Table of Contents

The disruption of established financial services caused by cryptocurrencies and underlying blockchain technologies has been profound yet substantially hard to anticipate and follow. New ways of dealing with digital money, digital trading assets, taking profits, and managing losses have inspired many innovative hybrid tech/financial companies to jump on the bandwagon and claim a place within the hyper-promising DeFi ecosystem.

MoneyToken stepped in as a possible solution to one of the critical problems of crypto assets – how to utilize and generate immediate added value to one’s existing crypto holdings. And on the other hand, how to borrow liquid funds without losing your collateral’s actual value.

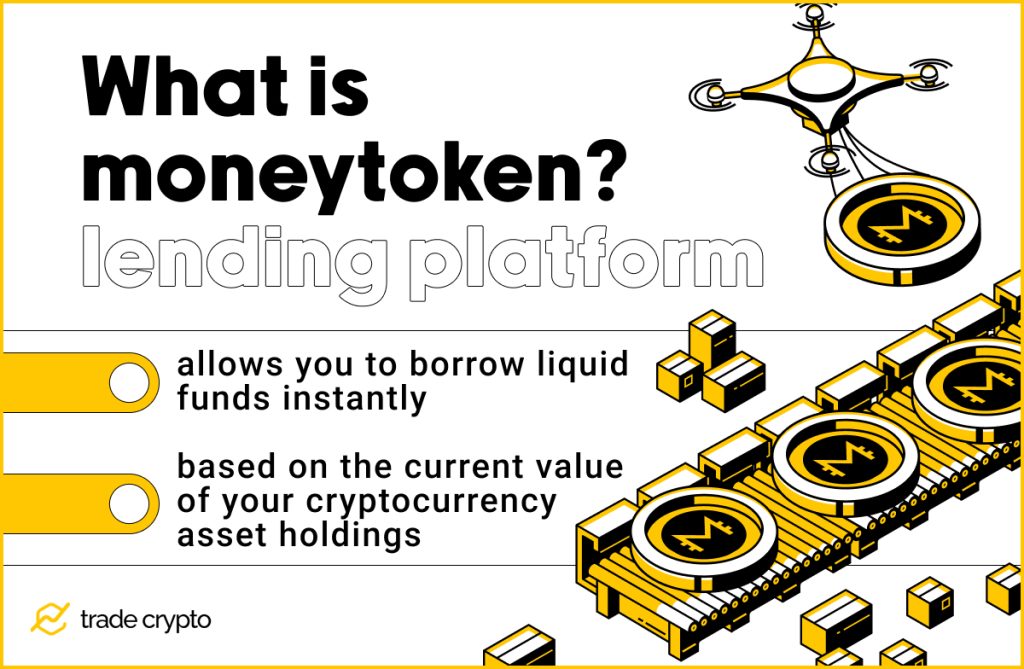

What is MoneyToken (IMT)?

The creators of Moneytoken properly identified a sore problem of cryptocurrency asset holdings. If you succeeded at buying a crypto asset cheaply, the time you are holding it until its price rises is idle and does not generate added value for you—those who buy low need to hold on to their investments to benefit from selling high. But what to do in between? How to benefit in another way? These are the questions Moneytoken tries to answer.

The MoneyToken platform allows you to borrow liquid funds instantly based on the current value of your cryptocurrency asset holdings. You get a crypto loan using your existing assets, such as Bitcoin or Ethereum as collateral.

Conversely, you can appear as a lender, earning a respectable APY.

A platform for Both Lenders and Borrowers

As a borrower, by putting up your cryptocurrencies as collateral, you receive an agreed loan amount in a stable currency (USDT). After the loan repayment, you will receive your whole collateral back – even if the collateral has increased in value. The procedure is swift and simple, allowing your cryptocurrency holdings to satisfy your immediate needs.

On the other hand, as a lender, you get the opportunity to put your volatile assets to work, earning a predictable and attractive interest rate from the funds you lend on the Moneytoken platform, secured by the collateral of borrowers, but also the platform’s reserve fund.

How Does MoneyToken Work?

The procedure for using crypto-backed loans on the Moneytoken (IMT) decentralized exchange service is easy and depends on whether you are a lender or borrower.

