Table of Contents

Decentralized finance (abbreviated DeFi) is a set of blockchain-based financial technologies. It is aimed at removing the economic domination of incumbent stakeholders and intermediaries over ordinary people and replacing it with financial autonomy, equality, and easier access to financial services for everyone.

Do the phrases “incumbent stakeholders” and “intermediaries” sound pretentious? They might be, but they are not without meaning. They denote those who have been using the existing system of centralized finance (CeFi) for their own prosperity: banks, financial corporations, insurance companies, brokerages, investment and wealth management companies, etc.

Holding their lucrative positions in the traditional finance system (‘incumbents’), they are the middlemen (‘intermediaries’) between the money and the people, taking a cut from every transaction made.

DeFi – Cutting Out the Middlemen

The position of the mandatory intermediary is the position of power. If you must, either as a business or an individual, turn to a bank – for a loan, saving, keeping, or safeguarding money; for virtually anything connected to money, including operating with your own funds – you cannot be a party equal to the bank.

The superior position of a bank (and a central authority) over users is demonstrated every day. Withdrawing your money from an ATM is directly reliant on the bank – if the ATM is empty, if the IT system is down, if the government has restricted the amount that can be withdrawn in a day, you are practically banned from using your own legal property. And the ‘best’ part is that you still have to pay them using your own money.

The Importance of Decentralization and Disintermediation

By using decentralized ledger (blockchain–like) technology that stores the history of transactions, DeFi addresses the ‘built-in’, pre-designed inequality between financial service providers and users, providing personal autonomy and ownership over one’s personal finances.

The technology here is the means of disintermediation. Allowing users to perform transactions without middlemen cuts out the banks from the system and their domination is profoundly jeopardized.

Furthermore, the financial operations in DeFi are software-run, impartial and impersonal, with the result being the removal of imposed authority – in the DeFi ecosystem, there is no room for subordination.

CeFi vs. DeFi

Is the centralized finance system (CeFi) some kind of a villain? No, it is not. It is just not good enough anymore. DeFi steps in and offers better results in those aspects where CeFi is flawed, insufficient, or unfair.

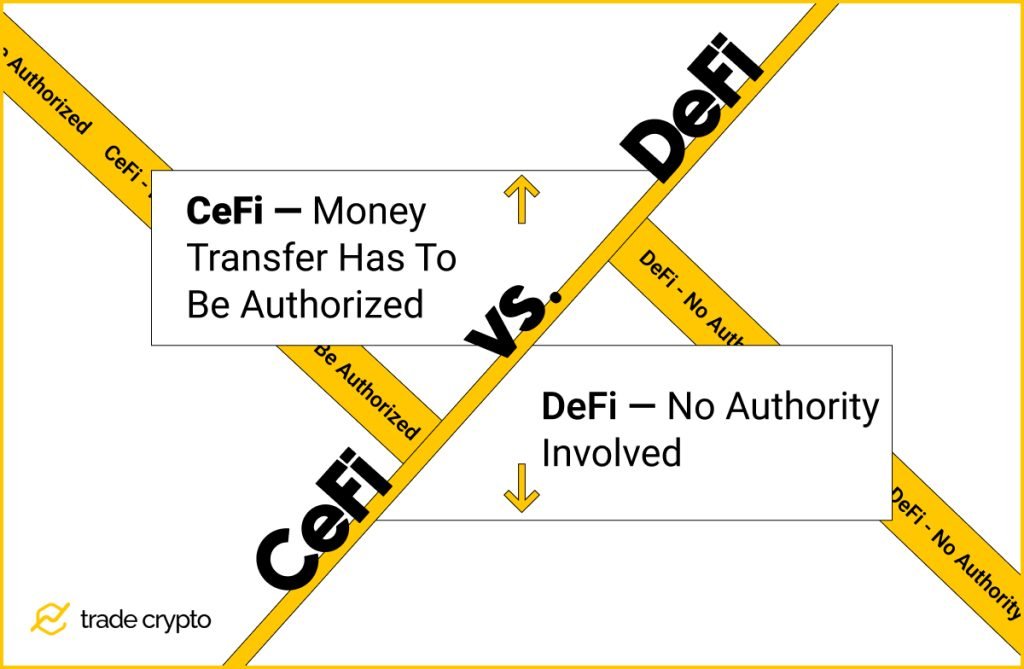

CeFi – Transfer of Money Has To Be Authorized

In the traditional centralized finance system, each transaction is handled through a financial institution that needs to confirm it. In most cases, that is a commercial bank, but under different circumstances, the authority in charge of confirming transactions may be another entity.

