Table of Contents

The crypto market is highly volatile, except for stablecoins, which by its design created to hold a 1:1 peg to real-world assets. Tether is one of them; thus, it’s a solid option for those entering the crypto world. It has been around since 2014, created by Bitcoin investor Brock Pierce, entrepreneur Reeve Collins, and software developer Craig Sellers. At the end of 2022, Tether’s market cap is over $66 billion.

More on stablecoins: USDT vs USDC: Which stablecoin to use

Tether (USDT) buying and storing guide

This article is designed to be your step-by-step guide on how to buy a stablecoin Tether (USDT), where to buy it, and how to store it safely and conveniently.

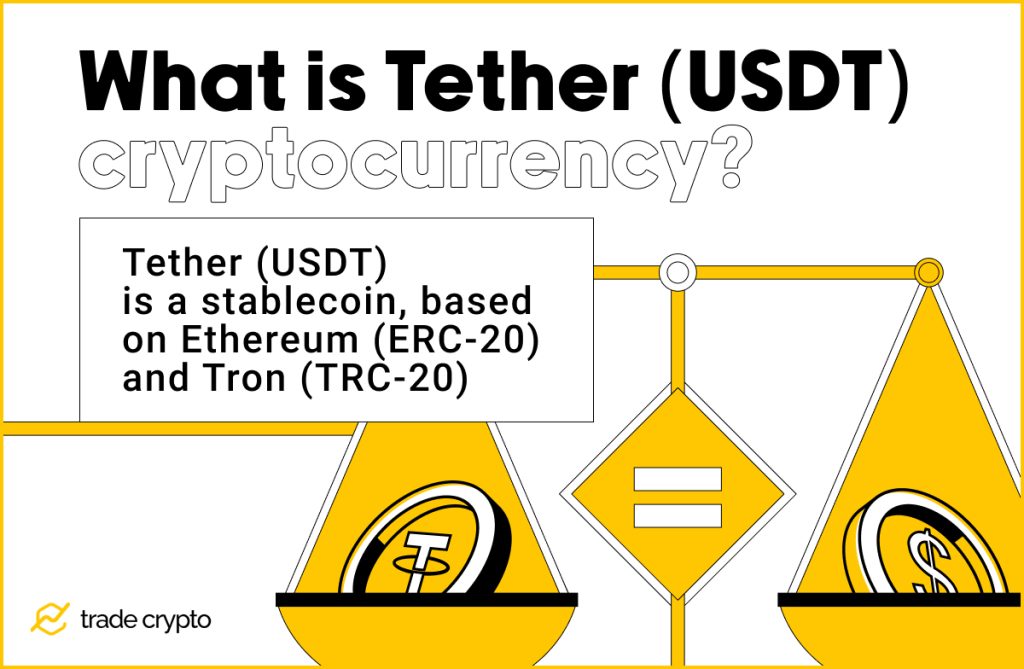

What is Tether (USDT) cryptocurrency

Tether (USDT) is a stablecoin. Stablecoin is a coin (token) that rarely loses a peg (only a penny) and is always 1:1 pegged by the US dollar.

Tether is based on several blockchain token standards: Ethereum (ERC-20 token) and the Tron (TRC-20 token). TRC20 and ERC20 both represent US dollars. However, fees for transferring USDT can often be cheaper on the Tron network using TRC20 than ERC20. Other than its design, it does not differ from other cryptocurrencies. It can be stored on a crypto exchange or in a self-custody wallet.

How to buy Tether (USDT) online and in-person

Tether is safer and easier to buy online than in person (peer-to-peer).

To purchase USDT peer-to-peer, you have to:

- Find a person willing to exchange cash or Western Union transfer for their Tether

Have in mind the following:

- You will have to search for an individual trader on P2P Binance or Paxful exchanges

- Trader’s fee is built into the price, as traders ask from $1.08 to $1.55 or more per 1 Tether

- It’s your responsibility, as you have to rely on the trader’s honesty to send you USDT after receiving your cash

To purchase USDT online, you will need the following:

- To decide on the crypto exchange of your choice (Binance, Coinbase, Kucoin, Crypto.com)

- To register an account at your chosen exchange, verify your mail address via code or other methods

- Access to funds on your credit card or on alternative payment services permitted by the exchange (some exchanges accept ApplePay, PayPal, simplex, banxa, Transferwise, or other third-party payment services)

- Wallet on your preferred blockchain (Ethereum, Tron, Solana, etc.) to store your Tether.

