Table of Contents

YouHodler Crypto Loans Review

YouHodler is an EU and Swiss-based company focused on crypto-backed lending and savings. YouHodler provides loans to help users capitalize on market volatility, delivering TradFi services to crypto users, thus bridging the gap between the fiat and crypto worlds.

Since its launch in 2018, YouHodler has enjoyed great popularity, likely because of its attractive offering of high interest rates and a high loan-to-value (LTV) ratio for borrowing.

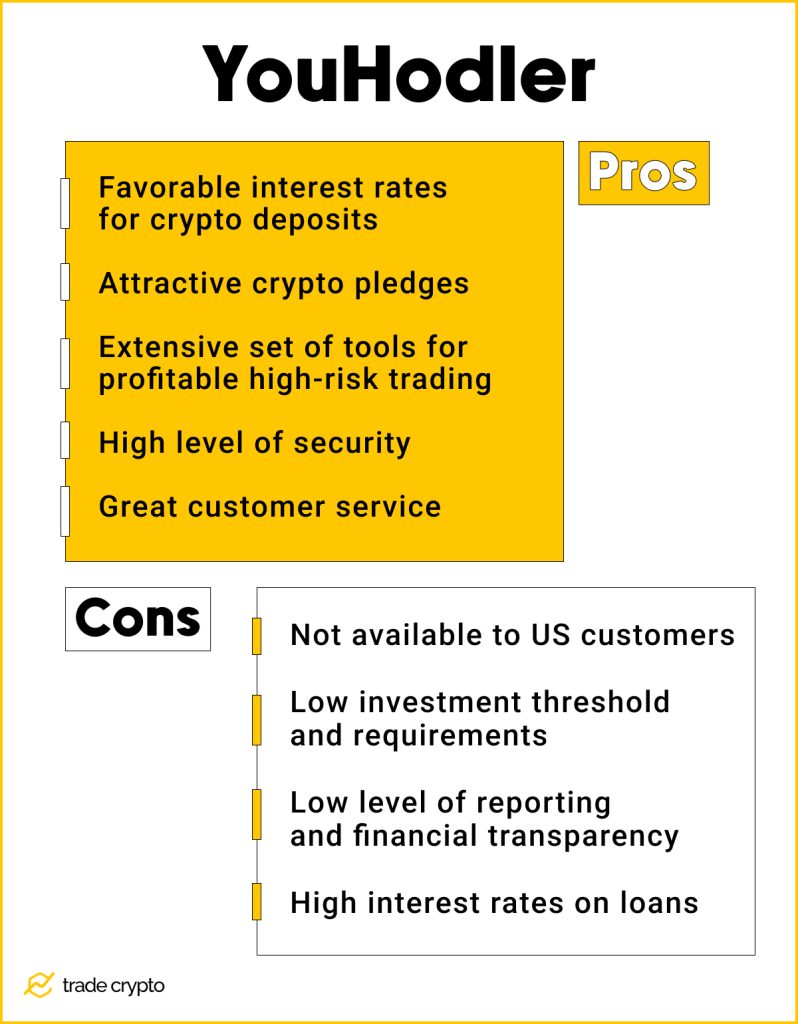

YouHodler Pros and Cons

Pros:

- Favorable interest rates for crypto deposits. Users can earn up to 10% annually in interest by investing in certain coins on YouHodler. For example, Polkadot DOT, USDT, USDC, and Avalanche AVA.

- Attractive crypto pledges. The platform allows you to create a full-fledged check for a certain amount in fiat currency or cryptocurrency as collateral for digital assets.

- Extensive set of tools for profitable high-risk trading. Multi HODL combines the best of both crypto exchanges and traditional trading platforms into one. Simple and intuitive interface, convenient trade management, and a decent multiplier.

- High level of security. YouHodler’s KYC (know your customer) and AML (anti-money laundering) verification procedures provide investor protection. The platform also provides with LedgerVault’s security technology, which protects and secures crypto funds.