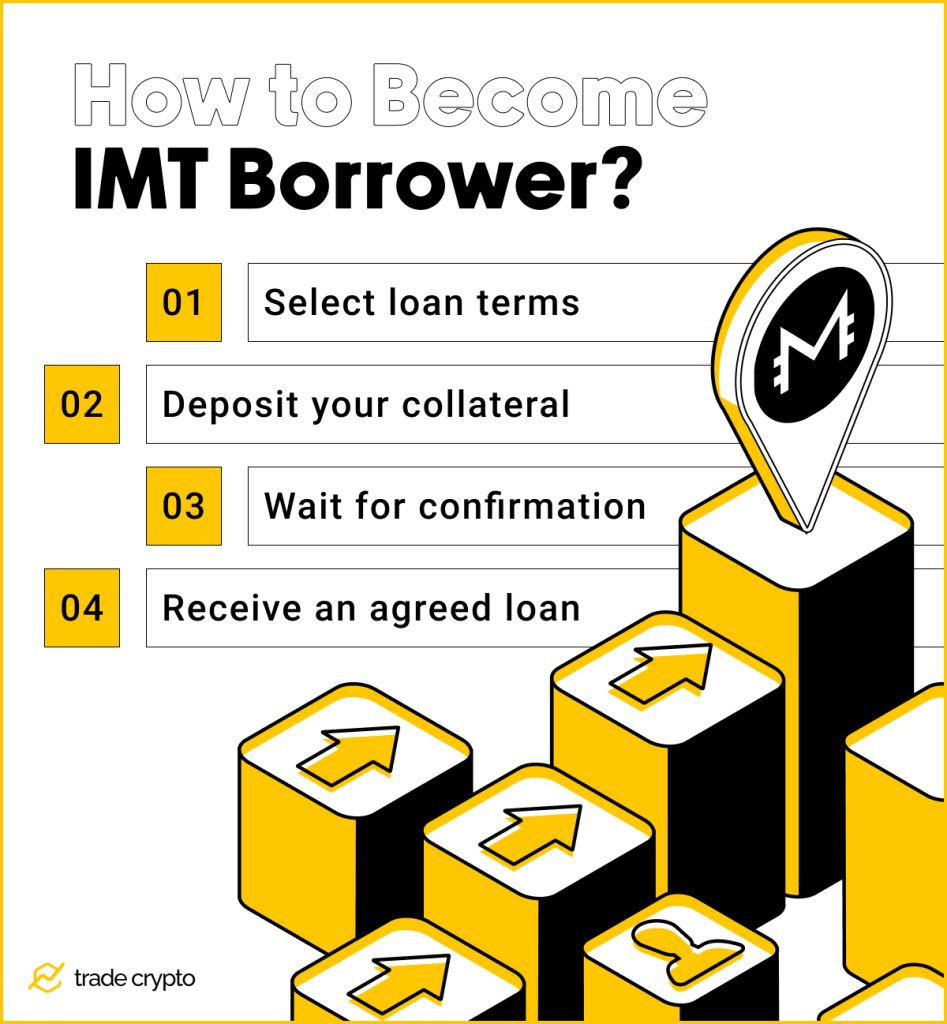

To Become IMT Borrower

To become a borrower and apply for a loan, you must sign up and pre-select one of the assets MoneyToken supports as collateral. The steps are:

After the stable currency loan repayment, the Moneytoken platform will restore the whole collateral – the value of your crypto position that you had held before the loan was executed.