The process is not transparent and only the authorized persons know where the money went and for what purpose.

The approving institution acts as a trusted 3rd party. It possesses all details pertaining to the transaction it needs to approve. Only after its approval can a receiver obtain his/her money.

DeFi – No Authority Involved

When using decentralized finance, there is no “manager” of the transactions, and the money is sent directly, from person to person. All those individuals need is an internet connection.

The DeFi approach is open and transparent, but the identities of DeFi users are kept hidden. As the software assumes the role of the intermediary, there is no central or any other authority to confirm the transaction, so it goes through almost instantaneously.

Pros and Cons of CeFi and DeFi

Each approach has its own set of advantages and disadvantages. Some elements are even shared, but handled differently.

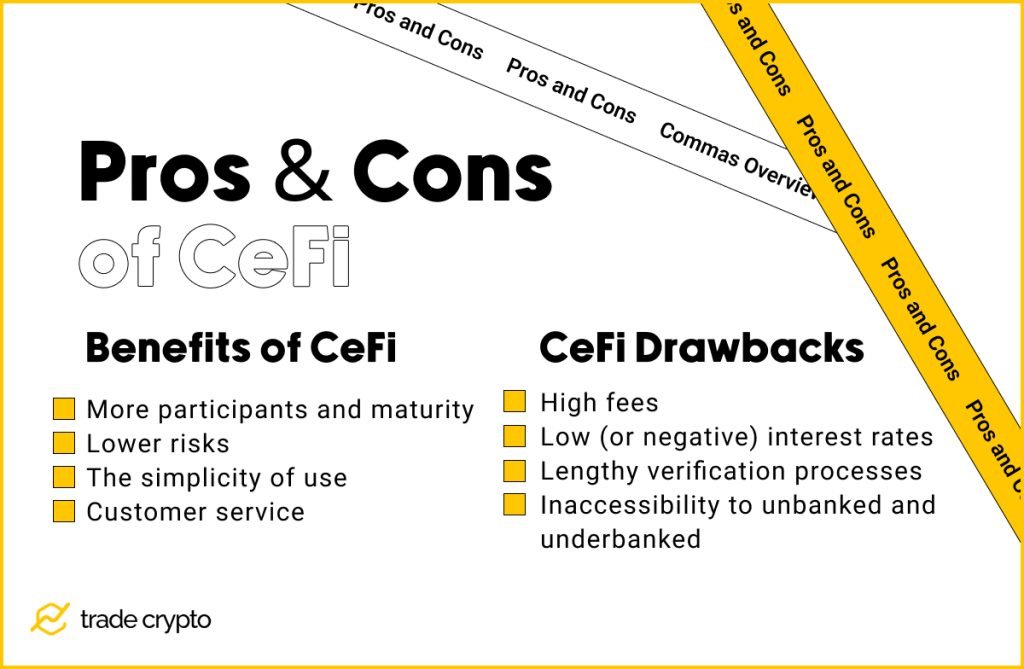

Benefits of CeFi

- More participants and maturity – the offered spectrum of financial services is wide, well-designed, proven, and well-known to users.

- Lower risks – insurance mechanisms and rigorous, and well-established regulatory and technological safeguards are in place to ensure the privacy and integrity of user accounts.

- The simplicity of use – there is no specialized knowledge required to log into your bank account or use an app or ATM.

- Customer service – a DeFi platform does not offer human assistance when a user encounters a problem.

CeFi Drawbacks

- High fees and charges paid to middlemen;

- Low (or negative) interest rates for keeping the money in the bank;

- Lengthy verification processes, checking your identity (KYC, AML) and credit history;

- Inaccessibility to unbanked and underbanked people – those who do not meet the necessary criteria.

