Table of Contents

What is Compound Finance?

June 16, 2020, was a pivotal day in the world of decentralized finance (DeFi): Compound Finance launched its ($COMP) governance token and sent the crypto world into a state of exhilaration. Only a single day of trading was enough for $COMP to become the leader of the DeFi ecosystem, toppling down the deFi pioneer Maker ($MKR). Today, Compound stands for one of the largest global decentralized financial systems.

Compound Finance is an Ethereum-based DeFi platform that enables users to lend or borrow crypto assets without intermediaries. While lenders earn interest, borrowers deposit their assets so they can borrow fresh capital without the limits imposed by traditional banking. The interest rates are determined algorithmically, based on the proportion of assets lent out.

In a word, the permissionless Compound protocol allows users to earn a yield on crypto-asset deposits, and use those deposits as collateral backing self-managed loan positions.

History of Compound Finance

Compound’s team is highlighted by Mr. Robert Leshner and his previous financial experience as a co-chair for San Francisco’s Revenue Bond Oversight Committee.

The project started as a centralized, tokenless experimental protocol run by the Compound Labs team, aimed at enhancing the business of crediting, a cornerstone of traditional finance. Upon reaching the adequate milestone, the COMP governance token was created and the team canceled all privileges it had.

The team that created the project intended to form a superior DeFi platform for easy lending and borrowing crypto assets under favorable market conditions. Crediting business has been a key component of the DeFi development and one of its major real use cases.

How Does Compound Finance Work?

As a robust decentralized lending marketplace, Compound is organized as a pool of crypto assets where users can make deposits and earn interest, or borrow the funds from the same pool under the condition of posting sufficient collateral. In this way, it offers a similar service as protocols such as BlockFi, AAVE, or CoinLoan.

These loans do not have any maturity and users do not have to wait for a counterparty since they are related to the aggregate funds put into the pool. Besides earning interest and taking loans, Compound can also be used by users for shorting assets.

Compound uses audited Compound smart contracts for the storage, management, and facilitation of all pooled capital. Users connect to Compound through web3 wallets like MetaMask with all positions being monitored with the help of interest-earning tokens called cTokens.

$COMP is the network’s governance token that provides its holders a vote on important protocol decisions like new collateral types, borrowing power, and interest rate models.

Decentralized finance (DeFi)

Decentralized finance (DeFi) empowers ordinary people with the possibility to gain financial freedom from traditional, centralized finance. It was designed with the mission to overcome the superiority of traditional financial institutions over their customers.

In the DeFi world, there are no central institutions of authority – the financial relationships are disintermediated and established directly between users (peer-to-peer), while the rules of business are defined and enforced by Compound’s smart contracts – pieces of automated, impartial software code.

DeFi consists of various sets of financial services, including decentralized exchanges (DEXs), yield farming or liquidity provision platforms, decentralized autonomous organizations (DAOs), borrowing/lending platforms, payment gateways, and many others.

How Do You Lend and Borrow on Platform?

The Compound protocol is responsible for forming and managing crypto assets pools, which operate as separate sub-markets.

Its algorithm is the factor that determines interest rates, by taking the current supply and demand for a particular asset into account. Borrowers of an asset interact automatically with the protocol, earning a variable interest rate, without the obligation to negotiate terms such as maturity, interest rate, or collateral with a counterparty.

When they connect via a web3 wallet, users can go to the Account Overview section where they can select assets and unlock the market they want to deal with. After enabling a particular asset, a user can borrow or lend it.

Lending assets is simple. After you have enabled an asset from the list, you have to sign the approval for the transaction and deposit the desired amount of capital. Your assets are then instantly added to the supply pool and you start earning interest immediately.

Every asset its separate Supply and Borrow APR, both of which change intensively relative to supply and demand at any given time. When submitting assets to the protocol, users receive cTokens which represent rights to a portion of an asset pool. Those tokens can be redeemed at any time.

To borrow assets, users must first supply collateral to earn Borrowing Power. Every asset has a unique Collateral Factor, indicating the fact that some assets may give more borrowing power than others.

Supported Assets

The list of crypto assets that Compound users can lend (stake) or borrow includes 17 different markets:

- Aave (AAVE)

- Basic Attention Token (BAT)

- Compound (COMP)

- Dai (DAI)

- Ethereum (ETH)

- Chainlink (LINK)

- Maker (MKR)

- Augur (REP)

- Sai (SAI)

- SushiSwap (SUSHI)

- TrueUSD (TUSD)

- Uniswap (UNI)

- USD Coin (USDC)

- Tether (USDT)

- Wrapped Bitcoin (WBTC)

- Yearn.finance (YFI)

- 0x (ZRX)

What Are cTokens Used For?

Assets that you put into the pool are represented by the ERC-20 tokens called cTokens. They entitle their owner to an increasing quantity of the underlying asset.

As the money market accrues interest (which happens when demand for borrowing rises), cTokens become convertible into a certain amount of the underlying asset. This is an easy way of earning interest for the deposited/staked/lent coins.

