Table of Contents

Guide Through Decentralized Exchanges in 2022

One of the greatest disruptions that blockchain technology brought happened within the fintech sector. Cryptocurrencies were just the start. Trading and speculating on bitcoin and similar cryptocurrencies was just the prerequisite for fully decentralized financial projects, like DeFi exchanges.

It wasn’t until the Ethereum network and smart contracts that new financial instruments were able to be offered without relying on any intermediaries such as banks and centralized exchanges. This is the world of decentralized finances.

Knowledge is critical for navigating this world, so we’ve prepared a Full Guide to DeFi as well as a detailed guide on How to Get Started with DeFi. Decentralized Exchanges are the platforms where the magic of DeFi is actually happening.

What are DeFi exchanges?

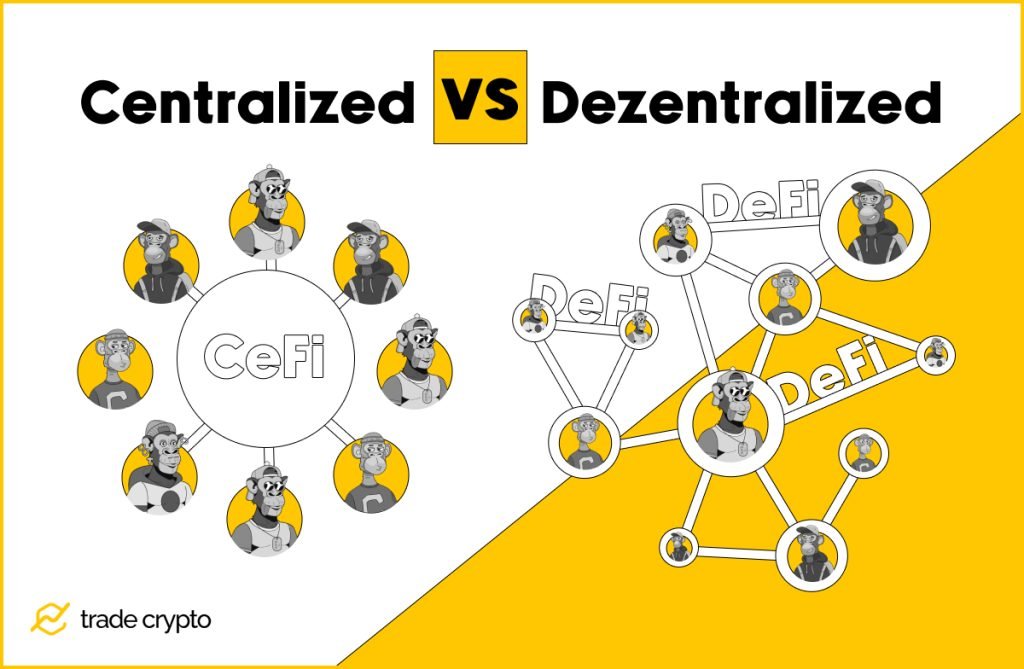

So, let’s see first what is a crypto exchange? The first generation of crypto exchanges is businesses, like Binance or Coinbase. They allow customers to buy cryptocurrencies for fiat currency (USD, EUR, GBP), trade, and withdraw profits to customers’ bank accounts. They are an entry point, of sorts, to the world of crypto. They are centralized, operated by an owner, and they directly participate in markets by clearing trades.

Digital order books are kept on the centralized exchange’s servers. Their software keeps track of matching up buyers and sellers. An important feature of CEX (Centralized Exchange) is crypto asset custody. In other words, customers deposit their funds before any exchange or trade can happen.

The centralized exchanges are currently the largest by volume trade, as 95% of crypto trading is done through these DeFi platforms. One of the biggest advantages they carry is safety. In order to operate, many countries in the world require CEXes to be registered, audited, and submitted to legal regulation, including the most important Know Your Customer (KYC) protocols that prevent money laundering, scams, and other malicious transactions.

