Table of Contents

Being an essence of blockchain technology Decentralized marketplaces allow traders to deal directly without middlemen using smart contracts and peer-to-peer systems

Decentralized marketplaces explanation

Decentralized marketplaces are all the rage nowadays, not only in the world of crypto but among every investor out there. Traditional marketplaces are hit by recession and regulation and burdened with middlemen, taxes, and fees, just like their centralized counterparts.

What’s so special about it?

The main difference between centralized and decentralized financial markets is the way value is determined. Centralized markets depend on regulation and value is driven by market strength and economic prospects, while decentralized markets are driven by supply and demand.

In traditional markets, there is a lot of burden in form of intermediaries. In a middleman environment, the fee becomes less expensive or even impossible. It’s also completely transparent that the market rules cannot change for a moment if users accept this rule. With reviews, reputations, and arbitration services added, decentralized marketplaces will offer a number of the benefits of conventional marketplaces with added clarity and lower fees. Decentralized market systems can be arranged into different types of setups. This section deals with blockchain marketplaces, application marketplaces, and platforms.

What is a decentralized marketplace?

Decentralized markets are what blockchain entails. The e-commerce portal allows people to interact with others through purely anonymous platforms without permission. Home appliances, hot sauces, and shirts can easily sell or buy from any source, regardless of whether you’re an inexperienced investor or an advanced trader. Decentralized marketplaces provide buyers with services that are matched by the sellers with the buyers. Most important functionality such as trading and releasing money has control over the software and not individuals. This means both the purchaser and seller agree to the conditions; after they meet the conditions, the transaction is automatically performed through the application.

Private versus public blockchains

Public blockchain systems such as Bitcoin and Ethereum do not require any approval or authorization. It’s also possible for any member of an organization to join without directly interacting with other users’ nodes. If more than 50% of the computer hardware is well behaved, the results of the system would dominate all malicious or malfunctioning nodes. This type of system can be very difficult to monetize. Private Blockchain is a better way to monetize the business. They’re generally used on permission networks which means the participant is allowed to only register based on the permissions of a prior member. For a better understanding of blockchain technology in business, check The Ultimate Guide to using Crypto in Business.

Marketplace: Centralized vs. decentralized

There are two main means of exposing the service provider: through the centralized marketplace or through the decentralized marketplace or otherwise without a single centralized marketplace. A central market will resolve all trust issues by relying on experts. The company is responsible for regulating and operating the marketplace. Other actors are convinced of their ability to protect the platform through implementing technology and mediating disputes if they have any. Financial settlements are managed via a trustworthy intermediary, which costs the user.

Smart contracts in a blockchain marketplace

Can anyone list the necessary components to satisfy the demands of our distribution market? It offers three functionalities. The next step would be to develop smart contracts that define workflows on our blockchain marketplace that utilize this capability

Market tokens

Often a decentralized marketplace has its own token for the purposes of facilitating marketplace functioning. While Bitcoin and Ethereum are network coins or general-purpose coins, Decentralized marketplaces can have their own token.

Governance or monetization

Platforms can use the native token for governance or capitalization. The most obvious use case is that interested users can participate in the future and life of a decentralized marketplace. For example, holders of Uniswap’s UNI tokens can vote on changes to the platform.

Less obvious is the capitalization use case, because it is hidden in plain sight. By issuing UNI tokens and allowing the market – actual users, traders, buyers, and sellers – to participate in the creation of real value of the token, representing the value of the project. Currently, for example, the UNI token is worth around $5.

Types of decentralized marketplaces

The most common decentralized marketplaces are – DEXes or Decentralized Exchanges. DEXes are part of a wider DeFi movement. They are like the forex or traditional marketplaces in the fact that they provide the service of trading assets, in the case of DEX the assets are cryptocurrencies.

The biggest difference from the traditional or centralized counterparts is that there is no order book and no pairing up of buyers and sellers. Actual trading is done with buyers interacting with automated market makers (AMMs). Investors deposit assets in liquidity pools, earning the cut of the market fees. Pools are self-balancing, controlled by a smart contract. That way asking and bidding prices are in the balance with supply and demand. Sounds complicated, but it’s all made easy in our Guide to Decentralized Exchanges!