- Great customer service. We tried to link different payment cards, and support helped with it immediately. You can receive a 24/7 consultation from the YouHodler support service.

Cons:

- Not available to US customers. Users in the United States can’t use the platform due to legal restrictions, and VPN does not solve this problem. This applies to a number of other countries, too.

- Low investment threshold and requirements. Due to the absence of strict investment rules and requirements, the platform is available to many clients, which puts a load on the main trading networks and forces the project team to develop more primitive forms of interaction with digital assets.

- Low level of reporting and financial transparency. The YouHodler company does not publish detailed reporting on its activities, complicating the platform’s reserves investigation.

- High interest rates on loans. This is a classic downside of any financial institution that provides cash loans. Due to the lack of healthy competition, YouHodler can set high interest rates on loans.

YouHodler Platform Background

YouHodler was founded as a fintech startup in 2017, with CEO Ilya Volkov and his team spending over a year working on their experience and expertise in Silicon Valley. After this early inception phase, YouHodler was originally launched in Cyprus. Still, the team continued searching for another permanent base worldwide, which ended up being the Canton of Vaud in Switzerland. The company is now an established EU and Swiss-based brand with plans of opening new European branches, such as one in Milan, Italy.

YouHodler is a certified member of the Blockchain Association, an independent self-regulatory body working to establish a safe and certified network of digital asset companies.

According to YouHodler’s dedicated Stats page, the average balance of coins and tokens per user is valued at $5,600. The platform has over 231,000 monthly users at the end of 2022.

YouHodler has an average score of 4.3 on Trustpilot.

To date, the company has not released any financial reports or information regarding its investors’ earnings or losses. The lack of transparency in this respect is explained by their intention to keep YouHodler’s exact business model and other pertinent information undisclosed to maintain their competitive edge.

YouHodler has its own blog featuring articles from industry experts. You can also stay up to date on YouHodler news and developments via the platform’s social media accounts such as Twitter, Telegram, Facebook, LinkedIn, Instagram, YouTube and Reddit.

What Makes YouHodler Special?

Things that distinguish YouHodler:

- Highest LTV on the market of up to 90%. Users can borrow up to 90% of their deposited crypto collateral;

- Interest rates on crypto deposits of up to 8.32% per year, depending on the digital asset; for example, 8.32% is available for NEAR and USDT.

- Unique features such as Multi HODL and Turbocharge, which allow customers to take out multiple loans at once by cascading them;

- Crypto savings accounts with major European banks and partnership agreements with trusted fiat currency interest payment providers;

- Support for a wide range of payment solutions, including bank cards, wire transfers and stablecoins;

- Continuous developments and improvements. The YouHodler team claims that it adds a new feature every week, depending on what’s requested by users.

How Does YouHodler Work?

At its core, YouHodler’s savings feature is one of the best parts of this platform. The company encourages asset holders to deposit their crypto holdings to gain interest over time (as high as 8.32% on certain Stablecoins).

Additionally, the platform provides crypto-fiat loans, allowing users to borrow fiat funds based on the value of their digital asset holdings and according to a specified loan repayment period.

Besides the core functionalities, YouHodler also serves as a trading, exchange, and conversion platform for crypto-crypto, crypto-fiat, and crypto-stablecoins conversions. Users can also use the platform to withdraw fiat funds to their personal bank accounts.

YouHodler maintains transparency regarding what they use their clients’ deposits for, which is only to support their lending services. Loans are secured by the borrowers’ crypto collateral, not by other users’ savings. Additionally, YouHodler doesn’t speculate on their users’ deposits or risk them in DeFi protocols.