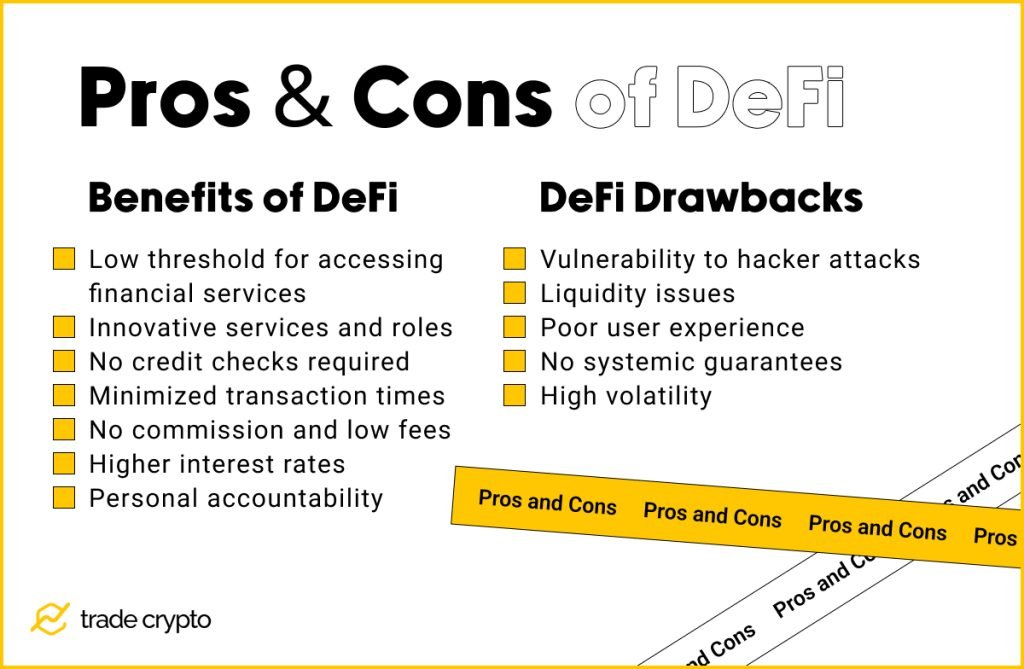

Benefits of DeFi

- Low threshold for accessing financial services – in the case of many financial services run by traditional providers, the bar is set too high for many users. For such users, this hinders full access to CeFi services or makes them too expensive.

- Innovative services and roles – DeFi users can lock up assets for rewards, or gain voting and governing rights on decentralized applications, so they can be equal community members and earn money at the same time.

- No credit checks required – automated protocols for lending and borrowing do not require credit checks.

- Minimized transaction times – by cutting out the middlemen, DeFi drastically minimizes transaction times.

- No commission and low fees – as there is no one in the way between the transaction parties, there are no commissions for an intermediary. DeFi platform charges go toward maintenance costs and variable APY rewards for users (on a CeFi platform, fees go directly to the provider).

- Higher interest rates – although the actual rates can profoundly go up and down, DeFi rates can be much, much higher than CeFi rates.

- Personal accountability – with DeFi, you are the only one in charge of what happens with your money. As there are no 3rd parties involved, your funds are accessible 24/7 and you possess total control over them.

DeFi Drawbacks

- Vulnerability to hacker attacks – smart contracts are at the center of DeFi. Being pieces of software, they are prone to cyber-attacks.

- Liquidity issues – liquidity can be a real issue on DeFi platforms. It occurs when there is an insufficient supply of digital currencies offered for sale.

- Poor user experience – dealing with crypto is still a bit bumpy on the side of an ordinary user and requires some training and getting used to it. This issue, however, is being solved by DeFi 2.0.

- No systemic guarantees – DeFi is an emerging financial ecosystem, and while this lends itself to greater innovation, its long-term validity is by no means certain.

- High volatility – An over-collateralized loan for a highly volatile crypto asset makes you exposed to substantial risk from market fluctuations. In the case of an asset’s sudden price drop, you could lose all your funds in the blink of an eye.

How DeFi Works – Smart Contracts

DeFi ecosystem uses a blockchain (or distributed ledger) set of technologies for its functioning. A special place in decentralized finance belongs to smart contracts.