If this seems too much to take in, don’t worry; we will cover detailed step-by-step instructions in the next sections, including how to open your wallet and buy your first Tether coin.

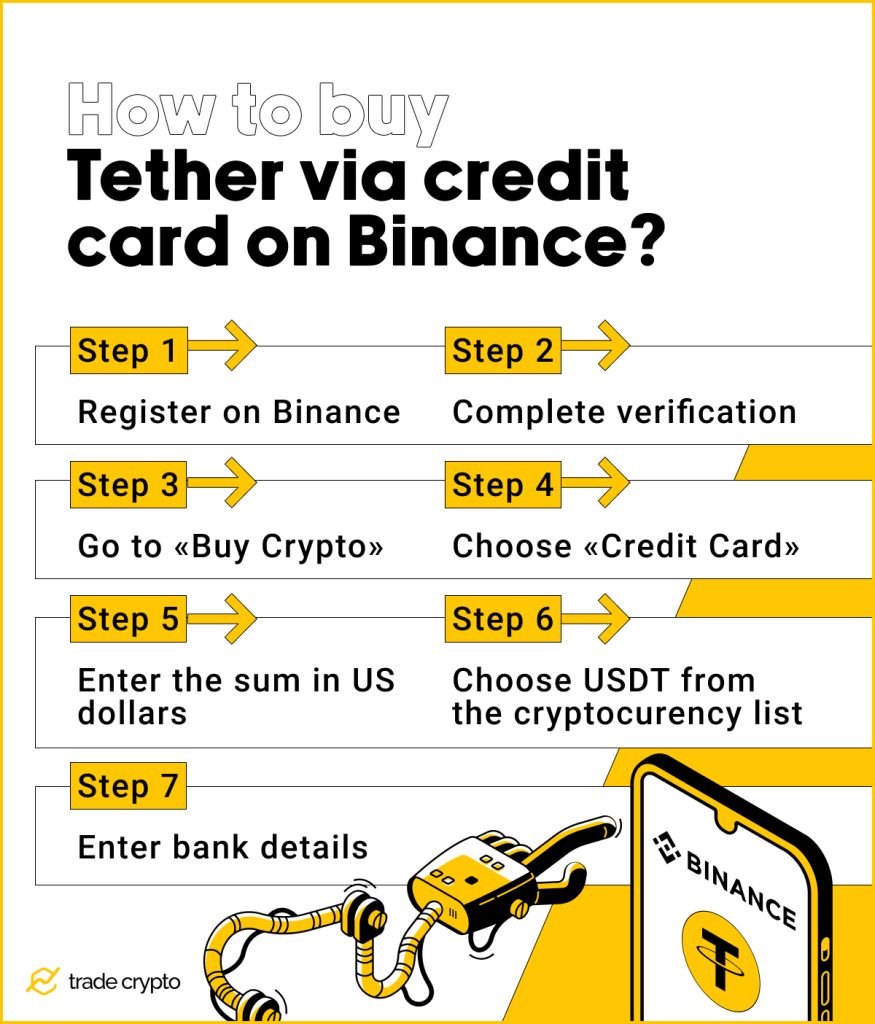

How to buy Tether (USDT) via credit card on Binance

Binance is the largest cryptocurrency exchange by trading volume. If you plan to buy your first Tether and make your first steps into the world of crypto trading, Binance is one of the safest places to do it.

Everything is pretty much on the table above, we’ll cover some details. If any questions will pop up, follow Binance instructions.

Step 3. Identity Verification. Verification is essential. Without it you don’t have access to exchange instruments. Binance will remind you to complete the verification, or you can add info anytime via the User Center bar.

Binance has three levels of identification, Verified, Verified Plus, and Enterprise Verification. Only the first level is mandatory. Other levels are there to increase your deposit and withdrawal limits and are optional.

The whole process is much easier through a mobile browser or mobile app. Don’t panic if the process results in a Verification Failed message. Try using other methods (mobile, PC, or app) and ensure the verification required documents and selfies are clear.