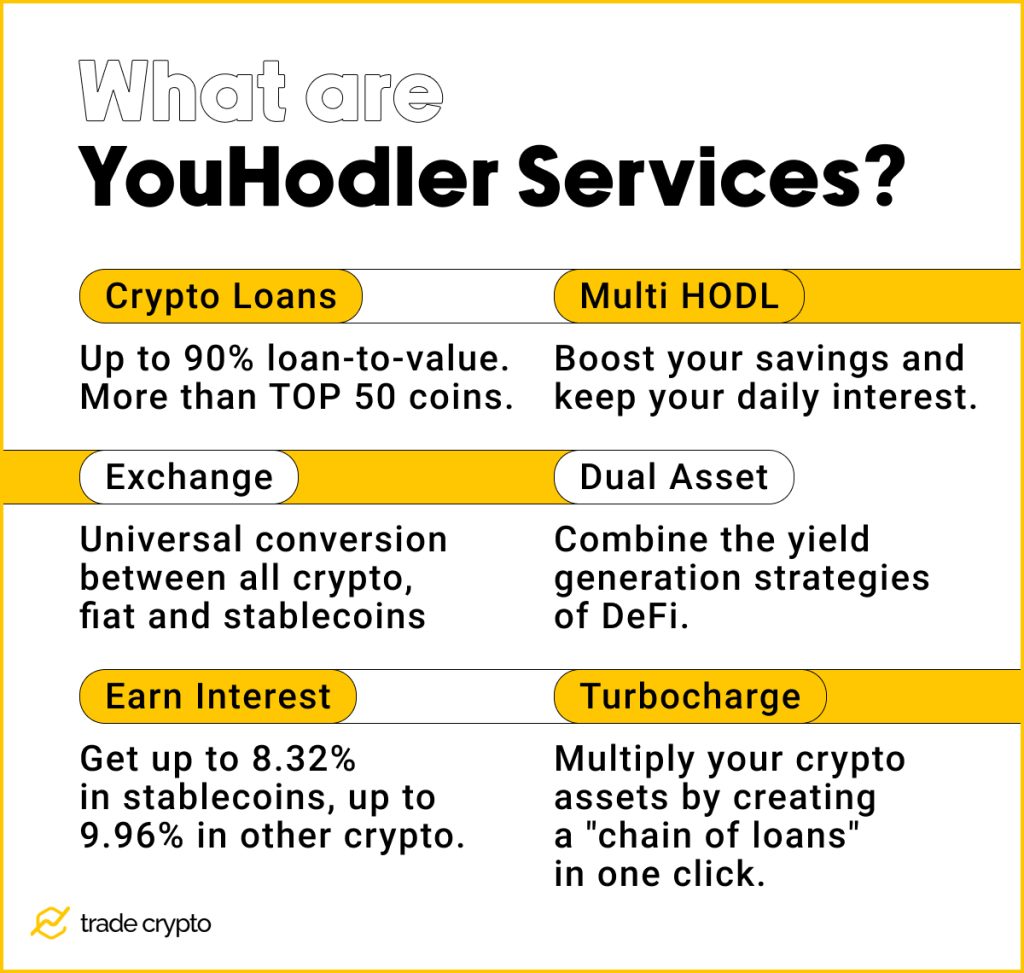

What are YouHodler Services?

Crypto loans

Users can take out loans on YouHodler using their own crypto as collateral. In return for their crypto assets, users choose a loan amount in fiat currencies: USD, EUR, GBP, CHF, but also BTC or Stablecoins. Users can withdraw their collateral as soon as the loan has been repaid, even if the collateral’s value has since increased.

Loans are subject to repayment terms. After choosing the cryptocurrency you plan to use as collateral, enter the desired currency and amount of loan funds you wish to receive. Then, select your preferred LTV (Loan-To-Value) plan, and their built-in calculator will display the amount of crypto you need to deposit to get a loan.

YouHodler currently offers the following 3 LTV plans for BTC/USD pair:

| LTV: 90% Loan duration: 364 days Daily fee: 0.0099% Price down limit: -5% | LTV: 70% Loan duration: 364 days Daily fee: 0.032% Price down limit: -25% | LTV: 50% Loan duration: 364 days Daily fee: 0.0548% Price down limit: -45% |

Multi HODL

The Multi HODL margin trading tool is another feature that allows you to leverage your crypto savings and bet on how the value of a cryptocurrency pair will change (i.e. whether it will go up or down) over a specified time period. It also creates a chain of loans (up to 50 times) with the user’s specified deposit amount as the initial collateral.