Why DEX, then?

Decentralized exchanges or DeFi exchanges don’t operate with fiat. While they can point their customers to different ways to obtain cryptocurrency, they deal exclusively with crypto. Most of the DEXes started as – Swaps.

Protocols that enable users to directly swap one token for another, a practice that would in centralized exchange require customers to sell their crypto and then buy another, incurring losses in the shape of exchange tax.

Where centralized exchanges keep records on their internal databases, DEX transactions are settled directly on the blockchain. Decentralized Exchanges are protocols that run on smart contracts, programs that execute transactions automatically according to preset rules and algorithms.

This enables DEXes to offer a vast variety of tokens. If you are a risk-taking investor, seeking to capitalize on the next big thing, new coin, new project, that you feel will ‘go to the moon’ or ‘skyrocket’, it’s highly unlikely that you will find it on any centralized exchange.

A wider gamut of financial products

Due to the decentralized nature of the DEX exchange, they can offer a wider gamut of products, as well. Because of the speed of execution of transactions (they are run on smart contracts, e.g computer programs) they can provide services that centralized exchanges simply can’t.

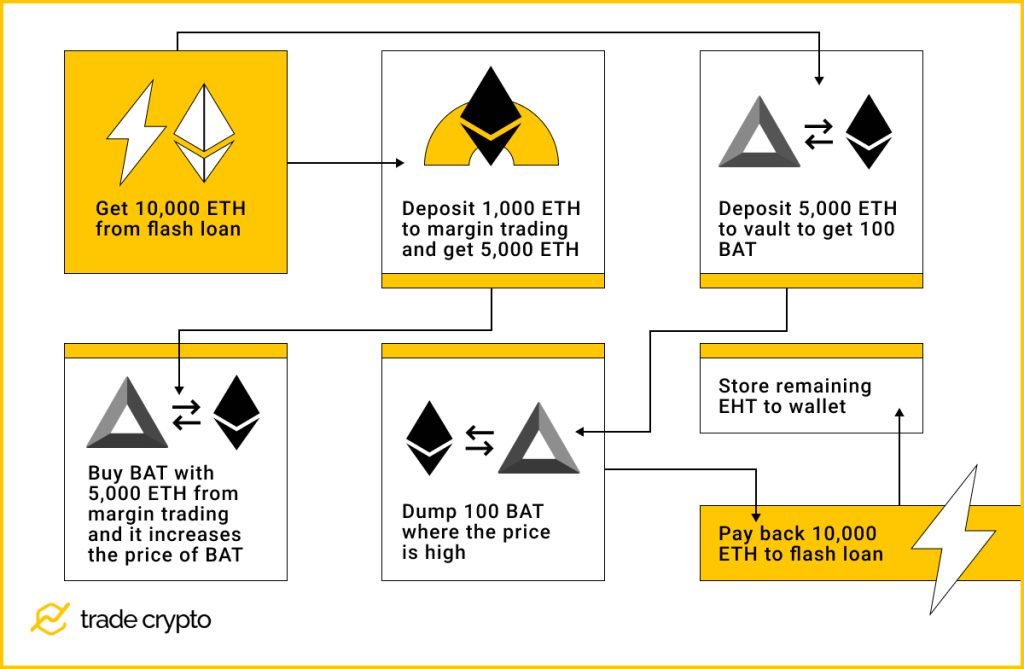

Flash loans are an example of this. It’s uncollateralized lending that has no limits, requires no approval. However, the loan is only active for a few seconds, and then the transaction is reversed. This sounds crazy, but it can help traders in arbitrage trading, who spot a drastic price difference of an asset.

Let’s say you spot that Token is cheaper at Uniswap than at FTX. The price difference will be tiny. But if you buy a lot of Token, then you can profit by volume, repaying the loan and interest fees, and the whole process is executed in seconds, making it impossible with traditional exchange platforms.