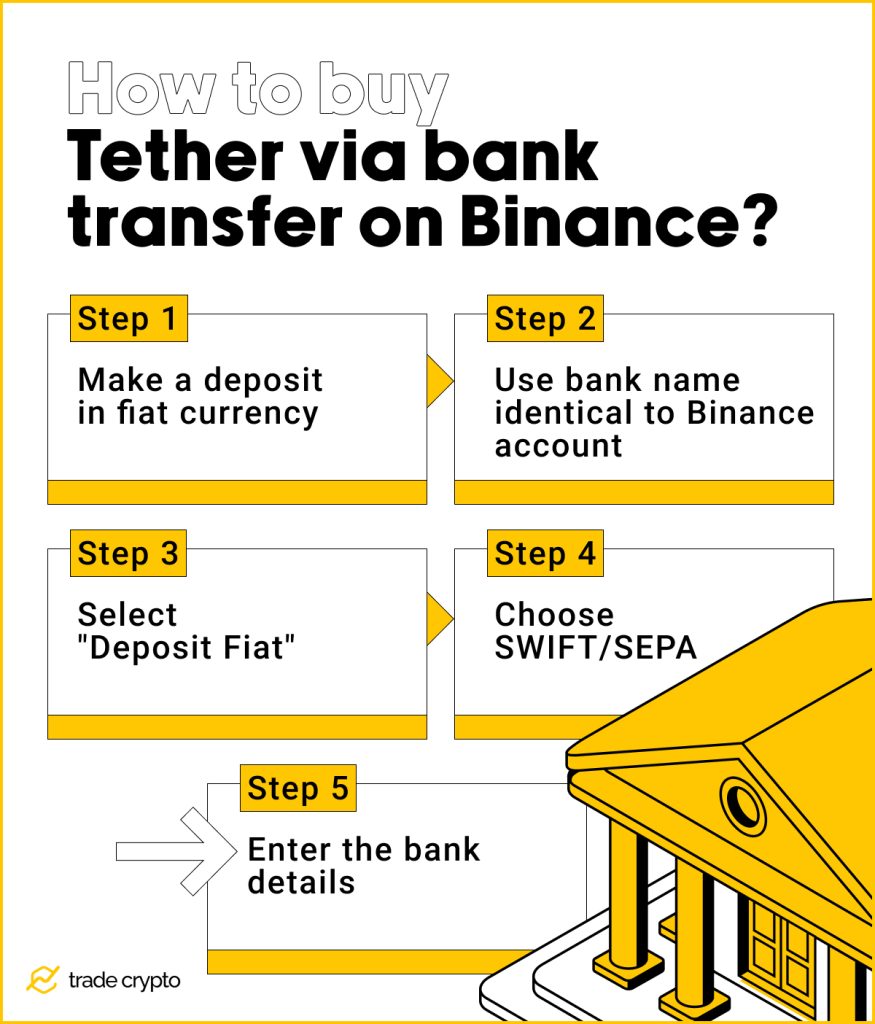

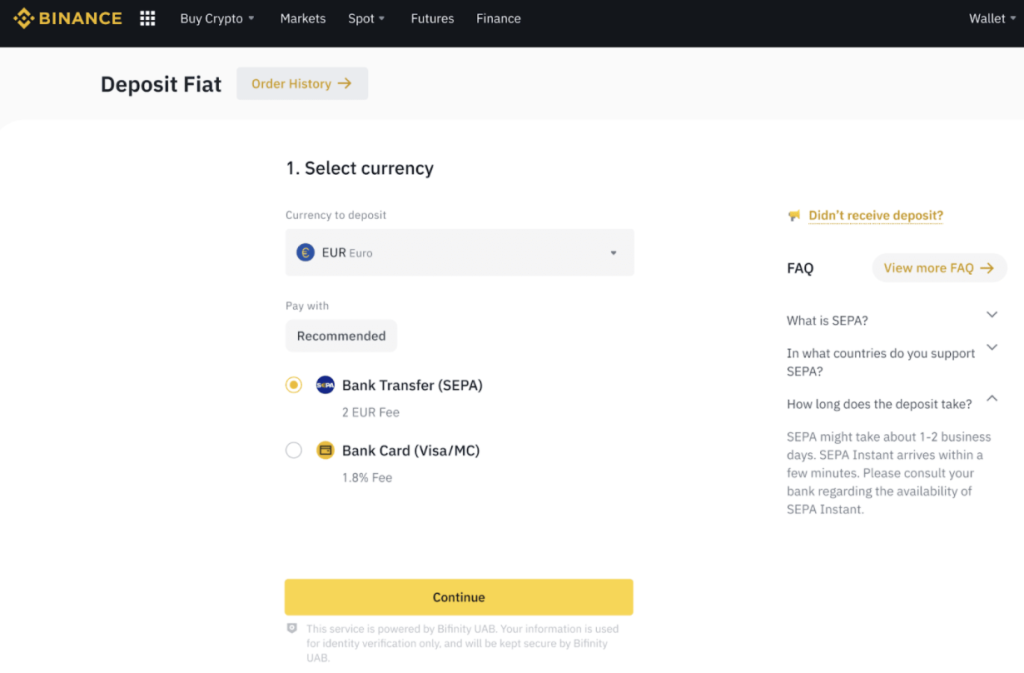

Buying Tether via SEPA / Bank transfer

To buy Tether via bank transfer, it is necessary to deposit fiat currency. Make sure you have enough funds in your bank account. Since there is a 2 EUR fee for deposits, always make deposits greater than 2 EUR.

The name on the bank account must match the name registered to your Binance account. Therefore, DO NOT transfer funds from a joint account.

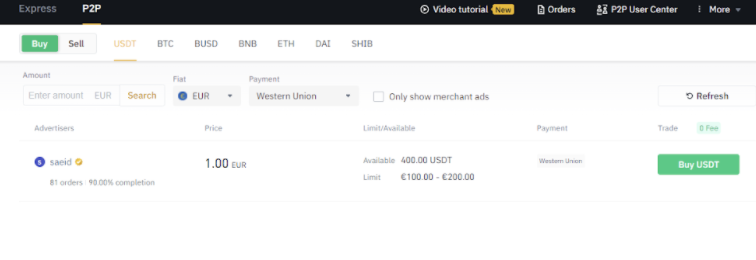

Buying Tether via P2P on Binance

The P2P option connects individual users holding crypto to you. It’s a marketplace, so sellers will offer crypto on their own terms. There is no guarantee that you will actually get your crypto because the exchange is not automated. Basically, you are making a payment to an individual. They promise to transfer crypto to you.

Select [P2P] option from the [Buy Crypto].

You will get the list of sellers. Note the number of orders and percentage of completion as indicators of the trader’s reputation. Next is the listed price, purchase limits, as well as payment methods. Namely, since individual traders are offering their personal funds, the payments will be possible through a wide variety of payment processors.

In the example from the image above, one trader is offering to sell up to 400 USDT, at a price of 1 EUR per USDT, and they accept Western Union transfers.

This is quite a risky way to buy cryptocurrencies, including Tether. The exchanges that support P2P trading usually issue warnings, since they don’t guarantee the reputation of traders and call for caution against scammers.