Smart contracts are pre-written pieces of software code that regulate DeFi transactions between users.

When certain pre-defined conditions are met, smart contracts are put in motion, executing the entire process of a financial operation.

As Anton Mozgovoy, the founder of Mover, says: “DeFi is all about code. With the help of things called smart contracts, your money is programmed to perform various [functions]. It creates a unique opportunity for anyone with a computer and internet connection to participate in the global economy”.

Smart contracts are transparent (anyone can see and review them), impartial, impersonal, automated, and permissionless – meaning that no authority has to approve or do anything else regarding DeFi transactions.

Smart contracts, together with the ability of the Ethereum blockchain platform to create decentralized (financial) applications – dApps, make it possible for DeFi to be utilized for various financial services, including: decentralized exchanges (DEXs), yield farming or liquidity provision platforms, decentralized autonomous organizations (DAOs), borrowing/lending platforms, payment gateways, and many other services.

Decentralized Exchanges (DEXs)

While centralized crypto exchanges (such as Binance, for example) are operated by an owner who represents the central authority and clears trades, decentralized exchanges (DEXs) are peer-to-peer platforms where users transact directly (“horizontally”) with each other.

An important feature of CEX (centralized exchange) is crypto asset custody. In other words, customers must deposit their funds before any exchange or trade can happen. On a DEX, there is no depositing of assets – you deal with it via your crypto wallet.

In addition, DEXs do not deal with traditional (fiat) money. They were, after all, created as crypto token swapping platforms.

On DEXs, protocols enable users to directly swap one token for another. In centralized exchanges, this would require customers to sell their crypto and then buy another, incurring losses in the form of the exchange fee.

While centralized exchanges keep records on their internal databases, DEX transactions are settled directly on the blockchain, and run by smart contracts.

What Types of DEXs Are There?

There are three main types of decentralized exchanges:

- Automated market makers,

- Order books DEXs,

- DEX aggregators.

All of them allow users to trade directly with each other through smart contracts, with AMM being the most frequently used model.

What are Automated Market Makers (AMMs) and Liquidity Pools?

Automated Market Maker is a protocol on which all decentralized exchanges are based. It allows digital assets to be traded in a permissionless and automatic way by using liquidity pools, rather than a traditional market of buyers and sellers.

AMM users supply liquidity pools with crypto tokens from their wallets, whose prices are determined by a constant mathematical formula.

A liquidity pool can be observed as a digital pile of cryptocurrency locked in a smart contract, that substitutes the market for many individual sellers and buyers. DEX customers are not trading with a counterparty, but against the liquidity locked into a pool, provided by other individual investors.

How to Earn Money on AMM DEX and What Are the Risks?

The pools are filled by investors willing to place their crypto assets there. In exchange, they are entitled to transaction fees that the protocol charges for executing trades on a trading pair.

These pool-filling investors are called liquidity providers. They have to deposit an equivalent value of each asset in the trading pair in order to earn interest on their cryptocurrency holdings, a process known as liquidity mining.

A serious downside – slippage – occurs when there is not enough liquidity. Slippage happens when a lack of liquidity on the platform results in the buyer paying above-market prices on their order.

Liquidity providers also face a risk called impermanent loss. It occurs when they provide liquidity to a liquidity pool, and the price of the deposited assets drops. The loss is called impermanent because the price of the asset can still move back up.

What is Blockchain Oracle?

Blockchain oracles are entities that connect blockchains to external systems, thereby enabling smart contracts to execute according to inputs and outputs from the real world.

They are the umbilical cord between the blockchain and the real world. The goal of an oracle mechanism is to gather accurate data from the outside environment and deliver it to the blockchain securely and reliably.

The problem with blockchain oracles reflects a fundamental limitation of smart contracts—they cannot inherently interact with data and systems existing outside of their native blockchain environment (“off-chain”).

There are several reputable oracle platforms to choose from (Chainlink, for example).

What Are DeFi Use Cases?

The ability of the Ethereum blockchain network to create and run decentralized applications (dApps) goes well beyond DEXs and maintaining DeFi lending and borrowing operations.

There are numerous DeFi solutions, with each of them competing within its market niche.