Decentralized exchanges also offer a reduced risk of hacking, as the assets are not in custody with a centralized exchange’s server, though DEX as such isn’t completely safe from malicious attacks. Anonymity is another great advantage, as well as the speed of transactions, enabling the unbanked and customers from developing economies to gain access to financial instruments that would otherwise be unavailable.

Disadvantages of Decentralized Exchanges

It’s only fair to warn you about the DEXes. For starters, these exchanges expose customers to tokens that could be part of the fraudulent “rug pull” schemes. While offering amazing return rates, liquidity pools, yield farming, staking, and other profitable products can incur losses.

The volatility of tokens can see your investment significantly diminished. Also if there is an imbalance in the liquidity pool, customers can also experience losses. More research and more caution are needed when handling DEX investments.

Another obstacle is the interface. Namely, many DEXes, especially if it’s a new DEX, will have different steps customer needs to take in order to place an investment. There isn’t a standard or uniformity. This means that you will need to watch tutorials for that particular exchange and see how things are done. This requires somewhat more advanced knowledge as many DEXes don’t have user-friendly support. Considering that the processes are handled by smart contracts, there could be bugs that could result in the loss of your investment.

How to find the best crypto DEX?

There are several criteria to discern which crypto dex is the best:

- Level of decentralization

- Custodianship

- Trading fees

- Rewards

- Trade volumes

Decentralization

First of all, you want to know if the DEX is actually decentralized or not. Check the website. Look for governance methods. You want to see that users actively participate in the running of the exchange. A dedicated development team is fine, but if you see prominent CEOs or leader figures, that could be a red flag.

Custody of assets

The best DEX will operate on some sort of peer-to-peer protocol. So if you can’t interact with DEX from your wallet, but need to deposit funds, that’s only a partly decentralized exchange. It doesn’t mean you shouldn’t make business with them, but beware of DEXes that require you to have funds in their wallet.

Trading fees

DEX is all about removing the intermediaries. This means that there should be very low fees. Industry-standard stands at about 0.3% on every token swap. Watch out for gas fees. Many DEXes work at networks outside Ethereum, requiring you to have a native token (e.g AVAX if you are dealing with Avalanche network) to pay for the transactions (gas fee).

Rewards

Whether you are providing liquidity, staking coins, you are reaching DEX to have a return on your investment. Check and double-check what kind of rewards to expect. Many DEXes will not pay you in staked cryptocurrency, but instead, provide rewards in utility tokens. This means that you will be investing your tokens, but receive their token as rewards. While this isn’t a red flag, it can be better to find a DEX that will not give you suspicious tokens as rewards.

Trade volume

Decentralized exchanges don’t have their own capital. They aren’t the bank. Without users providing liquidity there can’t be traded or swapped. Therefore you want to check the volumes of trade to see if there is a sufficiently large number of customers. Another relevant metric is Total Value Locked (TVL) as it shows how much crypto assets are committed by users.

Also, you don’t want to see liquidity pools dominated by few users, as they can disrupt the local market. You will see young DEXes offering three-figure returns (in APY or APR), as they want to incentivize users, but do check trade volumes, and don’t be greedy.

Top 5 DEX in 2022

If you were slightly intimidated by the previous section, do not worry. New projects, new DEX apps are quite difficult to read even for an experienced trader. Hardcore traders who can read and analyze smart contracts can play around, but for you, we have prepared a list of the best decentralized exchanges as of 2022.

Uniswap

This is the absolute king of DeFi. It runs on Ethereum, Polygon, Optimism, and Arbitrum, so you can avoid high gas fees on Ethereum. Uniswap has several protocols, so you will see Uniswap v2 or Uniswap v3. They have around $8 bn in Total Locked Value (TVL) and around $1.3 bn in 24h traded volume.

You might be intimidated at first as their interface is minimalistic, and they offer token swap and liquidity pool providing, the simplest and most basic of DeFi activities. However, built on their protocol is a plethora of apps, so you can find something to your liking.