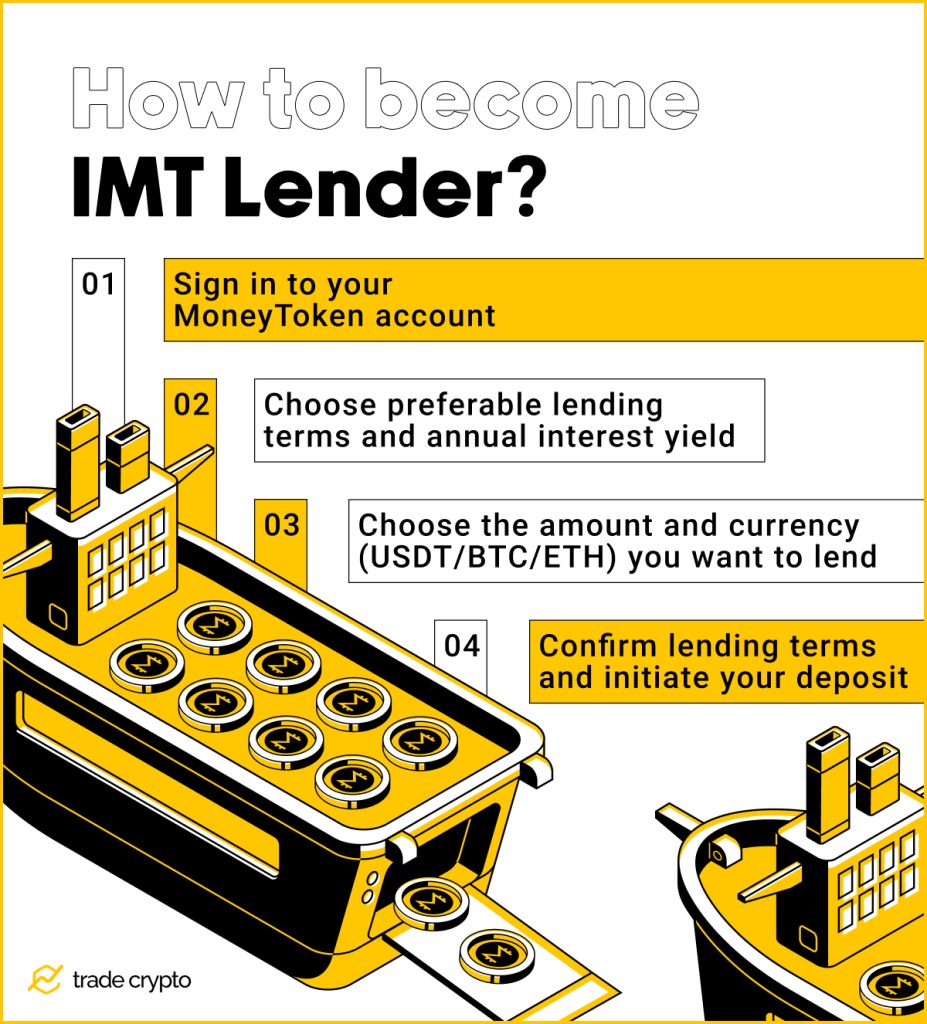

To become IMT Lender

To become a lender, you need to:

Your interest will be automatically distributed to you on the maturity date, i.e., the date of your final payment is due.

How Can I Buy MoneyToken ($IMT)?

Besides being designed as a powerful open trading platform, Moneytoken is also designated as the platform’s native ERC20 digital token ($IMT).

First, you will have a sufficient amount of BTC or ETH available for trading purposes. You should have them transferred to a crypto exchange that supports trading with IMT – MERCATOX. To use this decentralized cryptocurrency market, you need to register for their “E-Wallet” service from the top left menu. Once registered, you can deposit your BTC (or ETH) and use it for buying IMT at the supported asset trading pair page.

Who Is Responsible for Moneytoken?

Moneytoken was introduced in 2017 as an asset management global infrastructure for smart loans backed by crypto assets. Its primary aim was to address the hot issue of capitalizing on the intensive volatility of one’s cryptocurrency holdings. By empowering users to lend or borrow their (digital) money easily, the platform enabled users to earn interest or preserve their cryptocurrencies used as collateral upon the repayment of the agreed loan amount, respectively.

IMT: Where Technical Adequacy Met People’s Needs

The project gained substantial traction, and Moneytoken reviews were favorable, highly praising its creators for both the sense of technical innovation and satisfying the urgent financial cravings of early crypto enthusiasts.

The adoption rate of the IMT’s concept was quite formidable, and a devoted community was formed almost instantly. At its peak, the Moneytoken platform seemed headed to a bright future.

What Went Wrong?

In 2020, news and announcements became less and less frequent. The last news item from the official website was dated February 19, 2020, and the previous post on Medium was on April 5, 2020, saying the project’s site had been moved to a new URL. At approximately the same time, their Twitter account got suspended, and a new one (unverified!) was opened in January 2021, but without any activity.

