Table of Contents

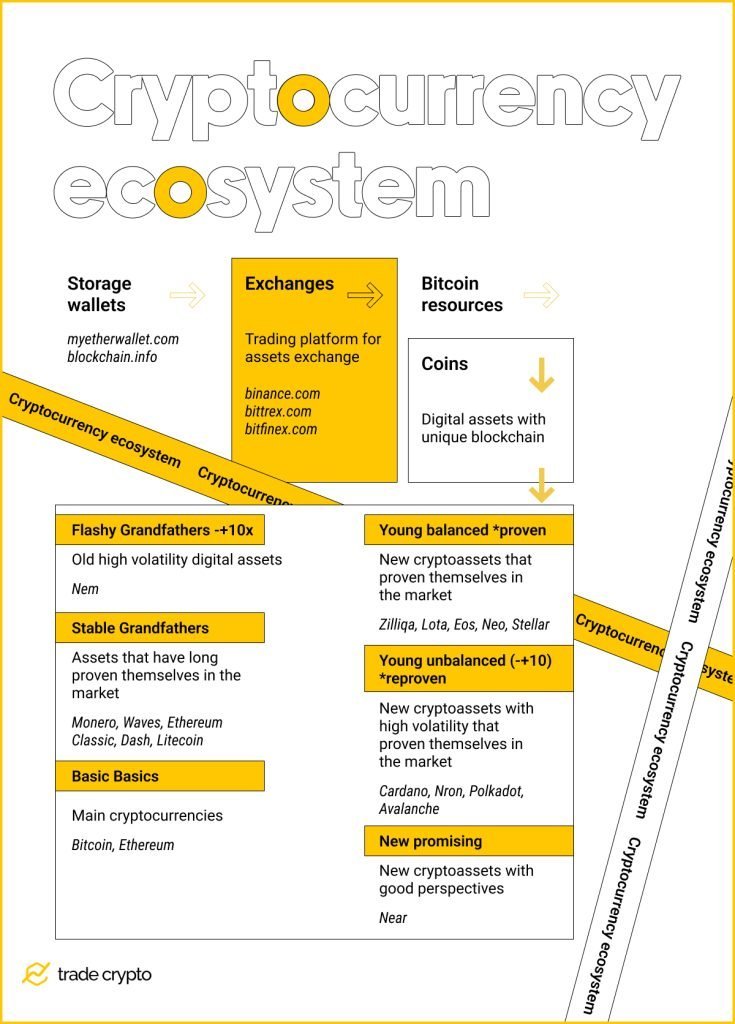

‘Cryptocurrency ecosystem’ is a phrase that might sound complicated and even a bit scary. In reality, that is quite far from the truth. The Crypto community only needed those words as a logical umbrella for 3 key elements that keep our world of crypto finance up and running smoothly: exchanges, wallets, and coins themselves. Being the most important cryptocurrency, Bitcoin should be counted as an independent, 4th segment of the ecosystem.

Mind the fact that Bitcoin is the central pillar of the cryptocurrency ecosystem. And that is not only because it was the first one. Any crypto coin can in a way be seen as a faceless, technical tool that serves a purpose, but that is not the case with Bitcoin. Its purpose is so important that the ideas born with it permeate and spread throughout the ecosystem, reshaping both the realms of global and personal finance. You can always consult with our CryptoAcademy for any further information resources on Bitcoin and crypto in general.

Cryptocurrency exchanges

Cryptocurrency exchanges are virtual places where you can exchange your cryptocurrency for other cryptocurrencies or fiat (ordinary) money and vice versa. They allow people to buy, sell, or swap the assets they own (fiat money or crypto assets).

The biggest crypto exchanges are centralized and owned by a company (Binance, Bittrex, Bitfinex, and many others). However, an integral part of decentralized finance (DeFi) is decentralized exchanges where users can perform all kinds of crypto-related financial transactions without intermediaries (peer-to-peer).

Crypto wallets

Crypto wallets are places where you keep your crypto coins. You may keep them on your account at an exchange you are using, but only for a short time. To be on the safer side, you should have a special personal wallet for that purpose.

Wallets may be web-based, mobile, desktop, paper, or physical pieces of hardware, that looks much like a USB flash drive. Each type of wallet has certain pros and cons, some of them putting the accent on increased safety, and others on being easy and convenient for frequent use.

Crypto coins

Finally, there are crypto coins. They represent the monetary value of the respective blockchains they have been built on.