Each sub-market has its cToken (cETH, cUSDC, etc.) which you will receive when you supply a respective asset to the protocol. Users collect interest on all cTokens held in their wallets based on the respective lending rate.

$COMP Tokens

The compound token (COMP) is the governance token for the Compound protocol.

COMP tokenholders can propose, discuss, and vote on all changes to the Compound protocol.

Approximately 50% of the COMPs that get released every day are distributed to borrowers, and the other 50% to the lenders, which emphasizes the balance between two typical parties in crediting business.

Besides being awarded by the protocol for supplying assets into the Compound pools, COMP can be bought in open markets and used as any other investment vehicle.

Governance Done by Tokenholders

The COMP token holders have to make decisions on the following topics:

- Listing new supported assets – cToken markets

- Updating market annual interest rates

- Updating oracle addresses

- Withdrawing cToken reserves

- Choosing new admins

Delegates have to hold at least 0.1% of Compound’s native tokens to make a new proposal.

Yield Farming with Compound Finance

A person who is yield farming will collect interest for depositing their crypto in Compound, plus receive a COMP token reward. The reward in COMP tokens is relative to how much a person is lending to the platform. A person can sell received COMP tokens for a profit or hold them for an investment.

This is a typical example of yield farming: an investor is earning yield on their lending (5.85% APY for Uniswap, for example), as well as the yield from collecting COMP tokens, which he/she can hodl or sell.

Compound liquidity mining was designed so that its users can achieve easier access and more profits than in any traditional markets offering financial products based on savings.

COMP Price and Annual Interest Rates

This Compound finance review cannot be full without answering the question of whether it can make you money.

Well, those who got familiar with the Compound’s potential early profited most. Compound announced it would start to distribute its Compound Governance Token on June 10, 2020, after a community vote. Prices for the token were not available at release, so nobody could have predicted how it was going to go. The answer came on the first day of trading with the COMP price skyrocketing some 60% at some moments.

After reaching an all-time high in May 2021, COMP’s price started to recede steadily, having lost almost 90% of its value from the ATH level.

Those more oriented towards yield farming are still massively live and kicking. Currently, there is appr. US$ 3.5 billion worth of crypto assets deposited and over US$ 800 million borrowed. During these gloomy days for crypto, the distribution of lent and borrowed assets is such that stablecoins prevail on both sides. This may be a sign of hope – 2/3 of assets borrowed in USDC and USDT indicate that many investors are bottom-fishing and buying the dip in the expectation that the cryptocurrency prices will recover.

The interest rate for a particular asset changes frequently, depending on the value of it deposited at a given time. The current actual interest paid is under 1% APY for most coins, with $AAVE being the top-performer in this area with 3.3% APY.

Comparison: Compound Finance vs. MakerDAO

Before Compound was born, MakerDAO had been the most popular DeFi project. Maker is a Decentralized Autonomous Organization on the Ethereum platform to mint DAI stablecoin pegged to the US Dollar, thus allowing its users to easily lend and borrow crypto assets.

Seen as a powerful agent of DeFi market disruption, Compound has yet to prove itself in the long run. Although the global crypto market’s ups and downs do influence the viability of DeFi platforms, it is widely believed that there is more than enough space for both existing and new similar protocols to flourish.

Going Multi-chain

The platform has recently announced the code for its forthcoming third iteration, called Comet. The Comet is designed to be deployed across any network that is compatible with the Ethereum Virtual Machine (EVM), which means that Compound will finally leave the realms of the native Ethereum ecosystem.

The protocol is designed to facilitate a single borrowable, interest-earning asset, with all other supported assets functioning as collateral. The risk management and liquidation engine were also redesigned to improve the safety of the protocol.

With the introduction of the Comet, each market can now be seen as a separate protocol instance with its collateral and liquidation factors. This gives the flexibility to create tailored money markets with different risk appetites deployed across multiple EVM chains.

Compound Treasury: When Fiat Comes to Crypto

Compound Treasury is the Compound team’s platform designed for non-crypto native businesses and financial institutions to access the benefits of the Compound protocol.

Compound Treasury allows neobanks, fintech start-ups, and other large holders of U.S. Dollars to access the interest rates available in the USDC market of the Compound protocol while eliminating blockchain-related burdens like private key management, crypto-to-fiat conversion, and interest rate volatility.

Users can wire their dollars to the Compound Treasury Account and begin earning fixed interest rates. Besides, they can deposit and withdraw at any time, the minimums are low and there are no maximum, and there are no fixed terms or durations. Auditable balance statements are available on demand.

Compound Treasury is therefore the bridge between the traditional and blockchain worlds, but in this case, the traditional dollar is the one who is opening the door of crypto finances, seeking to grow within the crypto environment.

