Table of Contents

Defi Solutions Review: Auto Lending Software Provider Overview

People cannot go a single day without reaping the rewards of automation. Automation is present in everything: from robotic carrying and packaging at warehouses and better quality cars, to the coffee machine that starts your day. No matter where you look, the benefits of automated systems are easy to find.

The same can be said about the automated lending sector. For both lenders and borrowers, automation has proven to be a game changer for numerous stages of the lending process. True enough, in today’s market that has seen diminishing sales and fewer loan options due to recent world events, professional lenders must rely on automated loan processing technologies to keep running profitable and competitive businesses.

Today, we will be reviewing Defi Solutions, a fintech services company that offers a range of automated loan origination software and loan origination solutions.

What Does the Defi Solutions Platform Do?

Defi Solutions specializes in innovative and user-friendly Loan Origination Software (LOS) apps that help lenders of all sizes satisfy the demands of different clients. Defi Solutions LOS is an entirely cloud-based and scalable system that provides ways for lenders to expedite their operations, ranging from app input through booking and financing, as well as the flexibility to change rules and procedures on demand.

The Defi Solutions centralized platform, which is designed for banks, credit unions, and car lenders, allows users to streamline lending processes, establish rules, and improve operational efficiency across the board. The platform includes practical features such as a compliance management tool, customer portal, audit trails, report generation and loan processing control. These and other functionalities are designed to help companies configure and apply improvements based on market trends, data analysis, and scorecards. Apart from these, included in its suite of tools is Defi Servicing, which enables lenders to collaborate on loan management with partner communities.

Third-party software can be integrated with Defi Solutions, allowing users to combine data across various apps to help enhance their lending decisions. Defi Solutions also comes with its own mobile app.

For purposes of loan origination and servicing, analytics and reporting, as well as outsourcing of business procedures, Defi Solutions’ tools are developed to provide scalability, stability, simplicity of adoption and integration, customization, and compliance, which allows lenders to focus less on the technical or mechanical aspects of their work, and more on their business goals.

What Is Automated Lending?

Business lending is the process of providing economic gain by funding businesses while ensuring the lender can earn a profit, add value to shareholders, and manage risk. However, assessing a company’s creditworthiness can be a difficult undertaking. Underwriting criteria, prompt approval, cost, and the size of any unexpected losses can all be influenced by the instruments a financial institution chooses to execute these procedures. That is why financial institutions are increasingly seeking apps that may help them solve these issues, improve the quality of their loan portfolio, and provide client happiness by simplifying and automating the lending process.

Automated lending benefits both lenders and borrowers. Many lenders still employ manual and paper-based loan approval processes, which appear quite out of date in today’s digital environment. As a result, they have lengthier decision times than many clients expect, as well as an internal data management issue that adds to bankers’ workload and increases opacity for both management and external examiners.

Automation can help to streamline heterogeneous systems, offer accurate and consistent data flow at any point of the loan origination process, and speed up the lending process overall, all while providing strong audit and control benefits.

Many software tools fulfill the loan origination and credit assessment needs of traditional and non-traditional lenders in today’s commercial lending sector. Financial institutions are becoming increasingly conscious of the need to improve their operations in various areas in order to boost efficiency, decision speed, and production, as well as to improve the client experience.

