Table of Contents

Update

After the article was written, social media, blogs, and websites were paused. Given all this, we understood the project lost its value if it ever had one.

What is the evidence?

1. Check the website. Zero activity. The links are supposed to work, but they don’t.

2. Check social media. They are active on Reddit, though they’re posting and deleting videos. Twitter is dead. They created a second official page in July, yet there are no posts.

3. Check CoinMarketCap. It’s still listed there, rank #6608, but the Bonfire token performance is far from okay.

4. Check comments and user reviews. For instance, Reddit.

A user wrote:

People please don’t waste anymore money on this nonsense. Time are about to get tough.

But some gold, silver, or food.

Still, our article is valuable. Learn how to detect scam tokens and create a Trust Wallet self-custody account.

INTRO

Despite the market taking a hit, the number of cryptocurrencies launching daily continues to rise. This influx of coins makes it harder for investors to find solid investment opportunities.

Seeing the trend of newly launched tokens in the crypto space, people are gravitating more toward community-driven projects. But it’s important to note that many launching projects are likely scams and aren’t sustainable in the long term. Therefore, you need to conduct proper research before investing.

This article is about one of the emerging projects which follows the same trend, Bonfire. After reading, you will gain a deeper understanding of Bonfire, how it works, and where to buy it.

What is Bonfire

Bonfire is a yield-generating contract run on Binance Smart Chain. The yield is generated through a unique mechanism implemented by the underlying smart contracts. For each transaction, Bonfire takes a 10% fee to distribute to token holders and equally creates a deep liquidity pool.

Such a static reward system was previously introduced by Safemoon and Reflect Finance. As this doesn’t involve usual yield-farming techniques from staking to lending tokens to generate more profit, the Bonfire reward mechanism is considered more sustainable. According to its design, the Bonfire token value is supposed to increase over time as tokens are constantly locked in liquidity pools, and investors prefer to hold tokens for rewards.

In addition to generating incentives, Bonfire is also maintaining a fair degree of transparency in terms of token distribution, when compared to other DeFi protocols. Bonfire is achieving this by not having a manual burn wallet, meaning a developer can’t control the majority of the token supply. At the time of writing, 41% of the supply was burned, with nearly 321k holders.

While the tokenomics aspect excited the crypto community, Bonfire’s utility makes it stand out. Bonfire plans to build an entire ecosystem with its native token, BONFIRE, as the centerpiece. According to the roadmap, the ecosystem will feature a social media platform and NFT marketplace. But the team behind Bonfire is yet to release any minimum viable product (MVP). You can take a look at their website and Twitter for more updates.

Having an incentive-driven protocol with promising utility possibilities is not enough. Proper security features should also be in place to avoid hacks and rug pulls. Bonfire has ensured that security is on par with the industry standards by doing multiple project audits. Dessert Finance and Metapulse performed their due diligence and deemed Bonfire smart contracts safe, with no risk to token holders.

Now that you clearly understand Bonfire, it’s time to dive into purchasing its tokens using Trust Wallet. But first, why consider Trust Wallet over others? Let’s find out.

Why Choose Trust Wallet

Trust Wallet is home to more than 25 million people when it comes to buying, selling, and exchanging digital assets most securely and conveniently. It supports 65 blockchains for your tokens. At the same time, Trust Wallet is compatible with ERC721 and ERC1155 token standards for NFTs.

Access to the entire DeFi ecosystem at your fingertips makes one’s job easier. But it should also be seamless to navigate different applications. To help overcome any shortcomings related to user experience, Trust Wallet features a DApp browser. This browser allows you to quickly connect to the most popular decentralized applications within the comfort of your mobile device.

The free-to-download mobile app of Trust Wallet also doesn’t require you to go through KYC verification. As it’s a non-custodial wallet, the user doesn’t share any data with third parties and can retain full control over crypto assets. If you lose access to your Trust Wallet by mistake, you can still recover it. Trust Wallet has solved backup issues of software wallets by integrating a 12-word phrase as the recovery key.

Trust Wallet has also lowered the entry barrier to decentralized finance. It doesn’t charge any fees or subscription charges. Users can freely download the mobile app on PlayStore or App Store.