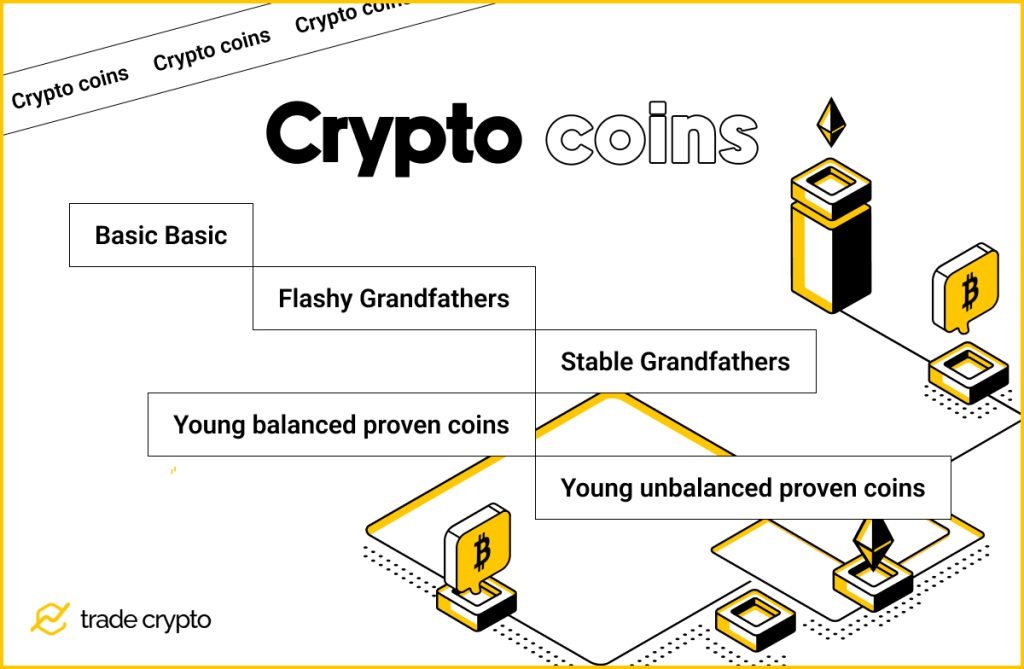

There are a lot of them, each trying to find its rightful place in the ecosystem. Roughly, we can divide them into five categories:

Basic Basic. Bitcoin and his closest follower Ether have always been Nr. 1 and Nr. 2 cryptocurrency. Which one is Nr. 3 has been a matter of dispute and further development of the crypto ecosystem may bring new changes to the Top 3 list.

Flashy Grandfathers. Yes, they are old. Not as Bitcoin is, but very old. Being old in the crypto world is not necessarily a bad thing at all. It means they have proven themselves to be worthy and enduring. Why flashy? Well, their price may jump up or down dramatically at short intervals. That property is called volatility. If you catch and ride the right tide, you can make some serious profits on them. A good example of these crypto veterans is NEM ($XEM).

Stable Grandfathers act more like real seniors. They are not fast, furious, or flashy. Their price movements are usually slow-paced, steady, and sometimes inert for longer periods. That does not make them bad. They are just different and therefore more attractive to certain types of investors, whose risk appetite is low. Some representatives of their kind are Litecoin, Monero, Waves, and Ethereum Classic.

Young balanced proven coins have emerged relatively recently, but have nevertheless established a solid reputation. The two most common things about them are a wide consensus that they are here to stay and that there will be more and more of them in the time to come. The balance attribute indicates that their volatility is moderate in comparison with other young(er) coins. Zilliqa, IOTA, NEO, EOS, and Stellar are just a few of them worth mentioning.

Young unbalanced proven cryptocurrencies have also built their good name as crypto financial assets. However, they still jump up and down quite wildly, bringing both happiness and tears for their traders and HODLers. Cardano ($ADA), PolkaDot ($DOT), and Tron ($TRX) may have reached their digital ‘teens’, but their pace is firm and prospects seem good.

New promising coins/tokens. Well, is there a single one for which its creators fail to claim it is promising? Thousands of coins have been created, some were never meant to be successful, while every other wait to “has its day”. Want an example? MINA is the world’s smallest blockchain and $MINA is its native coin/token. Will it go to the Moon? Perhaps. Will it go to zero? It is not impossible. The potential is huge with dozens and hundreds of freshly digitally minted coins, but let’s keep in mind that the disappointment is also a part of the crypto finance ecosystem.

Crypto Ping Pong Digest

Trash style news. You will definitely like