YouHodler recommends not to use more than 20% of your total deposited assets for this feature. Never use your entire balance for such margin trading instruments. The cryptocurrency market is very volatile and it’s often impossible to predict short-term price movements, which increases the risk of loss.

Exchange

Crypto-crypto and crypto-fiat conversions

YouHodler has a very practical conversion tool for crypto-to-fiat and crypto-to-crypto, which can be accessed via the user’s YouHodler wallet. Any sort of conversion may be done using the same tool. Note that the minimum crypto-fiat or fiat-crypto conversion amount is 30 USD.

The conversion times on YouHodler are as follows:

- Stablecoins ↔ Stablecoins – instant

- Crypto ↔ Fiat – instant

- Fiat ↔ Stablecoins – instant

- Crypto ↔ Crypto – 5-30 min

- Crypto ↔ Stablecoins – 5-30 min

Buying crypto using fiat

If the user does not have any digital coins but wants to obtain some on YouHodler, they can easily buy crypto using the aforementioned conversion tool. All the user needs to do is deposit some EUR, USD, CHF, or GBP to their fiat wallet, and then select the Convert option to pick which cryptocurrency to convert to. Once the conversion has been completed, the user will be able to see the acquired crypto amount in its respective wallet.

- Bank wire fee per transfer – 0 (except USD SWIFT – 25 USD per deposit; GBP – 20 GBP per deposit)

- Min deposit amount by bank wire – 100 for USD/EUR/CHF/GBP

- Bank wire processing time:

- USD, EUR (SWIFT) – up to business 5 days

- EUR (SEPA) – up to 2 business days

- GBP, CHF – up to business 3 days

- Bank card fee – 1%

- AdvCash wallet payment – 1%

- Bank card via AdvCash – 4.5%

Withdrawing fiat funds

The user’s fiat cash will display on the Wallets tab immediately after converting crypto to fiat or obtaining a loan on YouHodler. They will then see many alternatives for withdrawal by selecting the Withdrawal button. The processing times, commissions and minimal withdrawal amounts are listed below.

- Bank wire fees per transfer:

- USD (SWIFT) – 1.5% (min 70 USD)

- EUR (SEPA) – 5 EUR

- EUR (SWIFT) – 55 EUR

- GBP,CHF – 0.15% (55 GBP; 15 CHF min)

- Min withdrawal amount by bank wire:

- 500 for USD/EUR (SWIFT)/GBP

- 50 for EUR (SEPA)

- 100 for CHF

- Bank wire processing time:

- USD, EUR (SWIFT) – up to business 5 days

- EUR (SEPA) – up to 2 business days

- GPB, CHF – up to business 3 days

Dual Asset

Dual Asset combines the yield generation strategies from decentralized finance (DeFi) with the simplicity of traditional FinTech platforms. The result is an easy-to-use crypto wealth management product for everybody with returns as high as 365% APR.

1. Choose a currency pair from the assets list. All major cryptocurrencies are available (e.g., BTC/USDT).

2. Select the input coin. Cryptocurrency or stablecoins – depending on your wallet balance.

3. Choose a staking plan. Depending on your strategy – from one to five days

4. Profit. Let’s say you’ve chosen the 1-day BTC/USDT staking plan with a 365% APR. In the next 24 hours you’ll get your BTC or USDT back, depending on the market price. If the bitcoin price is lower than when you opened your position, you’ll receive your payout in BTC plus 365% APR on your payout. If the bitcoin price is equal to or higher than when you opened your position, you’ll get back your USDT plus the 365% calculated for one day. You’ll receive a payout in Tether or Bitcoin regardless of market volatility.

Earn interest in crypto

YouHodler’s savings function allows users to deposit their crypto holdings to earn attractive interest over time. Interest rates vary according to the type of cryptocurrency you deposit.