Investing in NFTs

The NFT market is an excellent place if you’re looking to invest in digital assets, collectibles, and artwork. Please choose an appropriate type of NFT for your purchases as well as crypto for your use. Aware that the new business sector is extremely speculative as well. Some currencies are more valued than others and they aren’t guaranteed. Digital art and collectibles work much like physical art. The value of a collection is subjective. Find something for sale when no one is in the store.

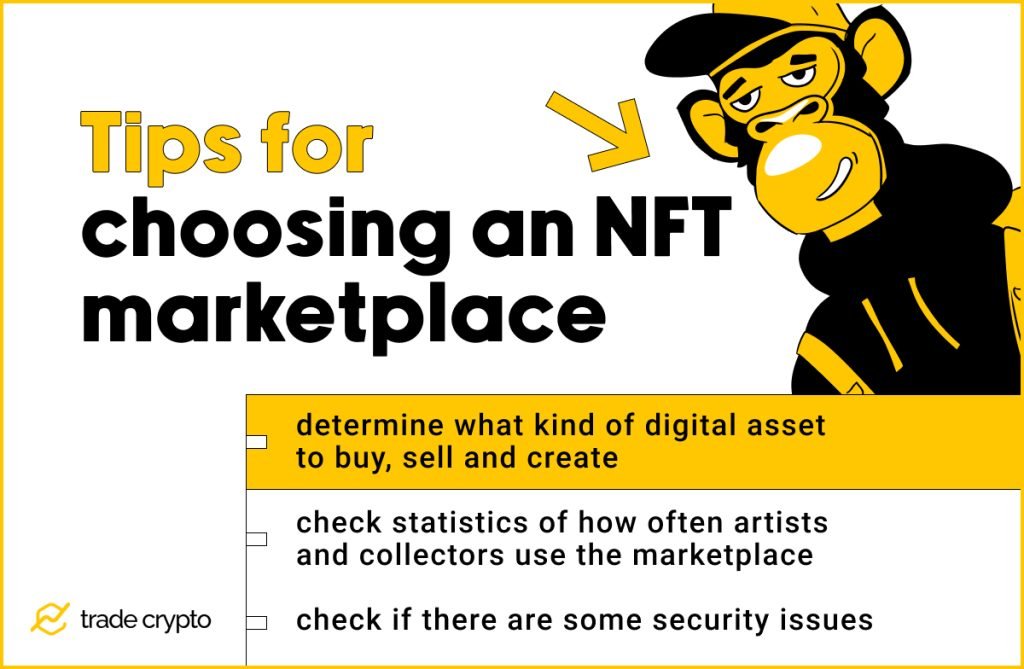

Tips for choosing an NFT marketplace

The first thing to remember is that an NFT is merely a property in an asset. When looking for a marketplace for digital assets, you should determine what kind of digital asset to buy, sell and create. Everything digital is a way to get tokens on the blockchain – the most commonly used cryptocurrency and the most cryptic. Other considerations include the type of token supported in markets. Some support many token types. Some of the open markets use proprietary tokens.

The next most important thing is the numbers. Statistic of how often artists and collectors use the marketplace. This can be checked from the data, primarily the data on trade volumes, showing how many buyer access the marketplace.

Security is a big concern, as many different types of NFT markets carry a risk. Decentralization prevents tighter safety measures when it comes to vouching for originality. For example, many popular NFT collections were routinely plagiarized by malevolent traders who pass the popular collections as their own simply because they take the embedded piece of art and mint new NFT tokens, effectively committing a forgery.

The chances of something like that happening in cross-network platforms is lesser because that kind of scheme would be quickly discovered. This is why we recommend OpenSea for all your NFT needs.

