning to actively use crypto lending platforms as part of their daily investment activities.

This makes sense, as it is not hard to see the benefits of platforms that offer lending services, usually along with interest-earning accounts, especially if the providers offer reasonable fees, fair repayment terms, and excellent returns.

Today, let’s look at one platform that focuses mainly on stablecoins and has a good track record in recent years: CoinRabbit.

What is CoinRabbit?

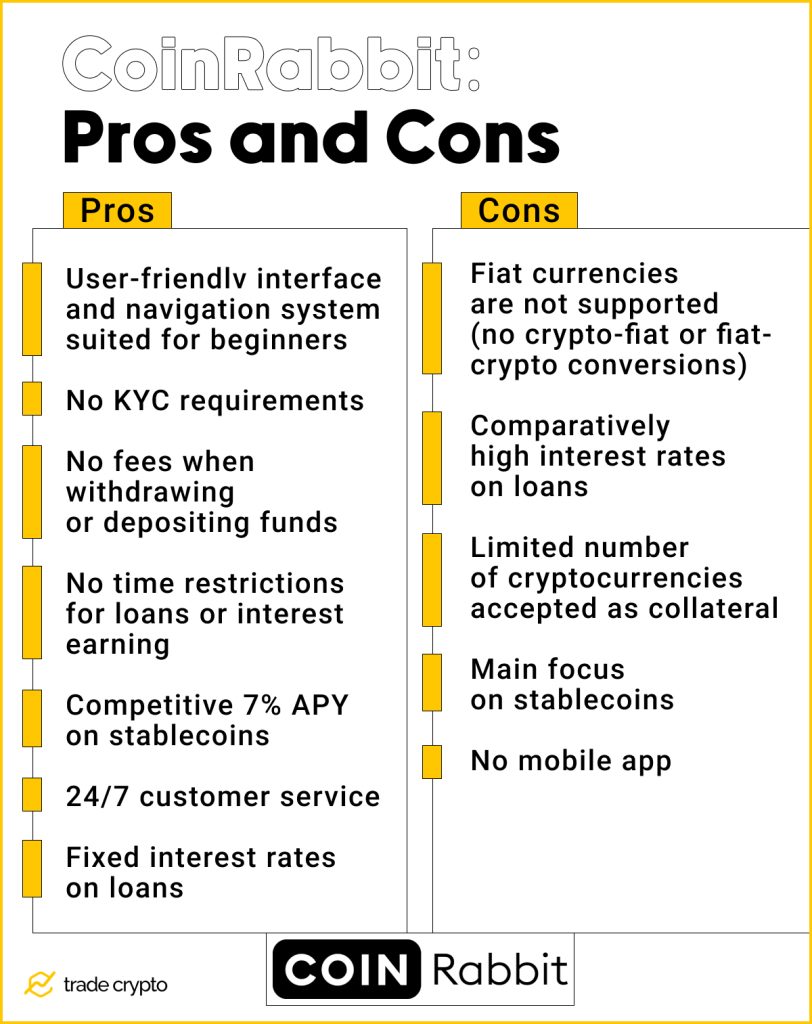

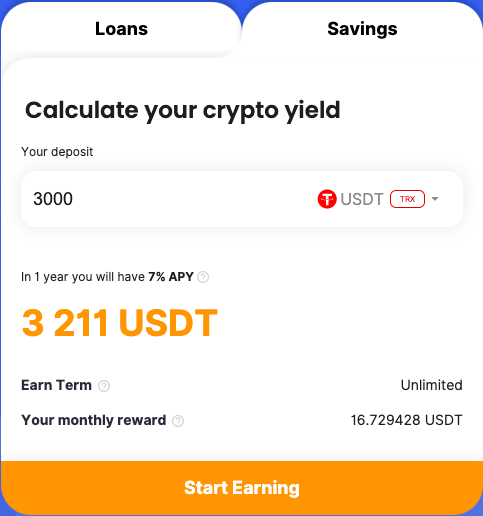

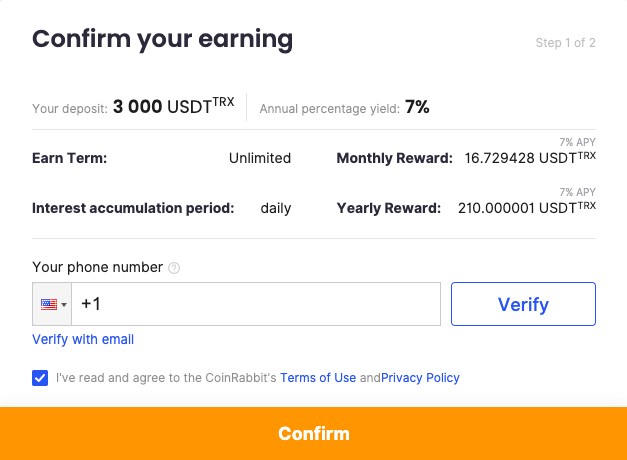

CoinRabbit is a decentralized financial platform that allows cryptocurrency holders to take out crypto-backed loans and earn profits through interest on deposited stablecoins. Although a relatively new platform, CoinRabbit has become known for its combination of user-friendly lending tools, a straightforward registration process with no KYC requirements (i.e. identity verification), and a competitive 7% annual return on stablecoins since its launch in 2020.

CoinRabbit has gained popularity mainly due to the clear functionality of its tools. The user can select “Lending” or “Saving” on the main page and enter the exact amount in cryptocurrency. The deal will be approved within two steps, with clear details such as the possibility to withdraw funds at any time and monthly yield percentage.

Although this crypto lending platform supports a limited number of cryptocurrencies that can be used as collateral, their zero-fee system, ease and speed of use, and excellent customer service are sure to appeal to beginner and experienced investors alike.

CoinRabbit: Pros and Cons

How Does CoinRabbit Lending Work?

Let’s start with CoinRabbit’s flagship feature: crypto-backed lending. Like other similar platforms, customers can borrow from CoinRabbit after depositing a certain amount of their crypto assets as collateral. Interest is charged on the loan amount, and the collateral can be returned at any time as long as repayments (including interest) are made.