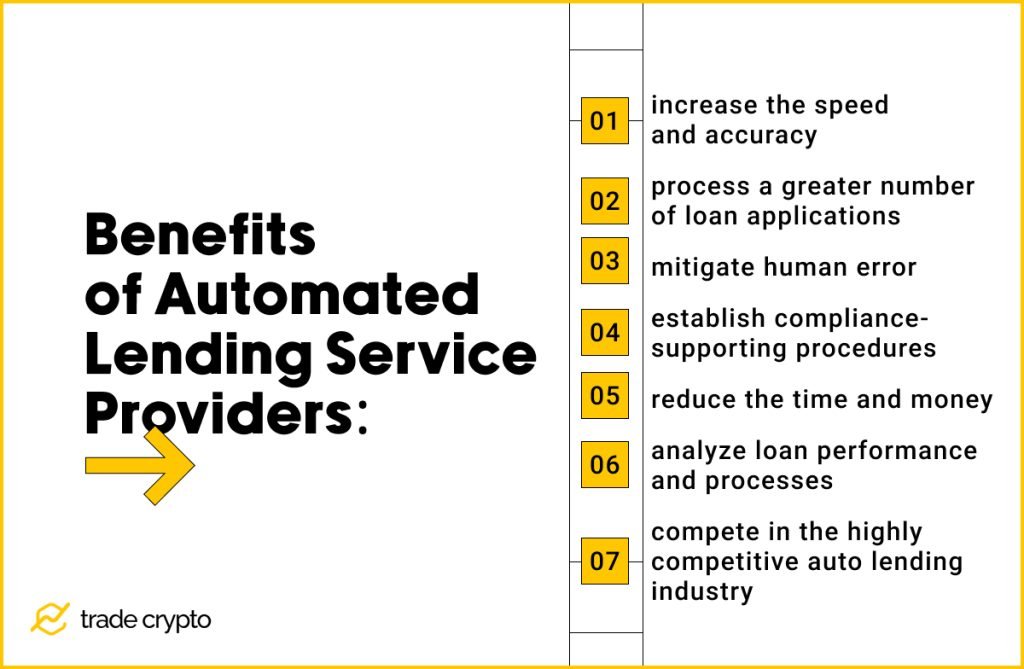

Benefits of Automated Lending Service Providers

The advantages of modern automated loan processing systems over traditional ones are numerous. To start, they are easily installed, configurable, deliver a superior user experience, enhance decision accuracy, and eliminate paper-based documents using the newest cloud and online technologies.

All steps of the loan cycle are accelerated by automated technology. A company may receive hundreds to thousands of applications every week, yet only a small number of them might be appropriate for their lending strategy. With automated lending tools, companies have the ability to swiftly analyze and select applications that satisfy their lending requirements, underwrite confidently, inform the borrower, and fund the loan—beginning to end.

Using automated tools to replace manual work, converting paper into digital formats, and collecting performance data on all stages of your lending process allows you to:

- increase the speed and accuracy of loan applications, in turn providing a better user experience;

- process a greater number of loan applications with existing resources;

- mitigate human error for faster, higher-quality evaluation decisions;

- establish compliance-supporting procedures that are predictable, repeatable, and auditable;

- reduce the time and money spent on paper-based procedures;

- analyze loan performance and processes with the objective of increasing efficiency and profitability;

- compete in the highly competitive auto lending industry, for which lenders must implement contemporary loan processing technologies.

In today’s market, it is clear that the automation technologies and capabilities inherent to these systems provide significant benefits to lenders.

Advantages of Using Defi Solutions Software

Defi Solutions offers a flexible and configurable loan origination system (LOS) and a reporting and analytics platform that is easy to set up and gives actionable insights based on process and loan performance.

The company states that their main target markets are “auto and light trucks, powersports, marine, recreational vehicles, home improvement and unsecured consumer lending.”

Some of the main benefits of opting for the Defi Solutions software suite include:

- Excellent configurability. Defi Solutions software configuration eliminates the need for costly and time-consuming bespoke programming to turn out-of-the-box lending software into a solution that matches your requirements. Configuration options allow lending professionals to make changes to practically every component of the LOS by clicking, dragging, dropping, and typing. Lending experts may make changes themselves in minutes with their own configuration approach, as opposed to weeks with conventional lending software.

- Native mobile app. Consumer expectations of the convenience of business transactions have shifted as a result of mobile technology. Younger people were born digital and grew up with smartphones. Lease or loan origination software must have counterpart mobile applications in order to be competitive in today’s financing climate. Not having a mobile app means you’ll almost certainly lose market share. Cloud-based, flexible, mobile-ready solutions give Defi Solutions a competitive edge when compared to other lease or loan origination software.

- Functionality enhancement options. A lender may from time to time have an urgent need for software capability that isn’t offered on the software provider’s roadmap. Defi Solutions recognizes this requirement and collaborates with clients to find a solution. Client-funded functional upgrades are usually completed in 30 to 60 days. The option to fund improvements can help you get the functionality you need to gain a competitive edge faster.

- Great credit and risk models. Typically, lenders have dozens of credit types that have developed over time and are continually updated in response to current and projected changes in the lending environment. Application and portfolio data, bureau tradeline data, and alternative credit data are all used in Defi Solutions’ machine learning approach to credit and risk modeling. Machine learning creates a single credit and risk model based on your data that examines applicant credentials to authorize new loans, assign prices based on your credit policy, or offer explanations when adverse action notices are necessary by evaluating your data.

- Customizable decision rules. Rules enable automation by converting (both basic and complicated) underwriting choices into ‘if, then, else’ instructions. Decision rules are simple to set up using Defi Solutions software. Rules mimic decisions (that an underwriter could take minutes to make) in just a fraction of a second. Rules greatly speed up loan origination and add uniformity to lending choices, since hundreds to thousands of similar decisions are made every day. Decisioning rules are also critical in assisting lenders in adhering to legislation.

Who Owns Defi Solutions?

Defi Solutions was launched in 2012 in Texas, USA. The private company has three offices across the country: their headquarters in Westlake, TX; another office in King of Prussia, PA; and another one in Amherst, NY.