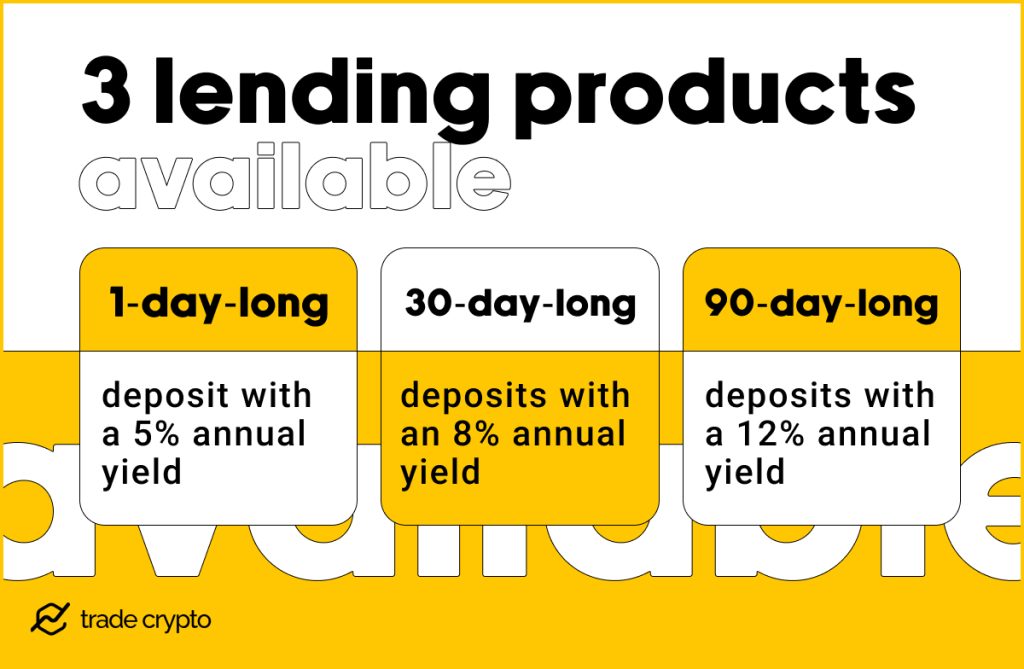

Let us take a look at the piece of the core financial offer marketed by Moneytoken. There were three lending products offered:

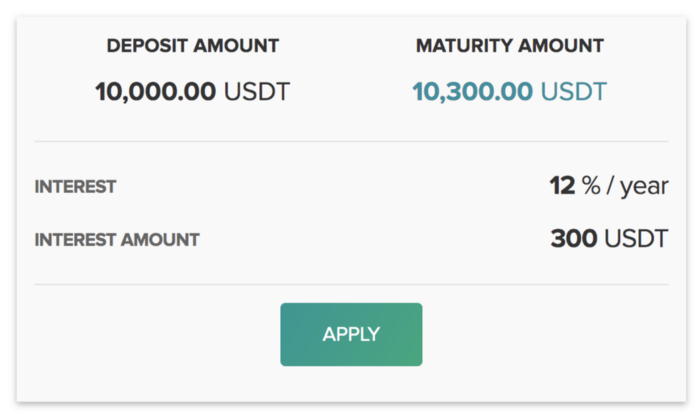

This means that if the user had deposited 10,000.00 USDT for an earthlier USDT interest would be equal to 1,200.00 USDT yearly. Or, it was a 300.00 USDT gain after 90 days of being patient. It was fully allowed to re-deposit the same (or another) amount in a stable currency, prolonging the loan period to one year and enabling a lender to take their 12% profits.

Ultimately, was this too good to be true? Even for crypto?

Is Moneytoken Safe to Use?

Although 12% APY may generally be an easily achievable financial goal, the winter of 2019 is often referred to as “crypto winter”, when the entire market collapsed, contracting by 80% and more. It is entirely conceivable that the project became financially unviable. Of course, rumors of fraud have always been present, but the lack of available information prevents us from reaching a definite conclusion.

However, we can identify and mark the MoneyToken project de facto dead. Its token with the same name has been de-listed from almost all exchanges, and no signs of legitimate trade have been spotted recently.