CoinRabbit interest rates have 12% and 16% APR, depending on which loan currency you choose. APR is charged monthly, starting when the loan amount is approved, and you repay APR as soon as you close the loan, meaning there are no monthly repayments.

Getting a Loan on CoinRabbit

Taking out a loan with CoinRabbit is quite simple and takes only 5 to 10 minutes.

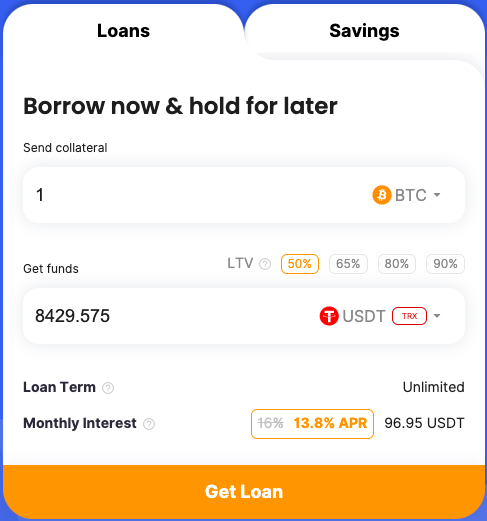

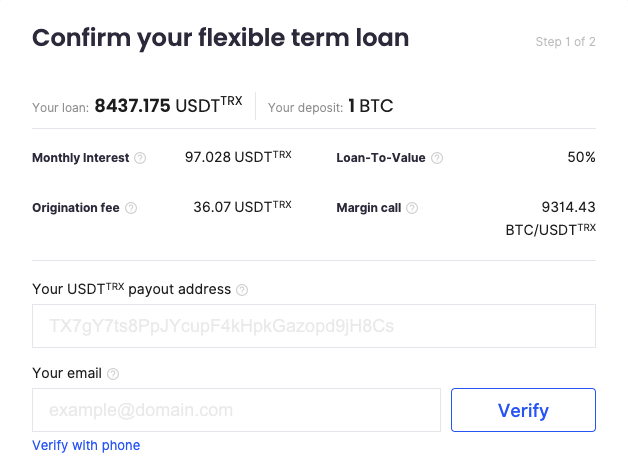

Once you’re on the website, you first need to calculate the loan amount by entering your preferred collateral option using the built-in calculation tool. Let’s say we want to use BTC as collateral to get USDT TRC-20.

You will then be shown the monthly interest rate and the liquidation price. Choose LTV wisely.

The loan-to-value (LTV) ratio is the related difference between the loan amount and the current market value of the collateral. The higher the LTV, the more loan funds you will receive, but at the same time, the margin call will be higher.

The margin call determines the exchange rate of the collateral at which the service automatically sells the amount of collateral to restore the loan funds

After reviewing these details, you need to specify the payout address to which the funds should be transferred and then confirm the transaction using your phone number or email address.

For risk management reasons, the borrowed assets will be transferred through CoinRabbit’s partner ChangeNOW once your collateral is deposited. If the collateral verification is successful, the loan will be delivered to the specified wallet, and APR will start accumulating from that moment, while the cut-off point for the accumulated APR is the moment you decide to close it and make your repayment.