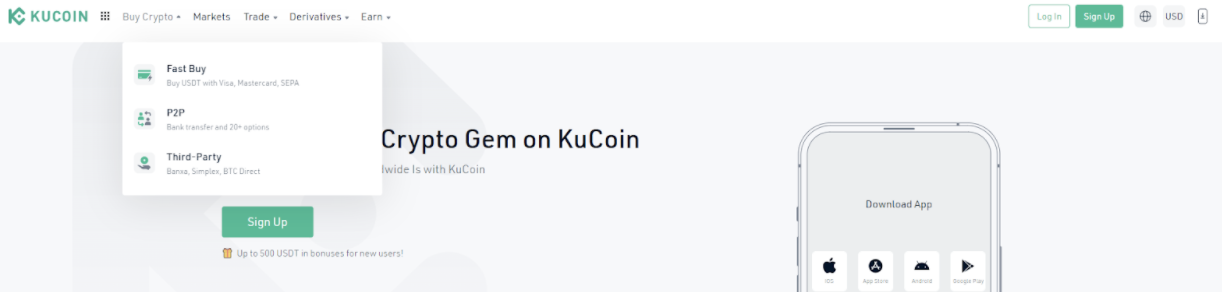

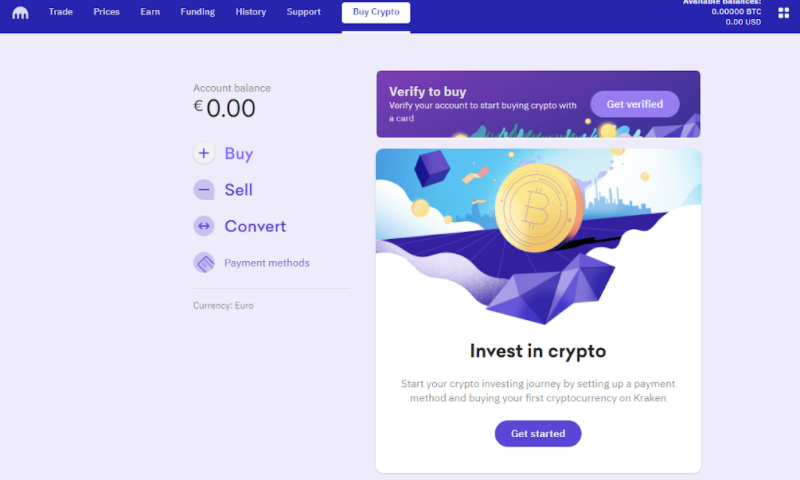

Other crypto exchanges

The detailed guide covered buying USDT via Binance. The process is very similar for any other crypto exchange you want to use, as KuCoin, Kraken, CoinBase and others all have [Buy Crypto] options, including credit card purchases (usually via 3rd party processors), bank transfers, and P2P options.

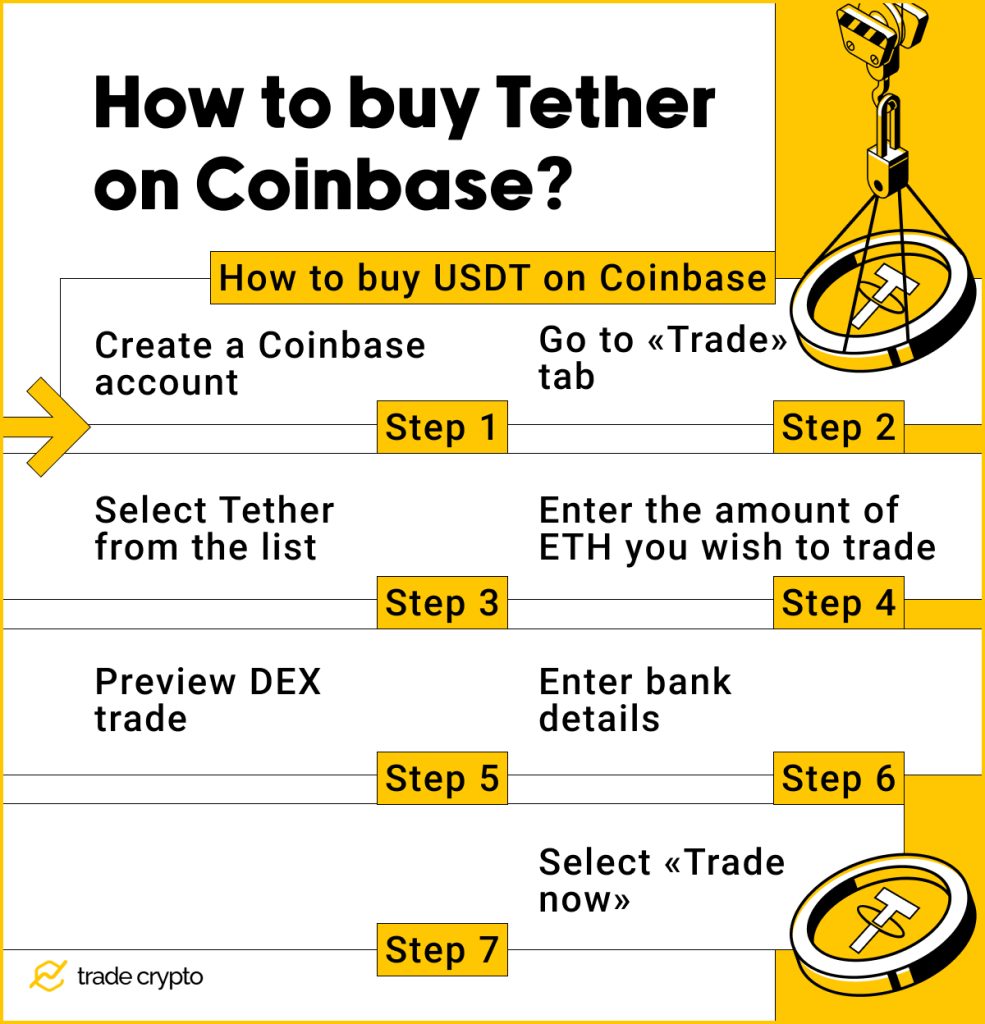

How to buy Tether on Coinbase

We decided to cover Coinbase separately. Remember we talked about different USDT token standards, ERC20 and TRC20? The thing is, Coinbase supports only one of them, ERC20, which runs on Ethereum. So if you want to buy USDT ERC-20, you should buy ETH first and then exchange it via the app for Tether. Don’t worry, we prepared a steps list and uncovered some details.