PancakeSwap

Uniswap operates on open-source code, so anyone could clone it and make their own Swap. Pancake is basically Uniswap’s code running on the Binance Smart Chain network instead of Ethereum. You will need BNB tokens for gas fees. If you want to participate in the decision-making of this DEX, you will need CAKE governance tokens.

PancakeSwap supports 4070 coins, has $4.3 bn Total Value Locked, and $330 million in 24h traded volume. Other than token swap, you can do limit orders, provide liquidity, earn and review your NFTs, earn from yield farming, participate in PancakeSwap lottery, or trade competitions.

PancakeSwap boasts a user-friendly interface and if you don’t mind holding your tokens on Binance Smart Chain you will see why it is one of the best decentralized exchanges out there.

SushiSwap

SushiSwap is another community-governed DEX, with a team of dedicated developers. They operate on no less than 16 different networks which makes it a top DEX if you want to support different projects and have an interest in more exotic crypto tokens. Other than swap and trade, you can provide liquidity, yield farm, and lend crypto, which effectively turns your wallet into a savings account. This is important for customers who want greater yield than traditional savings, without the hidden dangers of more advanced DeFi investments.

With $3 bn Total Value Locked, and $90 million in 24h traded volume, SushiSwap is another good choice for beginners and veterans alike.

Curve Finance

The curve is a popular AMM (Automated Market Maker) platform that provides very low fees and low slippage losses. In other words, Curve only deals in stablecoins and wrapped versions of crypto tokens, which brings lower volatility. This enables Curve’s algorithms to be more efficient. If you want more stability and less speculation, this is the best dex exchange for you.

Beware of a somewhat unfriendly interface, and lower yield rates. However, the proof of its popularity is $18 bn Total Value Locked and $324 million in 24h traded volume. Another great feature is the very informative Risks section which helps newcomers to understand the potential dangers of DeFi products.

1Inch

Slippage is a loss of value when an imbalance in the trading volume of asset results in purchasing price being too high or selling price being too low when you are performing trade or swap. 1Inch is an exchange aggregator. 1Inch’s protocol scans 21 DEXes to find the best prices and reduce slippage. Because liquidity is increased across the broader market, it also counteracts price volatility.

Other than a vast choice of pools and yield farming, users can provide liquidity to earn 1INCH tokens as interest. This token is used in the “instant governance” model, designed to allow everyone to participate in the governance process. Another useful feature is the ability to buy Ether (ETH) via MoonPay directly into this DEX.

FAQ

What is DEX?

Decentralized Exchange is a peer-to-peer crypto market that removes intermediaries, allowing users to benefit from lower fees and greater yields on their investments.

What is a smart contract?

Smart contract is a computer program or transaction protocol that executes automatically, according to the terms of a contract. They are compared to a vending machine. Once you insert a coin, you enter into a contractual relationship with the vendor which executes automatically, as they are obliged to provide the goods without intermediaries, arbitrations, or enforcement. Smart contracts are at the very core of decentralized finance.

What is Automated Market Maker (AMM)?

Automated Market Maker is a protocol on which all the DEXes are based. Since decentralized exchanges do not support traditional order matching or custodianship, liquidity is provided by ‘pools’. Smart contracts execute the trade, as customers are not trading with a counterparty, but against the liquidity locked into a pool, and provided by individual investors.

What is slippage?

Slippage is a loss of value when an imbalance in the trading volume of asset results in purchasing price being too high or selling price being too low when you are performing trade or swap.

What is impermanent loss?

When a user is providing liquidity to a liquidity pool, two crypto assets are deposited (pair). For example, ETH/USDT. Users will want to trade between currencies within this pair. When the price changes compared to when you deposited them the value at the time of withdrawal will be disrupted. The less volatile the crypto pair, the less is impermanent loss. That’s why stablecoins are popular in liquidity providing.

Crypto Ping Pong Digest

Trash style news. You will definitely like