The minimum deposit amount is $100. However, users who deposit Bitcoin can borrow as low as 80 USDT/USDC, whereas Ethereum and Bitcoin Cash users can borrow as little as 30 USDT/USDC. CoinRabbit, like most other crypto lending platforms, does not have a loan cap, which means you can borrow as much as you want as long as you have the necessary collateral to secure the loan.

Users who wish to take out several loans at once can use their current collateral amount or deposit more of their assets. Each loan can be individually monitored, whereas repayment details and interest rates all remain unique for each separate loan.

The loan duration on CoinRabbit is unlimited, but be aware that there is a $100 prepayment fee if you choose to pay off the loan within 30 days. Therefore, we do not think this platform is well-suited for users needing a short-term loan.

At the time of writing, CoinRabbit offers the following cryptocurrency options for loans:

Why Does CoinRabbit Primarily Deal With Stablecoins?

Although some might consider the lack of altcoin or fiat options on CoinRabbit as a disadvantage, the developers firmly believe that stablecoins are safer and more reliable because they don’t fluctuate. Since their price is linked to a fiat or “real” currency, it can never rise or fall dramatically within a short period of time, as is the case with all other digital coins, even the dominant ones like Bitcoin or Ethereum

Stablecoins are also accessible across several blockchain networks, including Ethereum, Bitcoin, EOS, and TRON, making it easier to exchange between them. In addition, stablecoin transactions tend to be much faster because of the blockchains on which they’re based.

Stablecoins also have the added advantage of having the consistency and reliability of a fiat currency but none of the associated costs go with fiat transactions. Fiat transactions involve (sometimes multiple) intermediaries who charge their own fees. However, these intermediaries or “middlemen” don’t exist within stablecoins such as USDT or USDC. Stablecoin transactions only incur a network fee, which is usually much lower.

Suppose you own an online store and offer cryptocurrencies as payment. In that case, you can benefit from setting your prices in USDT without worrying about price fluctuations in case of devaluation.

Using Stablecoin Loans

Here are some of the ways you could take advantage of a loan in a stablecoin currency:

- Purchase other cryptocurrencies. If you have researched the market and want to invest in another cryptocurrency that could give good returns in the future, you can use stablecoins for this purchase. (Always consider all potential risks and do your own research before making any crypto investment, especially with borrowed funds.)

- Real-world purchases. Stablecoins can be used to pay for goods and services in places that accept payments in currencies such as USDT or USDC. Due to the reasons we have already discussed, paying in stablecoins could be much faster and more convenient than using alternative digital coins.

- Staking purposes. If you’re smart about it, you can use your newly acquired stablecoins to deploy them on reliable staking platforms to generate income. Once you have collected enough income, you can use some of it to pay off your loan with interest and keep the rest for yourself to either use up or reinvest.

- Crypto-fiat conversions. Stablecoins are often used to buy traditional / fiat money that you can use to pay electricity bills or everyday purchases.

How Does CoinRabbit Calculate Collateral?

To qualify for a loan from CoinRabbit, you must provide twice the equivalent of deposited collateral, as you choose a loan-to-value (LTV) ratio of 50%.

Let’s say you want to deposit 1 BTC as collateral to take out a loan in USDT. If 1 BTC is worth $30,000, you will receive USDT worth $15,000.

In any case, users should keep an eye on the price of their crypto collateral throughout the life of the loan to ensure that they don’t miss the 50% LTV limit.

The same goes for other LTVs of 65%, 75%, and 90%. Though, those bets are riskier. The reason for this low LTV margin is a strategy to minimize risk and protect the end user from the high volatility of the value of its collateral. The 50% LTV ensures that CoinRabbit doesn’t sell the deposited collateral until its value has dropped to 50%, effectively protecting it from liquidation.