According to Crunchbase, the company was founded by Stephanie Alsbrooks, whereas the current executive team is comprised of Tom Allanson (CEO), Jason Barrett (Chief Client Success Officer), Steve Bissett (VP), David Call (CFO), Matthew Lehman (CLO/CHRO), Dave Murray (CPO), Drew Newman (CIO/CTO) and Susie Storey (CSO).

Customer Reviews and References

Customer review aggregation websites such as Software Advice show predominantly positive feedback on account of Defi Solutions’ software and their commendable customer-oriented approach.

One user describes the overall experience with Defi Solutions as excellent, going on to say that the team behind the company and its partners are its greatest asset. The user genuinely feels that the company cares about his business needs. Apart from the great customer experience he has had, the user is satisfied with actual products and is convinced of their benefits enough to be patient about improvements that are sure to be implemented down the line. They also feel that positive change is being enacted rapidly.

Another user commented that the software is quite intuitive, easy to use and navigate. They’ve also noticed that the tools have become faster since they first started using them, and that the customization levels are quite high.

Another reviewer goes on to say that the Defi team is “awesome” and that they truly enjoy working with them. The tools have a solid number of vendor integrations with the list expanding each day. They have been able to give their credit analysts and funders exactly the kind of information they need to do their jobs more efficiently, while at the same time providing them with the opportunity to give feedback and request improvements that the Defi company can provide. This user echoes what previous reviews have already said about excellent customer support and configurability options of the solutions.

One more exceedingly positive review describes the LOS experience of their Credit and Loan Processing Staff as “the best [LOS] they’ve ever used.” The company consistently met the smallest of issues with excellent levels of support. They point out that another positive feature of Defi’s tools is that their LOS develops as their business evolves, whereas other similar products have been a hindrance to their business growth. The Defi Solutions company has the flexibility and adaptability to include clients as a group in shared developments, making them an unmistakably modern business that isn’t scared to try new things. From the product manager to the owner, the service and client experience is always excellent, not forgetting the individuals that respond to clients’ tickets when they have an urgent question or issue to raise.

Can You Trust Defi Solutions?

Defi Solutions has been spearheading the automated lending software solutions industry since 2012; as such, they have a long track record of credibility.

Indeed, the company has had years to prove that their products and tools are reliable for the kind of end-users they are targeting, and the positive reviews we’ve summarized above can attest to that fact.

Defi’s CEO, Tom Allanson, asserts that they “do not have a single competitor whose products and services encompass the complete lifecycle of [their] clients and [the clients’] customers, the borrowers” and that Defi Solutions “are in a unique position to add more value to [their] targeted market participants.”

There are no processes or elements to Defi Solutions that could make them unsafe or insecure for their clients. In addition, the team behind Defi Solutions is evidently committed to giving their clients the opportunity to participate in the continuous improvement of the company’s products, or to tailor them to each client’s specific needs.

Defi Solutions: Some Disadvantages

Among the many reviews left by different clients, some of the issues that have been raised in regard to Defi Solutions’ products are mostly related to the speed at which clients have received software improvement updates, or the fact that vendor integration may sometimes take a bit more time than what the client had previously hoped. In addition, depending on your company’s goals, the software might initially be complex to set up.

However, users all reiterate that the customer support team is quick to react to any issues that might come up with the software’s performance, and that updates are continuously being pushed to deliver a better experience.

Conclusion

Our daily lives have been favorably influenced by automation. It enhances the quality and consistency of consumer products and services while increasing productivity and lowering costs. It’s reasonable to argue that without it, few industries today can compete or profit.

Lending is no exception. By making loan applications simple and rapid, an automated loan processing system improves the client experience. Decision criteria provide for a more efficient and accurate underwriting procedure. Multichannel communication allows for more timely alerts that may be saved as digital records to meet compliance needs. Companies can use analytical tools to continuously enhance lending efficiency and loan performance. To compete effectively in today’s auto lending market, lenders must understand the benefits of automation and how it may help them throughout the loan process.

That is where Defi Solutions comes in. The software company evidently offers a flexible, fully configurable loan origination system (LOS) whose benefits are backed by numerous positive reviews by satisfied clients. The LOS is simple to configure, whereas their reporting and analytics platform gives actionable insights based on process and loan performance to help lenders maintain a competitive edge in today’s market.

Apart from the aforementioned advantages of their products, the Defi Solutions team is clearly happy and ready to cater to each client’s specific automation requirements.

All in all, if you are on the lookout for an efficient loan origination system and accompanying tools, complete with great customer support, then Defi Solutions software might be the right choice for your company.

Crypto Ping Pong Digest

Trash style news. You will definitely like