Hope is Thin

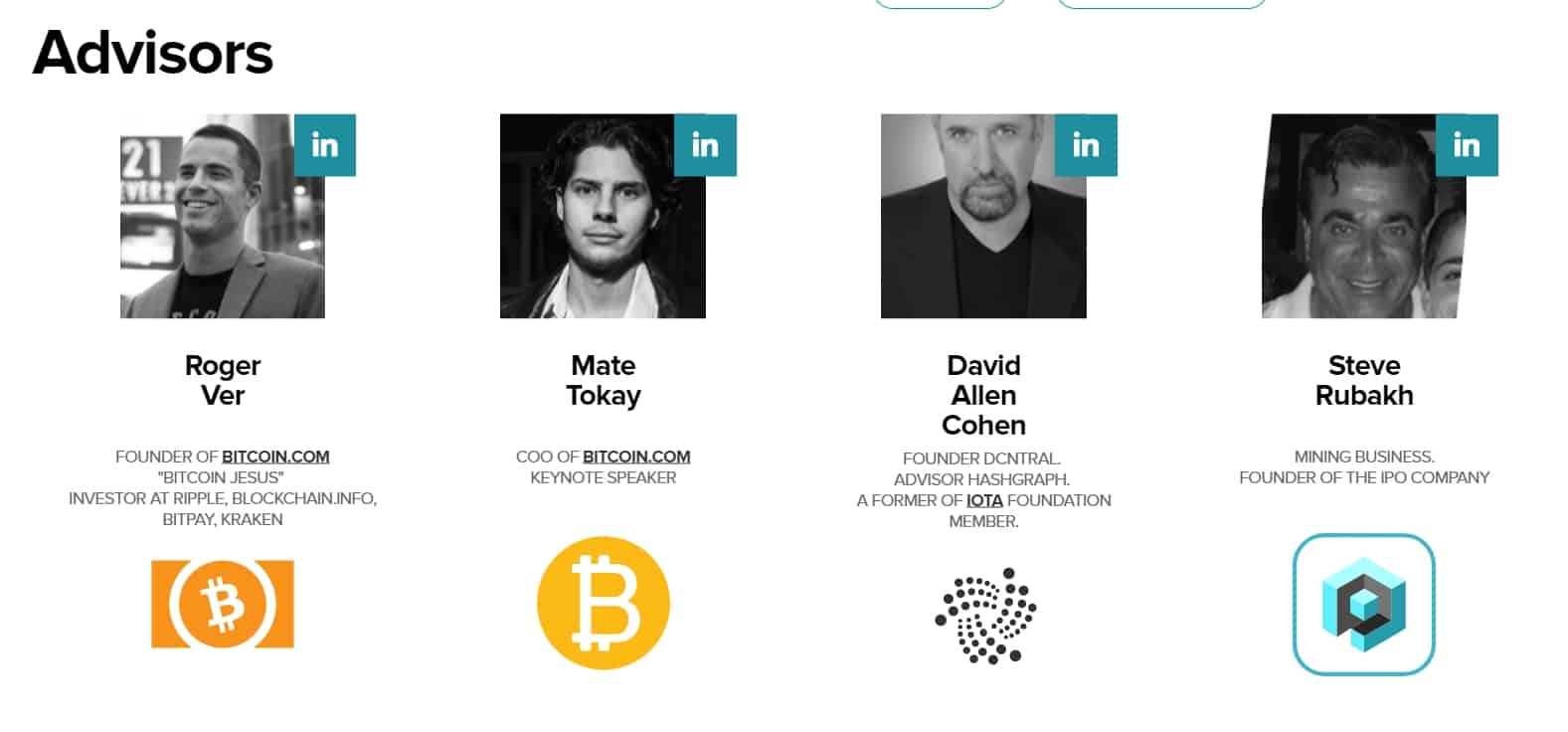

While several other crypto projects may fill in the gap, we can only hope that either someone else will be in a position to renew the Moneytoken project or the people behind it will re-emerge, utilizing their vision and knowledge base. After all, we noticed the name of Roger Ver as an advisory board member.

Our disbelief in the project’s fate is a bit more pronounced if that is true.

Crypto Ping Pong Digest

Trash style news. You will definitely like