OpenSea

Open Sea offers Ethereum-based blockchain products and games in cryptocurrencies, and the site provides a marketplace. Through the Smart Contract platform, sellers can communicate directly with one another. Alex Atallah and Devin Finzer founded this startup. The cofounder has a vast background in Google, Facebook, Palantir a.k.a. Google, and other tech startups. BlockStack is the biggest investor in the cryptocurrency industry and is a major investor in blockchain capital.

What can I do with OpenSea?

OpenSEA trades mainly NFT tokens – nonfungible tokens. Non-fungible means, unique. Each token carries a unique piece of art, usually a digital painting or a procedurally generated image, part of a collection.

With OpenSea you can put up NFTs for auction, which is a great way to earn crypto as an artist. Of course, considering that Ethereum fees are exorbitant, OpenSea is the biggest and greatest NFT marketplace, since it runs gas-free service due to the Polygon blockchain platform.

If you are a collector, you can find bits and pieces of art, music, gaming items, memorabilia, and other collectibles. Speculative investors will find a place to trade here. Transactions are free, and users are constantly buying and auctioning, which gives smart – and lucky – investors the chance to avoid high fees and build their portfolios.

The best part of NFT smart contracts is that the author gets a set percentage out of any sale made, creating opportunities for the artists to get both renown and remuneration. Maybe you will buy a new piece of digital history for $10 and sell it for $100, but the original artist will be getting all those millions once and – if – their art finds its way to a wale with a fat wallet.

Solana NFTs on OpenSea

NFTs were originally founded on the Ethereum network. A simple ERC-721 token standard quickly became impractical for wider use, as high gas fees prevented both collectors and artists to engage in higher volumes of trade.

OpenSea for the exact abovementioned reason is using the Polygon network but also accepts NFTs from other blockchains, such as Ethereum, Solana, and Klatyn. Solana is currently trending among the NFT enthusiasts, as around 20% of all the NFT exchange relies on this system.

OpenBazaar

OpenBazaar was a platform for selling and interacting with customers via P2P services.. OpenBazaar is well-known by its owner, OB1, which operates OpenBazaar. It is an open-source project, designed to create a fully decentralized marketplace. OpenBazaar was founded after the seizure of a dark market called Silk Road in.

It uses cryptocurrencies as a medium, e.g a currency, but the assets, items, and objects that could be found there are really many different types. The project was sustaining itself through donations, but it seems that they are about to close.

The importance of OpenBazaar

The utmost importance of OpenBazaar is that – it happened. Many ideas never get picked up by their contemporaries, but the fact that OpenBazaar worked as a completely decentralized, peer-to-peer network, and created a robust and truly anonymous private marketplace gives hope that there will be such projects in the future.

Risks connected with transparency are still there, but the OpenBazaar, as a general-purpose decentralized marketplace is truly something like a DeFi eBay, and there would be many more such projects in the future.

OpenBazaar: How does payment work?

In a bid at increasing security for payment, OpenBazaar uses Bitcoin’s escrow feature. Here are a few things to remember about this feature: Now, speaking about the payment itself, you should consider 3 forms: direct and offline.

Online payments

The money enters a temporary escrow account where buyers and sellers can access it at any moment the buyer wants. In any event, sellers are now offered this option as well.

Direct payments

Usually, the seller will give the coins when both parties are online. It was simply an easy transaction without much trouble.

Accountability and privacy in a decentralized marketplace

The decentralized marketplace is governed by a single entity that is responsible to ensure its functioning properly. Hence the guarantee needs to be made in the technical platform. It also needs proper design, implementation, deployment, and monitoring. Moreover, each of these guarantees must be verified at any moment. We identified several important requirements which must be fulfilled by the marketplace. At the highest level, the problem is about accountability.

Risks of decentralized marketplaces

Without clear accountability and no centralized entity to enforce the rules, everything is up to the behavior of participants in the marketplace. Even smart contracts and automation can only go so far.

If you become a victim of fraud, you have no one to complain to, no way to reverse the transactions. And frauds can be many, from buying counterfeited NFTs, to failing to receive purchased goods, to various wallet and payments related misconducts.

Crypto Ping Pong Digest

Trash style news. You will definitely like