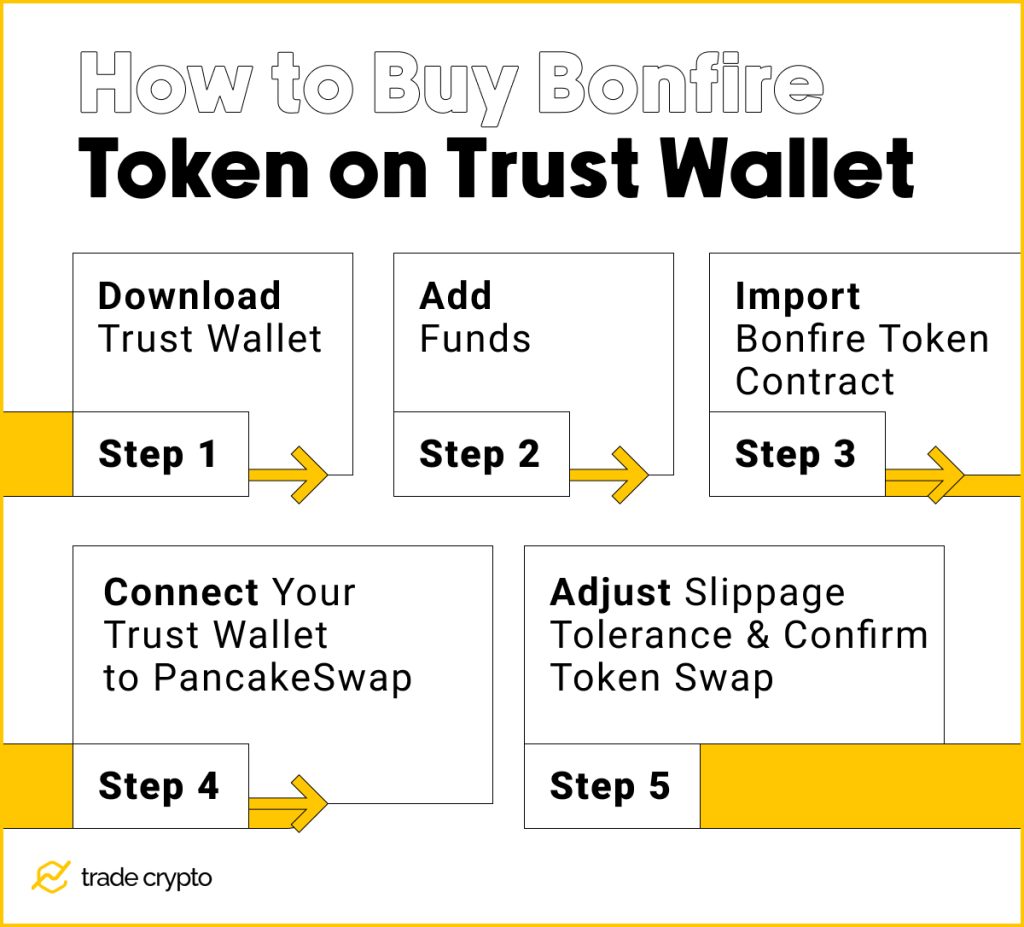

What the Process Looks Like

Buying popular crypto like Bitcoin or Ethereum in just one or two steps is easy. But it can get complicated when it comes to a token like Bonfire, which has low liquidity and exchange listings. That’s why we have provided a quick breakdown for you to follow:

Step 1: Download Trust Wallet

Trust Wallet is available on both Android and iOS devices. Depending on which one you use, visit the corresponding app store and install Trust Wallet.

Step 2: Add Funds

You need to use PancakeSwap to buy Bonfire tokens, so you need to have BNB. The easiest way to buy BNB tokens on Trust Wallet is by using your credit or debit card. But if you have your BNB on an exchange, you must withdraw it to your Trust Wallet.

For example, let’s assume you have a BNB balance on the Binance exchange. To make the transfer, you first need to open the asset overview page. You will see all crypto assets present in your portfolio. Select BNB, and click on Withdraw.

You will be asked to choose the type of network and how much BNB you wish to transfer. Enter the amount of BNB you wish to send to the Trust Wallet and select the BSC network. Click on Confirm and pay the gas fees to finish the BNB token transfer successfully.

Step 3: Import Bonfire Token Contract

Before buying Bonfire, you must manually create a custom token on Trust Wallet. Otherwise, you won’t see your token balance.

Select the icon next to Collectibles on your app dashboard. You will see a search bar pop up. Enter the Bonfire token contract address, and you will see the icon disabled. Enable it and proceed with buying Bonfire tokens on PancakeSwap.

Step 4: Connect Your Trust Wallet to PancakeSwap

To access PancakeSwap from your Trust Wallet, you must select the DApp browser. You will see a list of popular decentralized applications. Scroll down a bit, and you should see the PancakeSwap logo. Click on it, and you will be redirected to the browser. Once you’re on PancakeSwap, it’s time to connect your wallet. In our case, it is a Trust Wallet.

After connecting the wallet, select the tokens as BNB and Bonfire. You’ll need to import the contract address and add the token if Bonfire is absent.

Step 5: Adjust Slippage Tolerance & Confirm Token Swap

It is essential to check the token’s liquidity before confirming a token swap. With Bonfire, applying slippage anywhere between 8-12% is recommended for successful transactions.

Once you set the slippage, click on Swap and exit PancakeSwap. It can take anywhere from 2-10 minutes for your Bonfire tokens to arrive. If you don’t see the difference, try refreshing the app page.

And that’s it! We hope you understand Bonfire and how to buy it with Trust Wallet. Make sure to follow each step. If you are buying for the first time, we suggest starting with small amounts.

Is Bonfire Token a Worthwhile Investment?

An altcoin like Bonfire, with low market capitalization and liquidity, usually suffers the most when the market is in a downturn. Adding on to the uncertainty, we will also be facing a global recession in the near future. So, it is highly likely that investors will shift to risk-free assets and exit their stake in assets like crypto. If you are one of those investors, Bonfire might not be the best choice for diversification and crypto exposure, at least in the short term.

However, at the same time, if you have capital you’re comfortable investing in asymmetric bets in the long term, you can allocate a small portion for tokens like Bonfire. You should also track how well the Bonfire team is meeting community expectations. If they are progressing and reaching new roadmap milestones, that is a good sign for the future of the overall project.

Crypto Ping Pong Digest

Trash style news. You will definitely like