Step 5. Preview DEX trade.

At this point, the question arises regarding how to buy USDT with ETH.

You’ll be shown the details of your purchase, including payment method, exchange rate, fees charged by the Ethereum network to process your transaction, Coinbase fees, and the total cost of the transaction. Make sure everything looks good and then select “Trade now” to confirm your trade.

If you do not currently have any ETH in your primary Coinbase account, you will be prompted to “buy ETH with cash” or to “receive ETH from another wallet.”

If you already have ETH in your wallet, you will be asked to transfer ETH from your primary wallet to your newly created dapp wallet. On the “Transfer Ethereum” page, enter the amount of ETH you wish to transfer to your dapp wallet and then select “Preview transfer”

Once you’ve confirmed the details on the transfer preview page, select “Transfer now.”

How to buy Tether via PayPal on Paxful

Paxful is a popular peer-to-peer marketplace. Go to Paxful, and create a free account. And fill in the details on the left bar of the website, such as the location and fiat currency you are willing to spend. The most important step is choosing the seller. You can sort peers by “Vendors who were active in the last 10 min.” Choose the best offer. More info is to be shared on trade chat.

Buying directly from wallets

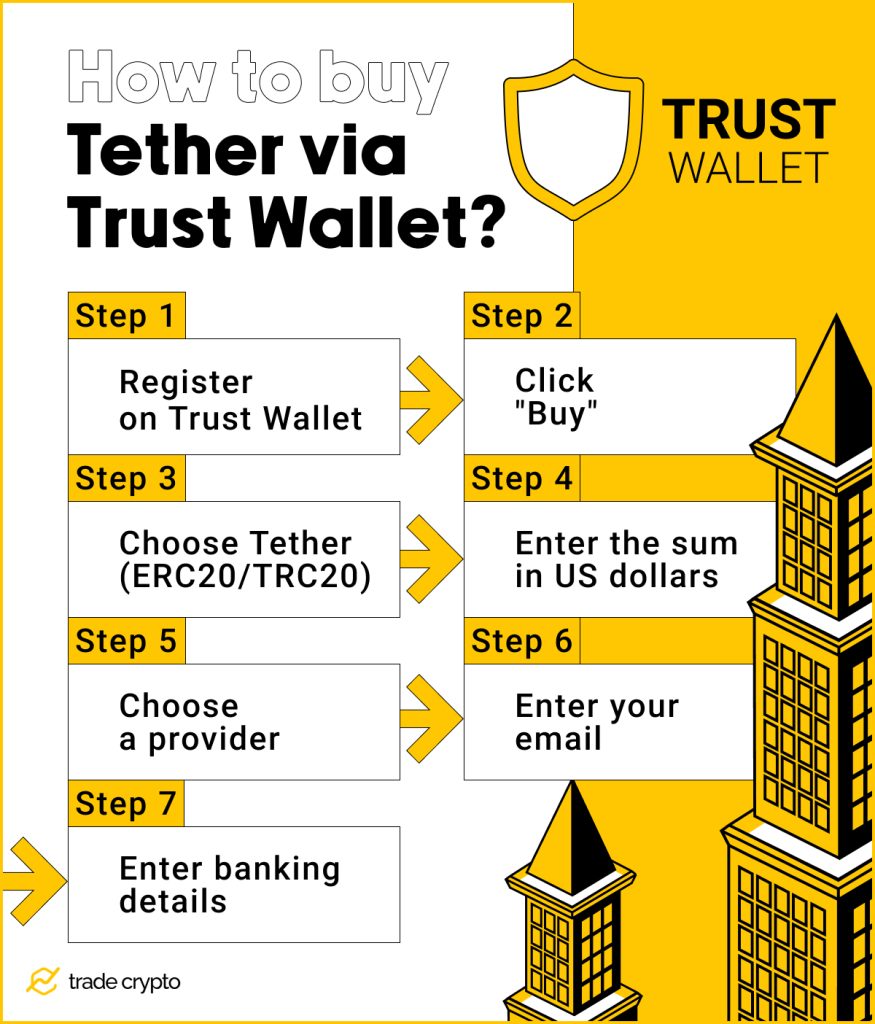

If you chose a self-custody option, this part of the text is for you. We’ll talk about Trust Wallet. Any wallet has its own identification procedures in place, and once you are verified, you can buy Tether and store it directly in your wallet of choice.