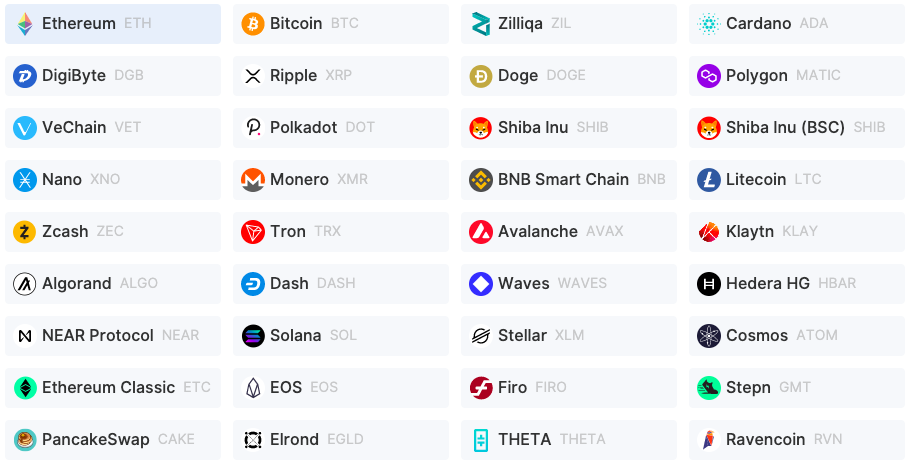

You can use 136 top coins as collateral. Some of them:

How Does Interest-Earning on CoinRabbit Work?

The second important function of CoinRabbit is earning interest. The platform allows users to increase their coin holdings over time by setting up savings accounts that pay interest on users’ deposited virtual assets. This is especially beneficial during market volatility, as investors can be assured that their assets will continue to accumulate returns over time.

Currently, interest accounts can earn 7% APY on deposited stablecoins such as USDT and USDC. Interest is accumulated daily and calculated based on the total amount deposited, meaning it doesn’t compound over time.

How to Start Earning Interest on CoinRabbit

The process of opening a savings account is basically the same as applying for a loan on CoinRabbit. First, you choose your deposit amount and the type of stablecoin you want to use.

The platform will ask you to enter your phone number or email for verification. Still, you will also need it to monitor the status of your deposit and the amount of interest you’ve accumulated. Then confirm your deposit and submit it.

Funds are transacted through the AML security layer, and the platform’s risk control system verifies each transaction on the blockchain

Once your deposit is activated, you can earn interest on your stablecoins. You can keep track of the accumulated APY via the dedicated dashboard, which is updated daily.

You can increase your deposit at any time to maximize your prospective profits. There are no time limits for deposits, and users can deactivate their savings account and withdraw the entire balance at any time.

Are There Any Risks?

As with any other DeFi lending project, there is always the possibility that you’ll lose your deposited collateral or that the value of your collateral will decline during the term of your loan. In such an extreme case, your funds will be liquidated if the price falls below a certain level, and your collateral will be sold to recoup the losses.

However, a clever feature of CoinRabbit is that you’ll be notified in advance when the market value of your deposited coins drops below a certain level. Apart from regularly checking the market, these notifications will help you better assess your positions and decide the next steps accordingly.

In any case, it’s up to the users to make informed decisions about their investments and put their trust in such a platform.

Is CoinRabbit Safe and Secure?

In terms of security level, CoinRabbit was launched in partnership with ChangeNOW and Guarda Wallet, both of which have a long track record and credibility. Like most crypto loan providers, CoinRabbit stores your funds and collateral in a cold wallet, in their case, Guarda. The platform assures that users’ private keys are kept secure and can only be accessed through a VPN via specific IP addresses. The developers also say that private keys are renewed monthly and that your funds are checked every second with ChangeNow’s risk management system.

Due to these measures, hacking could hardly be an issue on this platform. Still, you should remember that CoinRabbit doesn’t offer insurance for its savings accounts and loans. This is the case with many other platforms: you’re entrusting them with your asset keys. This means you can lose your digital assets even if CoinRabbit or its partners fail as a business. Therefore, it would be unwise to put large sums of money into a third-party asset management program, including CoinRabbit.

That being said, CoinRabbit has a TrustPilot rating of 4.4, and many customers have commented positively on its courteous customer service, fast and reliable loan transfers, and low-interest rates.

Does CoinRabbit Have Any Fees?

CoinRabbit doesn’t charge fees for depositing or withdrawing assets on the platform. However, a fee of $100 is charged if the borrower cancels their loan after less than 30 days.

Is CoinRabbit Worth It?

To summarize our CoinRabbit review, we believe the platform is ideal for beginners who want to use cryptocurrencies to increase their income in stablecoins. In return, the platform offers a safe and secure way to earn high returns but also get quick stablecoin credits.

If you want to earn interest on your stablecoins or use your cryptocurrency as collateral for a stablecoin loan, CoinRabbit is definitely a good option. However, there is no way to deposit money, get a loan, or accumulate returns in fiat money.

Several crypto-backed lending sites require registration, demand monthly payments, and have harsh repayment terms. CoinRabbit has chosen to make life easier for its community by developing an easy-to-use platform that eliminates most of these difficulties making collateralized crypto loans more accessible.

Crypto Ping Pong Digest

Trash style news. You will definitely like