Wrapped Bitcoins

“Wrapped” Bitcoins, or wBTCs, are applications that allow using Bitcoins directly in the Ethereum-based DeFi infrastructure. This is one solution to the problem of interoperability between different blockchain platforms, which is essential for the functioning of decentralized exchanges.

Each wBTC has the value of one Bitcoin, but is running on the ERC-20 standard. Of course, wBTCs can later be exchanged for Bitcoin.

Generally speaking, the use of wrapped Bitcoins can provide liquidity to the DeFi ecosystem, as it presents a bridge between various blockchains.

Moreover, such transactions are quicker and require less energy expenditure, as they only operate with one Ethereum node.

Stablecoins

Stablecoins are the type of cryptocurrency that is tied to a fiat currency (e.g. US dollar or Euro). They keep the same value in that currency over time, usually fluctuating by just a few percent. This is achieved by backing the stablecoin with the same amount in assets. Therefore, for instance, a value of a stablecoin that’s backed by the U.S. dollar will, in theory, always be worth $1.

Betting

Betting and predicting future events, like the results of sports games or presidential elections, is very simple with DeFi. Already, there are many DeFi platforms aimed at providing betting services.

In addition, as the information contained in DeFi protocols is very secure and extremely difficult to manipulate, many gamblers prefer this system. For them, DeFi presents an unheard-of level of fairness and virtually removes any potential for fraud that comes with centralized finance.

Lotteries

While organizers of traditional lotteries actually draw less than half of the total amount spent by players, DeFi allows the organization of no-loss lotteries. The winner then gets the entire amount that’s in the pool.

This means that, statistically, if you play the ‘decentralized’ lottery many times, you will eventually get to zero and not lose money, unlike with the traditional lotteries.

How to Earn Money in DeFi?

There are several methods of earning money by using DeFi platforms and their services.

Yield Farming

The yield farming method begins when a user of a DeFi platform places funds in a liquidity pool. The user’s tokens are then locked through a smart contract in a decentralized application (dApp). After that, they are awarded a fee or interest, for allowing their assets to be used across the platform for borrowing and selling purposes.

Yield farming resembles depositing money in a bank account and then letting it be used for loans and other operations, after which you receive a fixed proportion of the interest gained. In the same way, yield farming helps maintain liquidity across the DeFi ecosystem.

Liquidity Mining

When performing liquidity mining, crypto holders also lend their assets to decentralized exchanges and get rewards in return.

The difference between liquidity mining and yield farming is that liquidity miners tend to be rewarded in the native token of the blockchain they are using. In addition, they also have a chance to earn governance tokens, maximizing the kinds of involvement they can have with a particular project.

In short, yield farming is all about maximizing profits, while liquidity mining is also about one’s commitment and support to a particular project.

Staking

Staking is a way for you to put your cryptocurrency to use without selling it outright. Staking is like storing money in a savings account. When you stake crypto, you are locking up tokens for a certain period to earn rewards.

As node validators, stakers help vouch for the accuracy of transactions on the network. This also ensures the safety and liquidity of the platform.

Crypto Lending

Another way of earning passive income from DeFi is lending. When you lend crypto to a platform, you receive interest from crypto borrowers. Simple as that.

Is it Safe to invest in DeFi?

In DeFi, there is no governing body, and you are the only one responsible for the integrity of your investments.

Virtually anyone can launch their own project, token, or contract. As there are no pre-approving or vetting procedures, it is easy to get involved in a defective project or an outright scam.

The inherent risks of DeFi have led to the creation of DeFi 2.0 and CeDeFi.

Is CeDeFi the Future?

CeDeFi is a convergence of CeFi and DeFi, combining the best features and attributes of the two financial systems.

What is CeDeFi, and how does it work?

CeDeFi offers the same services as DeFi protocols, while being centralized. In other words, it allows users to access DeFi products (DEXs, yield farming solutions, lending protocols, etc.), but with the element of centralization present.

The hybrid CeDeFi ecosystem is usually managed by a single individual that has a certain degree of control over transactions.

The aim of this hybrid approach is to provide faster transactions, improve security, facilitate a larger transaction volume, and even lower fees.

Crypto Ping Pong Digest

Trash style news. You will definitely like