Trust Wallet is a self-custody cryptocurrency wallet where you can buy, trade, and store your Tether. Both ERC20 and TRC20 are supported. If you want to buy Tether, it will redirect you to providers via app, such as MoonPay, Binance Connect, and Simplex. We choose to cover the situation if you choose MoonPay.

How to store your Tether coins?

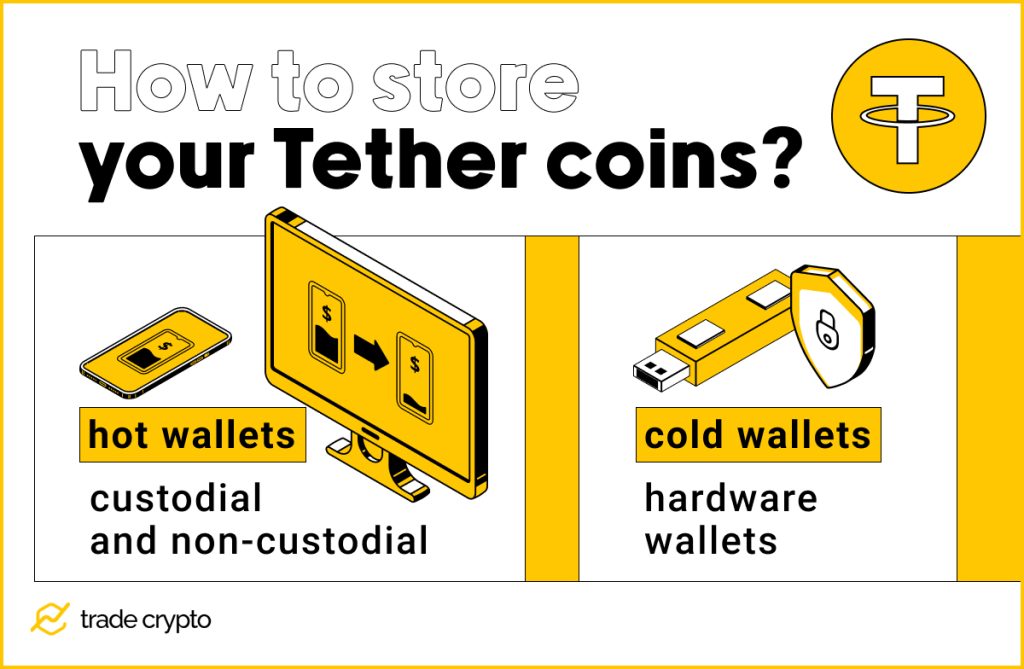

If you decided on Binance to buy Tether (USDT) coins, they’re stored there and protected by the registration and verification you did before. This is called a custodial hot wallet. Storage is safe and convenient, yet is shared with Binance. If something bad happens with the exchange, your funds may be temporarily frozen. If you chose a Trust Wallet, it’s again a hot wallet, but a non-custodial one. It’s also very convenient, but you are responsible for funds, not a third party.

For increased safety, at the expense of some convenience, are cold wallets, also called hardware wallets. Cold wallets look like USB stick devices and can be purchased online. They keep your coins safe like a safe deposit box would. Not very convenient for trading or purchasing, but quite inaccessible to anyone but you. Popular hardware wallets are Ledger Nano X, Tezos Model T, and Ellipal Titan.