For their complete and up-to-date list of coins they have on offer and their savings rewards, visit the dedicated page on YouHodler. Meanwhile, here are some of their most prominent coins and their interest rates:

© YouHodler

Turbocharge

Among its specialized products, YouHodler offers a high-risk tool called Turbocharge that allows users to take out a cascade of loans to potentially generate higher profits. Turbocharge works by the users depositing crypto assets as initial or base collateral. After this, the platform automatically uses the fiat funds received in exchange to buy more crypto that is then used to secure an additional loan. This can be done between 3 and 15 times.

Each extra loan is only meant to double the crypto used as collateral for a subsequent loan, meaning that users do not receive any of this money. They win only if the cryptocurrency’s market value goes up. However, if the value goes down, the user engaging in this transaction will not only lose all these funds, but they might also lose all of their initial crypto deposit and be left with just some leftover fiat cash. This is something to consider seriously before trying out the Turbocharge feature.

What are Lending Fees and Penalties

For an exhaustive and up-to-date list of all fees, commissions, and limits on YouHodler,

visit its website: YouHodler commissions and limits

How to Register with YouHodler Network?

Signing up for YouHodler’s services is simple and requires straightforward identity verification (KYC).

To create an account, go to the Sign Up page and enter your basic information: country of residence, email, and password.

Once you’ve gone through this step, you can log into your account, redirecting you to your Profile page.

Before you can use any of the platform’s functionalities, you will need to verify your account by confirming you are not a US citizen, signing the Beneficiary Ownership Confirmation (a document confirming you are the sole beneficial owner of the funds you will be using on the platform), then uploading a scanned copy of a government-issued ID and a photo of yourself.

Note that for fiat (wire) transactions, you must provide proof of residence, such as a bank statement or utility bill containing your full name and address.

What People Say About YouHodler – Is It Safe to Use YouHodler Loans?

With over 231,000 monthly users and a Tradepilot score of 4.3, YouHodler users seem reasonably happy with the services this growing platform provides.

Some negative comments refer to YouHodler’s overzealous promotion of high-risk trading and crypto leverage instruments such as their Multi HODL and Turbocharge products, without adequately explaining the risks involved. Another potential concern is the company’s lack of financial reporting.

Conclusion

YouHodler’s mission boils down to what many crypto enthusiasts strive for: an expanded utility of digital assets and an end to passive holding in favor of interest income. YouHodler is a safe and profitable choice for crypto owners who simply want to deposit their coins into a savings account and earn interest on them over time. For riskier tools, we advise users to read the fine print and consider all potential consequences of high-risk transactions with a third-party app, not just YouHodler.

Frequently Asked Questions

Is YouHodler legal?

YouHodler is a thoroughly vetted company, registered in accordance with Swiss laws. Official company information as listed on their website:

– Company Registration no. IDE/UID CHE-336.197.657.

– YouHodler SA has pawnbroker authorization from the commercial police of the Canton of Vaud. Authorization # LEAE-PGG-EV-2020-0001.

– YouHodler SA is a member of the SRO PolyReg and operates as a financial intermediary in accordance with art. 2 par. 3 Swiss Anti-Money Laundering Act (AMLA-CH).

– YouHodler SA is affiliated with Financial Services Ombudsman FINSOM. Affiliation confirmed 14.12.2020.

Is YouHodler suitable for long-term loans?

This platform is not the best choice for users who need a long-term loan as the interest rates for those are very high.

Is YouHodler available in the US?

Currently, due to legal restrictions, people located in the United States are not able to sign up for the YouHodler platform.

Where is YouHodler located?

YouHodler’s parent company is based in Cyprus but the platform is headquartered from Switzerland.

Are there any special procedures required to use YouHodler?

YouHodler requires new users to verify their accounts before they can use the platform’s functionalities and this is done through standard KYC i.e. identity verification procedures (providing a government-issued ID, a photograph of yourself, and in some cases proof of residence).

Crypto Ping Pong Digest

Trash style news. You will definitely like