In May 2022, the platform received a B- credit rating from S&P Global Ratings. This made Compound Treasury the first institutional decentralized finance (DeFi) offering to be rated by a major credit rating agency. Not only is this a sign of the crypto finance industry’s maturity, but is also the moment when DeFi starts using the language the traditional institutions understand and are willing to use in communication and interaction.

Is Compound Safe for Use?

Compound is not 100% safe (neither is anything else), but it is one of the most secure blockchain projects in the world.

A bug that emerged after the flawed system upgrade exposed Compound Finance to a fund loss on September 30, 2021, causing the improper distribution of US$ 162M worth of excess COMP given tokens to users.

Although it was purely an error of the development team, the project’s CEO turned to a mixture of pleas and threats issued to ‘surprise winners’. Enticing them to return the funds, while keeping a 10% goodwill reward, he threatened those who would not comply with revealing the information about a sudden gain to the IRS.

A combination of a security breach and unprofessional conduct of the CEO resonated poorly within the community. It also rose the question of whether similar accidents could happen again elsewhere, on other DeFi chains. What has been considered the DeFi’s strongest suit – decentralization – led this time to a problem of the inexistence of any admin controls or community tools to disable a flaw. As changes to the protocol require a 7-day governance process, flaws could theoretically stay open for exploitation for an entire week!

Compound Finance Review: Pros and Cons

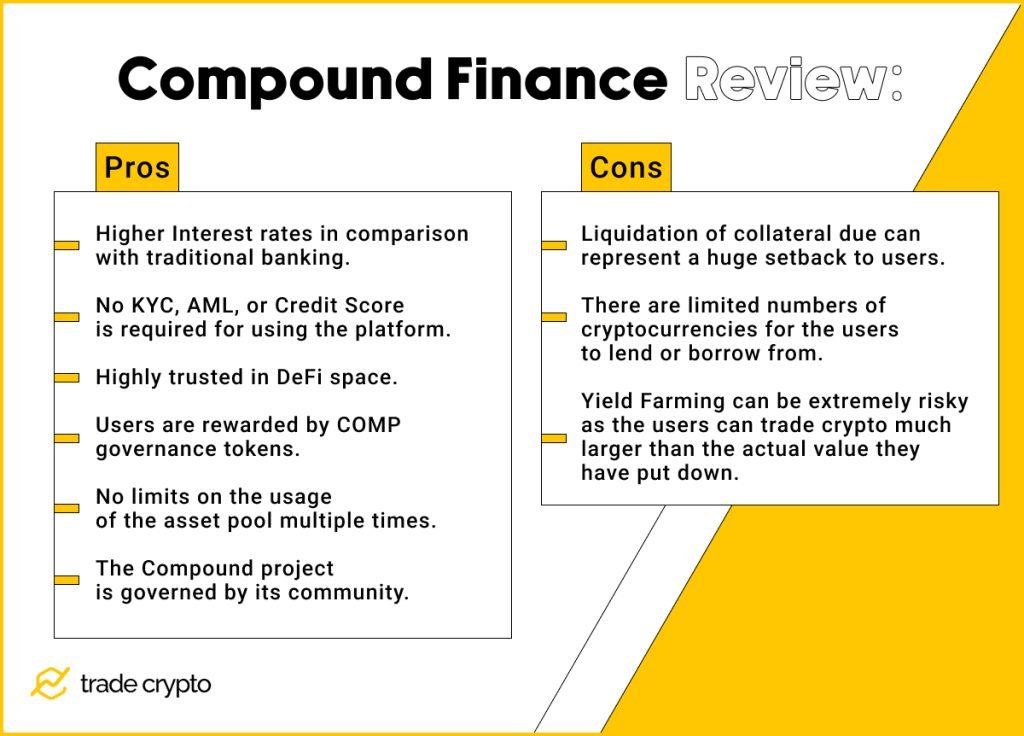

Pros:

- Higher Interest rates in comparison with traditional banking.

- No KYC, AML, or Credit Score is required for using the platform.

- Highly trusted in DeFi space.

- Users are rewarded by COMP governance tokens.

- No limits on the usage of the asset pool multiple times.

- The Compound project is governed by its community.

Cons:

- Liquidation of collateral due can represent a huge setback to users.

- There are limited numbers of cryptocurrencies for the users to lend or borrow from.

- Yield Farming can be extremely risky as the users can trade crypto much larger than the actual value they have put down.

Compound Finance Review: Conclusions

Compound smart contracts system provides smooth security and quick access, but they can be quite volatile causing higher risks during the investment process.

The first two iterations of the Compound finance protocol have given the community a sense of the importance of smart contracts and crypto lending platforms in general. Lending and borrowing will continue to be a cornerstone of DeFi platforms and the global crypto market.

As the Compound team said they would work with the community to finish auditing the new protocol over the coming weeks, we are looking forward to Comet protocol (finally) going multi-chain.

Should the crypto markets recuperate soon from the recent frantic downfall, the possible synchronicity may cause Compound and its governance token to go to the Moon again.

Crypto Ping Pong Digest

Trash style news. You will definitely like