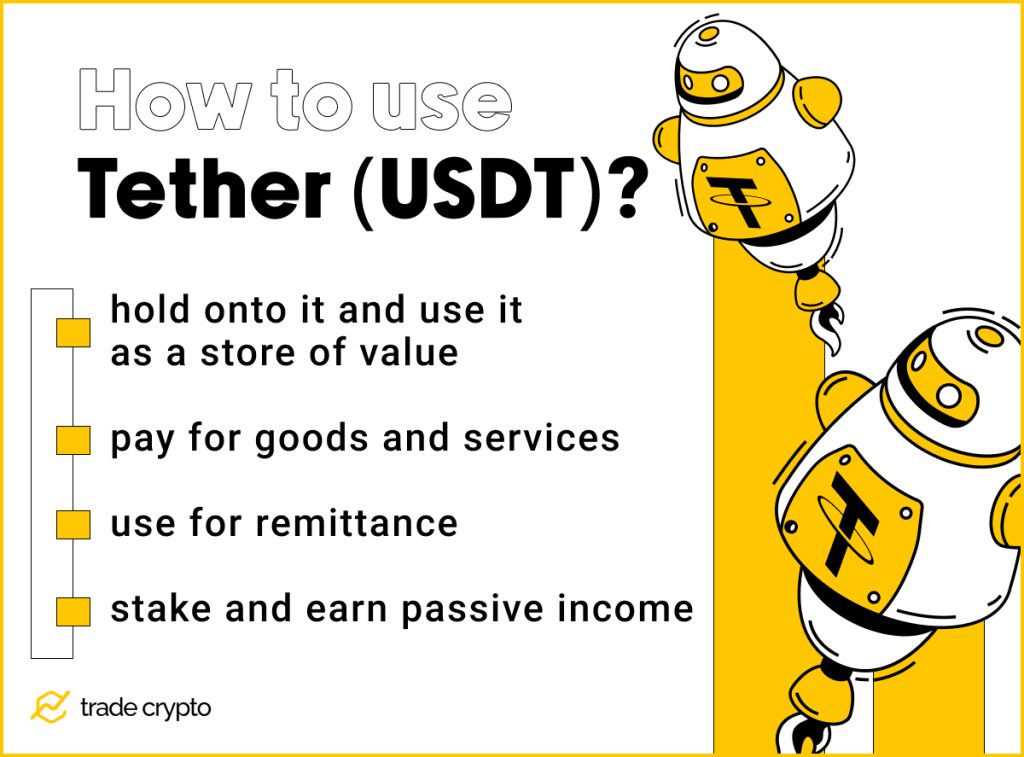

How to use Tether (USDT) cryptocurrency

So now that you have learned how to buy Tether, you may wonder, what do to with it? You can, obviously, hold onto it and use it as a store of value. The increasing number of merchants use Tether, so you can pay for goods and services. Because of the high speed and low transfer costs, Tether could be used to send funds to friends or family for remittance.

Because it is faster to convert other cryptocurrencies into Tether than into hard cash and vice versa, Tether is a very popular medium for investors and traders. A sort of “your safe haven” in the volatile world of cryptocurrencies. So, you could use USDT to buy other coins or exchange them back to USDT if you feel their value will diminish.

However, the most exciting and lucrative use of Tether is to earn more and make it part of your short or long-term investment plan.

You can earn more Tether coins by simply storing your Tether on a certain platform (a process called staking). Interest rates are high, from 1.2% on Binance, and typically between 6-12% on other platforms.

You could move your Tether to a lending platform for shorter, more lucrative, and risky investments. Other users and projects borrow your USDT coins, and you get a percentage of the fees they incur when trading. However, this advanced crypto-investment strategy requires deeper knowledge and closer monitoring of your crypto assets.

F.A.Q

What is Tether?

Tether is the world’s first stablecoin. It is a cryptocurrency that mimics the US Dollar, always worth 1$, thus connected, pegged, or tethered to the value of a dollar.

Is Tether (USDT) a safe cryptocurrency?

Yes. It is considered one of the safest because its value never changes, with negligible fluctuations measured in fractions of a penny. It is also safe to store and hold on to, making Tether very popular in the world of crypto-trading as an intermediary currency between US dollars and other cryptocurrencies, such as Bitcoin, Ethereum, etc.

What is the difference between ERC-20, TRC-20, and these other Tether variants I hear about?

Tether initially operated on the Omni blockchain network of Bitcoin. Ever since Tether has spread over the number of blockchains. The most popular networks for Tether are Ethereum (hence the ERC-20 token designation) and Tron (TRC-20 coin). But Tether can be stored on Solana, Algorand, HECO, xDAI, Polygon, and some other networks.

Can I do Forex-style trading with USDT?

Yes. Since Tether (USDT) is always worth $1, you can exchange local currency into USDT, then cash out or exchange for other assets once the local currency drops in value.

Can I lose money on USDT?

Think of Tether (USDT) as of digital representation of your dollar in the world of crypto-trading. You can always use the money on transaction fees or bad investments. But the value of Tether will not change, so if you hold onto it or use it for payments or money transfers, you should forever keep your money’s worth.

Crypto Ping Pong Digest

Trash style news. You will definitely like